After several closes below 15, the VIX is starting to make a strong move back to 20. VIX: 17.83 +0.77 (+4.51%) I noted in a recent post that the VIX was still in an Unstable Vix Pattern formed by an August 2007 Trigger Event. I noted then that the movement below 15 could be a sell signal accompanied by a need to buy hedges for long positions. If the trend below 20 continued until September 25th, then the movement below 15 would be a long term buy signal VIX Asset Allocation Model Update It remains to be seen which way the worm will turn under this model.

There are reasons to be pessimistic about the near and intermediate term future, but there are always good reasons for pessimism. I recall August 1982, the start of the last long term secular stock bull market, and the pessimism then was both prevalent and easily a majority position. But, the deep thinker types would see that the framework for a long term bull market was already in place. The Federal Reserve had squeezed inflation out of the economy, interest rates were still high but going down, and the computer revolution would drastically improve productivity. The investor did not need to focus on the here and now, but simply digest those big picture events and then act accordingly.

The underlying main problem now is not inflation but debt, both at the consumer and government levels. Underlying Cause of the Current Long Term Bear Market is Too Much Debt (June 2010 Post) That problem involves a few developed nations rather than the primary emerging market nations. The U.S. government is one of those offenders and has made no progress in reducing its out of control budget deficits. There is progress being made in several European nations, the other primary offenders in the government category. American consumers, the primary offender in the consumer category, are making decent headway in improving their balance sheets. It would be extremely important for housing prices to continue an upward trend.

Unlike August 1982, however, I can not say now that the underlying problem has been whipped, since one of the primary offenders, the U.S. government, has yet to address its debt and deficit problems. Our government is the whale in a china shop, not Greece. I may be overestimating the near and intermediate term dangers associated with U.S. government debt levels. My perception of the risk is way out of line with investors who are showering the U.S. government with money, willing to accept rates that will probably fail to earn them any return after inflation.

******

One "principal protected note", Citigroup Inc. 3.00% Minimum Coupon Principal Protected Notes based on S&P 500 (MYP), has been exhibiting bizarre and irrational behavior worthy of a commitment proceeding. I would place a current maximum value on that note of $10.4. I personally would not buy it at $10.40. Maybe I would buy a 100 at $10.20 to $10.3. If I owned 100 shares, I would have sold the entire position at the prices prevailing on either 8/29 or 8/30. MYP had no trades on 8/28 and traded just 400 shares on 8/27, all of which were at a $10.75 price. MYP Historical Prices On 8/29, the price surged to $12.30 with 9600 shares exchanging hands with an intraday high of $12.38. Yesterday, the shares closed at $13, a 30% premium to the $10 per share par value. Bizarre does not begin to describe this action.

MYP is a senior unsecured note issued by Citigroup Funding that matures on 5/12/14 at $10. The note only has two more annual coupon payments left before redemption. This note pays the greater of 3% or up to 32% based on the performance of the S & P 500. Pricing Supplement For the current coupon period, the following is a summary of the relevant data points:

Starting Value= 1,371.97 on 4/24/12 S & P 500 Historical Price

Maximum Level= 1,811 (1,371.97 x.1.320)

End Date: 4/23/13

Yesterday's closing Value=1,399.48

A single close in the S & P 500 above the Maximum Level (1,811), on or before the End Date, would cause a Maximum Level Violation and a reversion to the minimum coupon, irrespective of the S & P's value on 4/23/13. The S & P would have to be above 1,413.13, as of the 4/23/13 close, to even trigger an increase in the 3% annual coupon ($30 per 100 shares), and that would occur only when there is no Maximum Level Violation during the coupon period. The S & P is not even above that level now.

This is just simple math, with a small dose of common sense. To justify a $13 price now, an investor would have to be 100% certain that the S & P would close almost at its maximum level of 1811 on 4/23/13 without a single close above that level during the current annual coupon period. Even if one assumed that would happen, and no one in their right mind would, this security would pay only $3.12 on its $10 par value at a End Date price of 1800 on the S & P 500 with no Maximum Level Violation. Even if you knew in late April 2013 that MYP was going to pay $3.12, based on a S & P 500 close of 1800 on 4/23/13, an investor would not be getting a good deal at all by buying 100 shares at $13 even in an IRA. An investor can not value these securities based on such an asinine and absurd assumption about a future event almost eight months away. This security could end up being worth only a few cents more than its $10 par value at maturity if it ends up paying just its minimum 3% annual coupon for the two remaining annual payments!

**************

I review the Dividend page at the WSJ every weekday night. I noticed that France Telecom will go ex dividend on 9/4 for a $.70941 distribution. I will only own French companies in either my Fidelity or Vanguard brokerage accounts. Item # 2 FTE Dividend-Withholding Tax; Item # 2 Sold 105+FTE. Those were the only two firms that applied for tax relief at the source that reduced France's withholding tax to 15% from 30%. I currently own 100 shares of FTE. I also own several CEFs that will go ex dividend on 9/4/12, including RVT, FUND and RMT for quarterly dividends and two (IGD and FAM) that pay monthly. One of my regional banks that pays a good dividend, UVSP, will also go ex dividend on 9/4.

************

I decided to create a new investment category which I will call "The $500 to $1000 Flyers Basket Strategy ". Just what the world was waiting for, another investment strategy hatched by the OG and the Nitwit RB.

Due to the considerable uncertainty about the near term future, and an overall positive view about the intermediate and long term, a number of selections are likely to fall into this price range. My VIX model may flash a green light in about a month or the VIX may surge again to over 20 based on the usual list of fears. As with the Lottery Ticket Basket Strategy, which as a maximum of $300 plus any prior profits from the security, this strategy will control risk by limiting the amount of the investment to an insignificant amounts for me.

The strategy will include both ETFs and individual security selections. Some of the ETFs may be in sectors or investment styles that are currently out of favor with the crowd.

The individual security selections will generally be higher quality names than those selected for the LT strategy. However, as with LT selections, some of those selections will justifiably look like I am trying to catch a razor sharp falling knife, including the one discussed in Item # 2 below.

There are reasons to be pessimistic about the near and intermediate term future, but there are always good reasons for pessimism. I recall August 1982, the start of the last long term secular stock bull market, and the pessimism then was both prevalent and easily a majority position. But, the deep thinker types would see that the framework for a long term bull market was already in place. The Federal Reserve had squeezed inflation out of the economy, interest rates were still high but going down, and the computer revolution would drastically improve productivity. The investor did not need to focus on the here and now, but simply digest those big picture events and then act accordingly.

The underlying main problem now is not inflation but debt, both at the consumer and government levels. Underlying Cause of the Current Long Term Bear Market is Too Much Debt (June 2010 Post) That problem involves a few developed nations rather than the primary emerging market nations. The U.S. government is one of those offenders and has made no progress in reducing its out of control budget deficits. There is progress being made in several European nations, the other primary offenders in the government category. American consumers, the primary offender in the consumer category, are making decent headway in improving their balance sheets. It would be extremely important for housing prices to continue an upward trend.

Unlike August 1982, however, I can not say now that the underlying problem has been whipped, since one of the primary offenders, the U.S. government, has yet to address its debt and deficit problems. Our government is the whale in a china shop, not Greece. I may be overestimating the near and intermediate term dangers associated with U.S. government debt levels. My perception of the risk is way out of line with investors who are showering the U.S. government with money, willing to accept rates that will probably fail to earn them any return after inflation.

******

One "principal protected note", Citigroup Inc. 3.00% Minimum Coupon Principal Protected Notes based on S&P 500 (MYP), has been exhibiting bizarre and irrational behavior worthy of a commitment proceeding. I would place a current maximum value on that note of $10.4. I personally would not buy it at $10.40. Maybe I would buy a 100 at $10.20 to $10.3. If I owned 100 shares, I would have sold the entire position at the prices prevailing on either 8/29 or 8/30. MYP had no trades on 8/28 and traded just 400 shares on 8/27, all of which were at a $10.75 price. MYP Historical Prices On 8/29, the price surged to $12.30 with 9600 shares exchanging hands with an intraday high of $12.38. Yesterday, the shares closed at $13, a 30% premium to the $10 per share par value. Bizarre does not begin to describe this action.

MYP is a senior unsecured note issued by Citigroup Funding that matures on 5/12/14 at $10. The note only has two more annual coupon payments left before redemption. This note pays the greater of 3% or up to 32% based on the performance of the S & P 500. Pricing Supplement For the current coupon period, the following is a summary of the relevant data points:

Starting Value= 1,371.97 on 4/24/12 S & P 500 Historical Price

Maximum Level= 1,811 (1,371.97 x.1.320)

End Date: 4/23/13

Yesterday's closing Value=1,399.48

A single close in the S & P 500 above the Maximum Level (1,811), on or before the End Date, would cause a Maximum Level Violation and a reversion to the minimum coupon, irrespective of the S & P's value on 4/23/13. The S & P would have to be above 1,413.13, as of the 4/23/13 close, to even trigger an increase in the 3% annual coupon ($30 per 100 shares), and that would occur only when there is no Maximum Level Violation during the coupon period. The S & P is not even above that level now.

This is just simple math, with a small dose of common sense. To justify a $13 price now, an investor would have to be 100% certain that the S & P would close almost at its maximum level of 1811 on 4/23/13 without a single close above that level during the current annual coupon period. Even if one assumed that would happen, and no one in their right mind would, this security would pay only $3.12 on its $10 par value at a End Date price of 1800 on the S & P 500 with no Maximum Level Violation. Even if you knew in late April 2013 that MYP was going to pay $3.12, based on a S & P 500 close of 1800 on 4/23/13, an investor would not be getting a good deal at all by buying 100 shares at $13 even in an IRA. An investor can not value these securities based on such an asinine and absurd assumption about a future event almost eight months away. This security could end up being worth only a few cents more than its $10 par value at maturity if it ends up paying just its minimum 3% annual coupon for the two remaining annual payments!

**************

I review the Dividend page at the WSJ every weekday night. I noticed that France Telecom will go ex dividend on 9/4 for a $.70941 distribution. I will only own French companies in either my Fidelity or Vanguard brokerage accounts. Item # 2 FTE Dividend-Withholding Tax; Item # 2 Sold 105+FTE. Those were the only two firms that applied for tax relief at the source that reduced France's withholding tax to 15% from 30%. I currently own 100 shares of FTE. I also own several CEFs that will go ex dividend on 9/4/12, including RVT, FUND and RMT for quarterly dividends and two (IGD and FAM) that pay monthly. One of my regional banks that pays a good dividend, UVSP, will also go ex dividend on 9/4.

************

I decided to create a new investment category which I will call "The $500 to $1000 Flyers Basket Strategy ". Just what the world was waiting for, another investment strategy hatched by the OG and the Nitwit RB.

Due to the considerable uncertainty about the near term future, and an overall positive view about the intermediate and long term, a number of selections are likely to fall into this price range. My VIX model may flash a green light in about a month or the VIX may surge again to over 20 based on the usual list of fears. As with the Lottery Ticket Basket Strategy, which as a maximum of $300 plus any prior profits from the security, this strategy will control risk by limiting the amount of the investment to an insignificant amounts for me.

The strategy will include both ETFs and individual security selections. Some of the ETFs may be in sectors or investment styles that are currently out of favor with the crowd.

The individual security selections will generally be higher quality names than those selected for the LT strategy. However, as with LT selections, some of those selections will justifiably look like I am trying to catch a razor sharp falling knife, including the one discussed in Item # 2 below.

As with other basket strategies, the success will be dependent on how the overall portfolio performs rather than one or even a few components. Given the small amount devoted to each selection, I can afford to be patient in case it takes a long time for the investment to pay off.

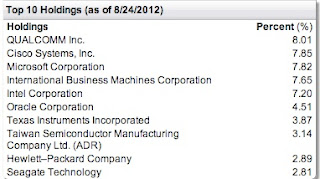

Since a few recent selections fit within this category, I will include some of those in this basket. An example would be the ETF TDIV. Bought 50 TDIV at $19.95 (8/28/12 Post). I will not post a table until I have at least 20 selections. I may include a couple of more ETFs after I sell 50 shares to bring them within the dollar limit of this basket strategy. An example would be the ETF LIT which contains a large number of companies that are currently way out of favor, including all of the battery companies owned by that fund.

1. Bought 50 of the ETF FVL at $12.95 Last Wednesday (The $500 to $1000 Flyers Basket Strategy)(see Disclaimer): This ETF is certainly out of favor and has an ignominious 1 star rating from Morningstar. That may be a tad harsh. I would not give it more than 2, however, given its past performance.

This ETF will include the 100 stocks rated 1 in timeliness by Value Line, hence the name First Trust Value Line (R) 100 Fund. For those unfamiliar with this system, VL ranks 1700 stocks with a timeliness ranking of 1 (highest) to 5 (lowest). One hundred stocks are given a timeliness rank of 1, and VL will make changes to those rankings on a weekly basis. The fund will rebalance quarterly.

Link to Sponsor's Website: First Trust Value Line® 100 (FVL)

Link to Current Holdings: FVL Holdings

FVL will be rebalanced on the last Thursday of each quarter.

The expense ratio is high at .7%. I suspect some of that money has to be paid to VL for the use of its name and index.

The Value Line method for picking stocks has its detractors. It is a quantitative method. While I do not know all of the factors used by that firm or the weight given to each factor, I believe that VL is using a momentum based model that relies heavily on price and earnings. This model seems to work better in long term stock bull markets and is less desirable during long term secular bear markets. That is just a personal observation/opinion.

I am not now, nor have I have been, a "quant" or a "momentum" investor. Actually, most people would describe the OG as a "deep value" and "anti-momentum" investor, which also has its drawbacks including but not limited to the "value trap".

Another problem is that there is frequent movements out of, and into the 1 timelessness ranks. This will cause a fund based on those ranks to incur significant trading costs and potentially large short term realized gains during strong cyclical up moves. The Morningstar page shows the following capital gain distributions during 2005-2007 which illustrates the problem:

12/19/05: $2.4 capital gain distribution of which $1.49 was the tax inefficient short term capital gains (STCG)

06/01/05: $.826 capital gain distribution of which 54.6 cents was STCG

12/20/06: $1.053 capital gain distribution-no STCG

12/06/07: $1.055 capital gain distribution of which $.958 was STCG

In addition to the Morningstar site, the historical distributions can be found at FVL Distributions.

Having noted this problem, one cure for tax inefficiency is to have a large capital loss carryforward that would shelter future gains. The 2011 annual report shows that FVL manage to realized capital losses of $91.553M, of which $47.8+M expires in 2016 and another 29.477+M in 2017. ftportfolios at page 111 The downside is that realized capital gains will probably not be distributed to FVL shareholders to the extent they are offset by the loss carryforwards. At least the loss carryforwards could make the fund more tax efficient for several years, assuming it can start generating large profits rather than losses. And to generate those large profits, the fund would need a lot more money than it has now. Outflows have been the recent norm.

Having noted this problem, one cure for tax inefficiency is to have a large capital loss carryforward that would shelter future gains. The 2011 annual report shows that FVL manage to realized capital losses of $91.553M, of which $47.8+M expires in 2016 and another 29.477+M in 2017. ftportfolios at page 111 The downside is that realized capital gains will probably not be distributed to FVL shareholders to the extent they are offset by the loss carryforwards. At least the loss carryforwards could make the fund more tax efficient for several years, assuming it can start generating large profits rather than losses. And to generate those large profits, the fund would need a lot more money than it has now. Outflows have been the recent norm.

Another issue is that the selections are not good dividend plays for the most part. There were no dividends paid by FVL between 2008-2010. And only a very modest income dividend was paid in 2011 and so far in 2012.

Many of the selections would not be discarded by a fundamental analyst based simply on a movement into a 2 or 3 timeliness ranking.s

FVL: 12.83 -0.12 (-0.96%)

I will probably hold this one for several years, just to see how the VL system works in practice.

I have not owned this ETF since I started this blog back in October 2008. I do recall trading it several times after holding it for a few days or 5 weeks at the most. When I discuss a security for the first time, I will check my trading history going back about six years to see how I handled the security in the past. For FVL, it was never viewed as anything other than a clip. This first trade shows that I had more confidence in the First Trust Value Line Dividend Fund:

The 2008 FVL trade was typical for that time period. I would stick my head up whenever it seemed opportune, buy some stock, quickly sell the positions, and then burrow back into the ground. I kept my head above water that way for the year. I took some snapshots of trades made in 2008 from the same taxable account as the FVL trade, a real hodgepodge of securities:

I really just do not remember any of the foregoing, just one big blur, but I can see now what I was doing and why.

2. Bought 50 VALE at $15.9 Last Wednesday (The $500 to $1000 Flyers Basket Strategy)(see Disclaimer): The bear case for Vale is well understood. There are two major problems. Its main product is iron ore which is crashing in price. This article at Seeking Alpha goes into details.

Iron Ore delivered to Qingdao China - 62% Ferrous Content - USD/dry metric ton Chart

Iron Ore 62% Fe, CFR North China (Platts) Swap

Vale is the world's largest producer of iron ore

Prices for other metals have also been hurt by a deceleration in China's economy and the ongoing recessionary conditions in Europe coupled with sluggish U.S. growth. Vale is the second largest producer of nickel, manganese and ferroalloys. It also has coal, copper, fertilizer, cobalt, and steel operations. It is the largest provider of logistics and transportation in Brazil due to its ownership of railroads and ports.

The other problem involves Brazil's government and that issue caused me to sell 100 shares last year. Item # 2 SOLD 100 VALE at $34.6 I never view a significant government stake in a private company positively. And, when the government has a controlling stake, the potential for mischief and undesirable meddling is high. This concern will become acute in Latin America, where leftist governments will frequently use companies as a source of funds and political patronage. As shown by some recent activities in Argentina, a government takeover is not out of the question.

Vale was privatized in 1997. The government has retained 12 golden shares that gives it some limited veto powers. A controlling shareholder is Valepar, which has the right to appoint 9 out of 10 directors, and Valepar can be influenced by the Brazilian government through the Banco do Brazil's pension fund Previ, and the Brazilian government's development bank known as BNDS which is both a Valepar shareholder and a lender to Vale. (see page 110-113 SEC Form 20-F, 2011 Vale Annual Report)

I view the Brazilian government's hostility to capitalism to be comparable to Argentina's government, though not as extreme at the present time. Argentina is possibly a notch or two better than the Hugo Chávez administration in Venezuela.

Some of the political risk in Brazil is demonstrated by the government claiming an additional $15.19 billion in taxes on Vale's overseas profits, and a demand for $1.98 billion in additional royalties. Reuters In short, Brazil views the company as a honey pot to raid whenever the leftist politicians want more money.

The tax issue is currently before Brazil's Supreme Court. An adverse decision by Brazil's Supreme Court could easily send the shares down significantly. Conversely, the price could also jump if Brazil's Supreme Court squashed the government's effort to collect that $15.19B. I believe that Vale lost in the lower courts (SEC 6k) and is arguing that the government's position is violation of Brazil's Constitution which prohibits double taxation. That would be a good amendment for the U.S. Constitution.

This kind of political climate will cause investor's to head for the exits in droves, and that stampede will only accelerate if and when Brazil succeeds in crippling Vale's expansion prospects with these kind of demands. The downturn in profitability adds fuel to the fire. Given this extremely adverse political climate and a significant downturn in prices for the commodities produced by Vale, I would not buy more than 50 shares even at the current depressed price.

On the day of my purchase, the price had fallen almost 4% below my target re-entry price of $16, so I bought just 50 shares knowing that the near term outlook is negative. Hopefully, most of that negative outlook, relating to Vale's operations including the price of iron ore, is already priced into the shares, which have fallen from a 2008 high near $44. VALE Interactive Chart

The last bottom after a huge downdraft was hit near $10 late in 2008. I suspect that bottom may be tested if Vale has to pay another $15B in taxes. The most recent top was around $36 in January 2011 and it has been mostly downhill since that high. Possibly, it would have made more sense to pick up this small position with the share price nearer $10. When catching a falling knife, sometimes it pays to wait until the point of maximum pessimism is reached by investors, marked by a wholesale dumping of the security. It is hard to know one way or the other. I do know that a buy of 50 shares at $15.9 looks a whole lot better than continuing to hold until now those 100 shares sold at $34.6 last year.

Some share price support is provided by the dividend which will fluctuate with earnings. The next ex dividend date is 10/17/12 and the approximate amount of the dividend is $.59 per ADS share according to Marketwatch. According to Deloitte, Brazil does not levy a withholding tax on dividends. This is a link to a Deloitte summary of withholding tax rates by country: deloitte.com. pdf

Given the uncertainty about Vale's profitability and the political situation, however, I would not count on future dividends being paid, let alone paid at the current rate.

I did read a few reports before purchasing the shares. S & P rates the shares at 4 stars with a $24 12 month price target. That target is probably to high for 12 months. A $24 price in 24 months may be more realistic.

Morningstar has a 4 star rating on VALE and a consider to buy price, which may prove to be about right, at less than $13.9.

This is a link to the 2012 second quarter report filed with the SEC. Net sales fell 21% to $11.9B. Operating earnings per ADS fell to 60 cents from $1.22.

VALE: 16.04 -0.06 (-0.37%)

If I receive a decent pop in these shares to over $20 within the next six months, I would seriously consider harvesting that profit plus the one dividend payment.

FVL: 12.83 -0.12 (-0.96%)

I will probably hold this one for several years, just to see how the VL system works in practice.

I have not owned this ETF since I started this blog back in October 2008. I do recall trading it several times after holding it for a few days or 5 weeks at the most. When I discuss a security for the first time, I will check my trading history going back about six years to see how I handled the security in the past. For FVL, it was never viewed as anything other than a clip. This first trade shows that I had more confidence in the First Trust Value Line Dividend Fund:

|

| 2006 FVL 100 Shares +$68.96/FVD 400 Shares +$764.43 |

| 2007 FVL 100 Shares $42.96 |

| 2008 FVL 100 Shares $50.59 (5 days) |

I really just do not remember any of the foregoing, just one big blur, but I can see now what I was doing and why.

2. Bought 50 VALE at $15.9 Last Wednesday (The $500 to $1000 Flyers Basket Strategy)(see Disclaimer): The bear case for Vale is well understood. There are two major problems. Its main product is iron ore which is crashing in price. This article at Seeking Alpha goes into details.

Iron Ore delivered to Qingdao China - 62% Ferrous Content - USD/dry metric ton Chart

Iron Ore 62% Fe, CFR North China (Platts) Swap

Vale is the world's largest producer of iron ore

Prices for other metals have also been hurt by a deceleration in China's economy and the ongoing recessionary conditions in Europe coupled with sluggish U.S. growth. Vale is the second largest producer of nickel, manganese and ferroalloys. It also has coal, copper, fertilizer, cobalt, and steel operations. It is the largest provider of logistics and transportation in Brazil due to its ownership of railroads and ports.

The other problem involves Brazil's government and that issue caused me to sell 100 shares last year. Item # 2 SOLD 100 VALE at $34.6 I never view a significant government stake in a private company positively. And, when the government has a controlling stake, the potential for mischief and undesirable meddling is high. This concern will become acute in Latin America, where leftist governments will frequently use companies as a source of funds and political patronage. As shown by some recent activities in Argentina, a government takeover is not out of the question.

Vale was privatized in 1997. The government has retained 12 golden shares that gives it some limited veto powers. A controlling shareholder is Valepar, which has the right to appoint 9 out of 10 directors, and Valepar can be influenced by the Brazilian government through the Banco do Brazil's pension fund Previ, and the Brazilian government's development bank known as BNDS which is both a Valepar shareholder and a lender to Vale. (see page 110-113 SEC Form 20-F, 2011 Vale Annual Report)

I view the Brazilian government's hostility to capitalism to be comparable to Argentina's government, though not as extreme at the present time. Argentina is possibly a notch or two better than the Hugo Chávez administration in Venezuela.

Some of the political risk in Brazil is demonstrated by the government claiming an additional $15.19 billion in taxes on Vale's overseas profits, and a demand for $1.98 billion in additional royalties. Reuters In short, Brazil views the company as a honey pot to raid whenever the leftist politicians want more money.

The tax issue is currently before Brazil's Supreme Court. An adverse decision by Brazil's Supreme Court could easily send the shares down significantly. Conversely, the price could also jump if Brazil's Supreme Court squashed the government's effort to collect that $15.19B. I believe that Vale lost in the lower courts (SEC 6k) and is arguing that the government's position is violation of Brazil's Constitution which prohibits double taxation. That would be a good amendment for the U.S. Constitution.

This kind of political climate will cause investor's to head for the exits in droves, and that stampede will only accelerate if and when Brazil succeeds in crippling Vale's expansion prospects with these kind of demands. The downturn in profitability adds fuel to the fire. Given this extremely adverse political climate and a significant downturn in prices for the commodities produced by Vale, I would not buy more than 50 shares even at the current depressed price.

On the day of my purchase, the price had fallen almost 4% below my target re-entry price of $16, so I bought just 50 shares knowing that the near term outlook is negative. Hopefully, most of that negative outlook, relating to Vale's operations including the price of iron ore, is already priced into the shares, which have fallen from a 2008 high near $44. VALE Interactive Chart

The last bottom after a huge downdraft was hit near $10 late in 2008. I suspect that bottom may be tested if Vale has to pay another $15B in taxes. The most recent top was around $36 in January 2011 and it has been mostly downhill since that high. Possibly, it would have made more sense to pick up this small position with the share price nearer $10. When catching a falling knife, sometimes it pays to wait until the point of maximum pessimism is reached by investors, marked by a wholesale dumping of the security. It is hard to know one way or the other. I do know that a buy of 50 shares at $15.9 looks a whole lot better than continuing to hold until now those 100 shares sold at $34.6 last year.

Some share price support is provided by the dividend which will fluctuate with earnings. The next ex dividend date is 10/17/12 and the approximate amount of the dividend is $.59 per ADS share according to Marketwatch. According to Deloitte, Brazil does not levy a withholding tax on dividends. This is a link to a Deloitte summary of withholding tax rates by country: deloitte.com. pdf

Given the uncertainty about Vale's profitability and the political situation, however, I would not count on future dividends being paid, let alone paid at the current rate.

I did read a few reports before purchasing the shares. S & P rates the shares at 4 stars with a $24 12 month price target. That target is probably to high for 12 months. A $24 price in 24 months may be more realistic.

Morningstar has a 4 star rating on VALE and a consider to buy price, which may prove to be about right, at less than $13.9.

This is a link to the 2012 second quarter report filed with the SEC. Net sales fell 21% to $11.9B. Operating earnings per ADS fell to 60 cents from $1.22.

VALE: 16.04 -0.06 (-0.37%)

If I receive a decent pop in these shares to over $20 within the next six months, I would seriously consider harvesting that profit plus the one dividend payment.