An article in this week's Barrons ranks state debt by combining debt and unfunded pension liabilities relative to each state's GDP. I would rank the debt of California, Illinois, and New Jersey near the bottom using mostly my judgment. Using the Barron's criteria, Illinois was second from the bottom, but Connecticut's debt was the least safe. Tennessee was ranked third, and I would expect my state to be the near the top. Tennessee's debt plus its pension liability was 1.5% of its GDP, while Connecticut's ratio was 17.1%. New Jersey's debt was ranked at #42 and California at #34. I was surprised by Kentucky being ranked near the bottom. Municipal bond investors need to pay more attention to unfunded pension liabilities when evaluating the safety of longer term bonds.

Nokia shares rallied strongly yesterday in response to Apple's patent victory against Samsung. The thinking is that Samsung will have to withdraw some smartphones from the U.S. market and that will give Nokia an opportunity to grab some much needed market share. The Washington Post MarketWatch It is also expected that Nokia will preview new devices in early September. I am not following the details, but new devices will use Microsoft's new Windows Phone 8. Bloomberg I own NOK common shares in my Lottery Ticket Basket Strategy. Item # 3 Bought 50 NOK at $2.88-LT Category

NOK: 3.26 +0.18 (+5.84%)

Nokia shares rallied strongly yesterday in response to Apple's patent victory against Samsung. The thinking is that Samsung will have to withdraw some smartphones from the U.S. market and that will give Nokia an opportunity to grab some much needed market share. The Washington Post MarketWatch It is also expected that Nokia will preview new devices in early September. I am not following the details, but new devices will use Microsoft's new Windows Phone 8. Bloomberg I own NOK common shares in my Lottery Ticket Basket Strategy. Item # 3 Bought 50 NOK at $2.88-LT Category

NOK: 3.26 +0.18 (+5.84%)

*********************

For amusement, the OG will frequently read comments made by WSJ readers, and it is not difficult to spot the TBs (see, e.g. WSJ). One person who left a comment argues that the government's budget problems originate from the Democrats showering free money on minorities. He does not say African Americans or anything that could easily be pegged as overtly racist. He is referring to food stamps and welfare. Those angry white men, along with assorted wingnuts, will eventually cause the GOP to become a minority party bordering on irrelevance. Give it twenty years at the most.

Do racists now vote for Democrats or Republicans? In the south, they were mostly voting for Democrats before that party started to support the civil rights legislation in the 1960s. Then, as part of the GOP's Southern Strategy, they changed their allegiance to the republican party and have never left.

The Southern Strategy has been a great success for the GOP so far at least. As pointed out by Michael Barone in an article published yesterday by the WSJ, the GOP is now receiving 60%-69% of its electoral votes from the South.

Barone points out that noncollege whites have been declining as a percentage of the electorate. Noncollege whites who are also evangelicals supplied 42% of McCain's votes in the last election. When that is kept in mind, the recent comment by Romney that no one has asked to see his birth certificate can not be construed as a bad joke, but as a sop to those core GOP votes who view a black President as foreign, someone who does not share their "American" values as Sarah was so fond of saying during the last Presidential election.

It is also not difficult to convince this crowd that the Vietnam War (LBJ-D) or the Second Iraq War (Bush Jr.-R) was in the nation's national interest. And they are also subject to easy manipulation with false campaign advertisements.

It is impossible to reason with the angry caucasians who feel that their country is slipping away from them. They do not recognize their own dependence on the government and are quick to stereotype the poor as non-working, who vote for Democrats in exchange for all of that free welfare and food stamp money.

The government could save far more money by eliminating all federal subsidies for Medicare, so that those angry middle age white men can support their parents as they slide into poverty.

Another source of funding for the government would be to eliminate the mortgage interest deduction which costs the government more than food stamps (WSJ), to treat premiums paid by employers for health care as income to employees, and to eliminate deductions for dependents and for state and local taxes. Elimination of those middle class entitlements would help the government narrow its budget deficits considerably. Maybe Mitt has those entitlements on his hit list. Romney's Tax Plan; FactCheck.org

Or, perhaps, those angry whites, who blame the poor for everything including the Near Depression. Ideology and Facts: Coexistence Not Allowed, could be denied extended unemployment compensation when they are fired or laid off during a recession and are unable to find a job. No, the racist will not focus on their government benefits, or those received by their family members, and will instead focus entirely on the programs intended for the poor, particularly the non-white poor who fit within their stereotypes and racist perceptions. What do they see in their mind's eye? An overweight black woman standing in line for a welfare check with ten babies by eight different fathers in tow, using one of her eighty aliases to defraud white people of their hard earned tax dollars. The repetitive welfare queen's statements made by Ronald Reagan, which blew way out of proportion a case of welfare fraud involving $8,000, NYT, were intended for this audience. The Willie Horton ads had the same purpose, as did the ads run against Harold Ford by the RNC in Tennessee when that black man ran against Corker for the U.S. Senate. Harold call me!-YouTube; New York Times Ann Coulter demonstrated their perspective on events when she said, in her usual incendiary way, that the mortgage crisis originated from giving loans based on a persons ability to hit a jump shot. HUMAN EVENTS All of the foregoing are mere extensions of the GOP's Southern Strategy, as they successfully took it national.

I have not mentioned two major sources of the government's current budget problems: (1) the trillion dollars sunk into Bush's Iraq War and (2) the trillions lost in the Bush Tax cuts that primarily benefited a few old white people, the major source of the GOP's campaign contributions, rather than those middle class white men who may still believe that those cuts were intended to help them. Both of the foregoing drains on the government's finances were supported by the TBs en masse.

I thought that I would just focus on one program which draws their collective ire-Food Stamps.

During deep recessions, expenditures for the food stamp program will rise, as a number of middle class families slip into poverty In 2007, there were 26,316 million participants receiving an average of $96.18 per month in nutritional assistance. That was a decrease from the participants during 2006. As one would expect, the severity of the last recession, the worst in the OG's lifetime, caused more participation in this program, by all races, and the number of participants ballooned to 44,709 million at an average cost of $133.85 per month or $1,606.2 per year. Supplemental Nutrition Assistance Program Annual Summary (formerly known as food stamps)

Three-quarters of SNAP benefits go to families with children. Almost one-third of the beneficiaries are senior citizens and the disabled. The House GOP plans to cut this program by 20%. House-Passed Cut in SNAP (Food Stamps) That is just their first whack at this program. CBO Report This would be done in conjunction with lowering the tax bills for the Koch brothers and other generous donors to the GOP. New Tax Cuts in Ryan Budget Would Give Millionaires $265,000 on Top of Bush Tax Cuts

The number of recipients will start to trend down once the economy more fully recovers from the Near Depression. Some of the increased costs are due to higher benefits originating from Obama's 2009 stimulus that are set to expire at the end of 2013. CBO | The Supplemental Nutrition Assistance Program The CBO estimates that about 20% of the increased cost is due to those temporary benefit increases. Arguably, those additional benefits should expire at the end of this year. I would agree with the republicans on that issue.

Over the weekend, I listened to a speech given by Eisenhower at the GOP convention in 1956. The speech was replayed on CSPAN. I was impressed by it. I was also reminded in stark fashion how much the GOP has changed for the worst since that time. I would have had no difficulty voting for Eisenhower.

The Modern GOP is no longer a conservative party but a reactionary one trying to appease the fringe elements in our society that have always existed in large numbers. It has retrogressed to a 19th Century parody of itself at it re-adopts a slightly more modern version of Social Darwinism that was fashionable, among the less enlightened set, over 120 years ago.

********************

While watching the season finale of the HBO series "Newsroom", written by Aaron Sorkin, a newscast ends with a criticism of the Modern Day GOP that could have been found in this blog, including the use of the phrase "American Taliban" to describe an important GOP voting bloc. I had never heard or seen a similar use of that phrase outside of this blog. I started using that phrase in 2009, usually in the context of stating that the GOP has been kidnapped by the American Taliban movement.

("american taliban" site:http://tennesseeindependent.blogspot.com/ - Google Search)

*****************

1. Bought 50 of the ETF TDIV at $19.95 Yesterday (see Disclaimer): The First Trust ETF VI NASDAQ Technology Dividend Index Fund (TDIV) is a new ETF that focuses on dividend paying technology stocks. First Trust Launches Multi-Asset Diversified Income Index Fund and First Trust NASDAQ Technology Dividend Index Fund

If the OG was not nervous about the market, I would have bought 100 shares. One thing is for certain. A 50 share purchase is not going to help or hurt me, but creates the psychologically beneficial impression that I am doing something rather than just sitting on my behind doing nothing which is actually what I am doing now.

This new ETF includes technology and telecommunications companies that pay dividends. The weighting will be about 80% in technology companies and 20% in telecommunications. For inclusion, the company must have at least a .5% yield and must have paid a regular common within the past 12 months. That low minimum qualifies Oracle for inclusion. ORCL: 31.83 -0.12 (-0.38%) Apple will be eligible for inclusion in the index next year.

This ETF is discussed in a Barrons' article. The author of that article claims that this index currently has a 3.3% yield. To arrive at the fund's yield, it would be necessary to subtract the expense ratio. According to the Prospectus at page 9, the fund anticipates paying quarterly dividends.

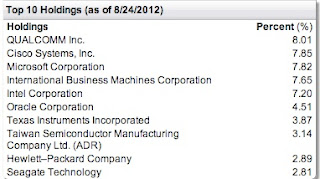

I took a snapshot of the top 10 holdings as of 8/24/12:

First Trust NASDAQ Technology Dividend Index Fund Holdings (TDIV)

The expense ratio is .5%. The fund had 59 holdings as of 8/25/12. I decided to nibble at this one as several large technology companies have recently instituted dividends and/or started to increase existing payouts significantly (e.g. Cisco). Many of them certainly have the cash and capacity to increase dividends at a more rapid rate than companies in other sectors.

CSCO Key Statistics: Cash per share $9.14; Cash $16.33B as of 7/28/12

ORCL Key Statistics: Cash per share $6.28; Cash 37.12B as of 5/31/12

MSFT Key Statistics: Cash per share $7.28; Cash 62.08B as of 6/30/12

AAPL Key Statistics: Cash per share $29.5; Cash 27.65B as of 6/30/12

INTC Key Statistics: Cash per share $2.73; Cash 13.65B as of 6/30/12

IBM Key Statistics: Cash per share $9.83; Cash 11.23B as of 6/30/12

TXN Key Statistics: Cash per share $2.05; Cash 2.33B as of 6/3012

Unfortunately, a lot of the cash is held by overseas subsidiaries of these companies, and is consequently not available for dividends unless the corporation wants to pay a large tax to bring funds back to the U.S.

If Romney is elected, I would expect a reduction in corporate tax rates and possibly a tax holiday for repatriation of those funds.

Previously, U.S. multinationals promised to create U.S. jobs in return for a 5.25% tax on repatriation as part of the 2004 American Jobs Creation Act, but of course failed to deliver on that promise. Instead, corporations used the repatriated funds to increase dividends, which is fine with their shareholders, and to line the pockets of their executives with increased pay and benefits. (Press Release with link to Senate report on this issue)

The windfall for the corporations was approximately $265B. New York Times The Congressional Research Service noted that there is no empirical evidence that there was any increase in investment or employment by those firms utilizing this one time tax break. repatriationholiday.pdf

I am not making a policy argument here. If the GOP wins, I suspect that large tech firms will be able to bring money back to the U.S. that can be used to accelerate their dividend increases. The plan will be sold to the public as a measure to create jobs, and many gullible people will accept that line of B.S. without questioning it.

TDIV: 19.91 -0.08 (-0.40%)

2. Hudson City (own: Regional Bank Basket Strategy): HCBK is one of the three "underperforming" stocks in my regional bank basket. Yesterday, Hudson City Bancorp announced that it was being acquired by M & T Bank (MTB). This seems to be a good long term deal for the MTB shareholders, as shown by yesterday's price gain. MTB Stock Quote

Under the deal, HCBK shareholders will receive consideration valued at .08403 M& T shares in the form of M & T stock or in cash. I have a generally favorable opinion about M & T. I The offer is subject to proration, so that no more than 60% of the aggregate consideration can be paid in M & T stock. Since I only own 111+ shares, I may end up selling this lot just to avoid the proration.

HCBK Stock Quote

I have few unfavorable comments to make about MTB. The company participated in TARP, always viewed unfavorably here at HQ. In addition, MTB has not redeemed the government's cumulative preferred shares. It is allowing the government to sell those shares to the public. Treasury Department Announces Public Offering of M&T Bank Corporation Preferred Stock; Underwriting Agreement, dated August 17, 2012 As previously noted, the government's preferred stock pays 5% over the first five years and then the coupon increases to 9%. Second quarter earnings fell to $1.82 per share from $2.16 in the 2011 second quarter. The capital ratios are at best okay:

10-Q/A

There are also many positives for M & T. It navigated the Near Depression period better than most banks and has significantly expanded its geographic footprint by acquiring other institutions that faltered, including Wilmington Trust. As of 6/30/2012, the efficiency ratio was good at 56.86%; nonaccrual loans were acceptable at 1.54% of total loans; and the average return on tangible assets for the last quarter was 1.3%. SEC Filed Press Release Under the circumstances, the net interest margin was okay at 3.74%, basically unchanged from a year ago.

Before HCBK became fell victim of the Fed's Jihad Against the Saving Class, the stock was trading over $16 per share back in October 2008. HCBK Interactive Chart This bank was highly dependent on outside funding sources and home mortgages. With the decline in rates, Hudson's net interest margin was negatively impacted far more than other regional banks that I own for those two reasons.

While it is just my personal opinion, I believe HCBK shareholders would be better off long term rejecting the MTB offer and simply wait for a more opportune interest rate environment before selling out. By selling out now, they in effect value the bank at 2003 prices. (see long term chart of HCBK; and WSJ) For that reason, I will vote against the merger.

HCBK: 7.45 +1.01 (+15.68%)

MTB: 89.81 +3.94 (+4.59%)

For amusement, the OG will frequently read comments made by WSJ readers, and it is not difficult to spot the TBs (see, e.g. WSJ). One person who left a comment argues that the government's budget problems originate from the Democrats showering free money on minorities. He does not say African Americans or anything that could easily be pegged as overtly racist. He is referring to food stamps and welfare. Those angry white men, along with assorted wingnuts, will eventually cause the GOP to become a minority party bordering on irrelevance. Give it twenty years at the most.

Do racists now vote for Democrats or Republicans? In the south, they were mostly voting for Democrats before that party started to support the civil rights legislation in the 1960s. Then, as part of the GOP's Southern Strategy, they changed their allegiance to the republican party and have never left.

The Southern Strategy has been a great success for the GOP so far at least. As pointed out by Michael Barone in an article published yesterday by the WSJ, the GOP is now receiving 60%-69% of its electoral votes from the South.

Barone points out that noncollege whites have been declining as a percentage of the electorate. Noncollege whites who are also evangelicals supplied 42% of McCain's votes in the last election. When that is kept in mind, the recent comment by Romney that no one has asked to see his birth certificate can not be construed as a bad joke, but as a sop to those core GOP votes who view a black President as foreign, someone who does not share their "American" values as Sarah was so fond of saying during the last Presidential election.

It is also not difficult to convince this crowd that the Vietnam War (LBJ-D) or the Second Iraq War (Bush Jr.-R) was in the nation's national interest. And they are also subject to easy manipulation with false campaign advertisements.

It is impossible to reason with the angry caucasians who feel that their country is slipping away from them. They do not recognize their own dependence on the government and are quick to stereotype the poor as non-working, who vote for Democrats in exchange for all of that free welfare and food stamp money.

The government could save far more money by eliminating all federal subsidies for Medicare, so that those angry middle age white men can support their parents as they slide into poverty.

Another source of funding for the government would be to eliminate the mortgage interest deduction which costs the government more than food stamps (WSJ), to treat premiums paid by employers for health care as income to employees, and to eliminate deductions for dependents and for state and local taxes. Elimination of those middle class entitlements would help the government narrow its budget deficits considerably. Maybe Mitt has those entitlements on his hit list. Romney's Tax Plan; FactCheck.org

Or, perhaps, those angry whites, who blame the poor for everything including the Near Depression. Ideology and Facts: Coexistence Not Allowed, could be denied extended unemployment compensation when they are fired or laid off during a recession and are unable to find a job. No, the racist will not focus on their government benefits, or those received by their family members, and will instead focus entirely on the programs intended for the poor, particularly the non-white poor who fit within their stereotypes and racist perceptions. What do they see in their mind's eye? An overweight black woman standing in line for a welfare check with ten babies by eight different fathers in tow, using one of her eighty aliases to defraud white people of their hard earned tax dollars. The repetitive welfare queen's statements made by Ronald Reagan, which blew way out of proportion a case of welfare fraud involving $8,000, NYT, were intended for this audience. The Willie Horton ads had the same purpose, as did the ads run against Harold Ford by the RNC in Tennessee when that black man ran against Corker for the U.S. Senate. Harold call me!-YouTube; New York Times Ann Coulter demonstrated their perspective on events when she said, in her usual incendiary way, that the mortgage crisis originated from giving loans based on a persons ability to hit a jump shot. HUMAN EVENTS All of the foregoing are mere extensions of the GOP's Southern Strategy, as they successfully took it national.

I have not mentioned two major sources of the government's current budget problems: (1) the trillion dollars sunk into Bush's Iraq War and (2) the trillions lost in the Bush Tax cuts that primarily benefited a few old white people, the major source of the GOP's campaign contributions, rather than those middle class white men who may still believe that those cuts were intended to help them. Both of the foregoing drains on the government's finances were supported by the TBs en masse.

I thought that I would just focus on one program which draws their collective ire-Food Stamps.

During deep recessions, expenditures for the food stamp program will rise, as a number of middle class families slip into poverty In 2007, there were 26,316 million participants receiving an average of $96.18 per month in nutritional assistance. That was a decrease from the participants during 2006. As one would expect, the severity of the last recession, the worst in the OG's lifetime, caused more participation in this program, by all races, and the number of participants ballooned to 44,709 million at an average cost of $133.85 per month or $1,606.2 per year. Supplemental Nutrition Assistance Program Annual Summary (formerly known as food stamps)

Three-quarters of SNAP benefits go to families with children. Almost one-third of the beneficiaries are senior citizens and the disabled. The House GOP plans to cut this program by 20%. House-Passed Cut in SNAP (Food Stamps) That is just their first whack at this program. CBO Report This would be done in conjunction with lowering the tax bills for the Koch brothers and other generous donors to the GOP. New Tax Cuts in Ryan Budget Would Give Millionaires $265,000 on Top of Bush Tax Cuts

The number of recipients will start to trend down once the economy more fully recovers from the Near Depression. Some of the increased costs are due to higher benefits originating from Obama's 2009 stimulus that are set to expire at the end of 2013. CBO | The Supplemental Nutrition Assistance Program The CBO estimates that about 20% of the increased cost is due to those temporary benefit increases. Arguably, those additional benefits should expire at the end of this year. I would agree with the republicans on that issue.

Over the weekend, I listened to a speech given by Eisenhower at the GOP convention in 1956. The speech was replayed on CSPAN. I was impressed by it. I was also reminded in stark fashion how much the GOP has changed for the worst since that time. I would have had no difficulty voting for Eisenhower.

The Modern GOP is no longer a conservative party but a reactionary one trying to appease the fringe elements in our society that have always existed in large numbers. It has retrogressed to a 19th Century parody of itself at it re-adopts a slightly more modern version of Social Darwinism that was fashionable, among the less enlightened set, over 120 years ago.

********************

While watching the season finale of the HBO series "Newsroom", written by Aaron Sorkin, a newscast ends with a criticism of the Modern Day GOP that could have been found in this blog, including the use of the phrase "American Taliban" to describe an important GOP voting bloc. I had never heard or seen a similar use of that phrase outside of this blog. I started using that phrase in 2009, usually in the context of stating that the GOP has been kidnapped by the American Taliban movement.

("american taliban" site:http://tennesseeindependent.blogspot.com/ - Google Search)

*****************

1. Bought 50 of the ETF TDIV at $19.95 Yesterday (see Disclaimer): The First Trust ETF VI NASDAQ Technology Dividend Index Fund (TDIV) is a new ETF that focuses on dividend paying technology stocks. First Trust Launches Multi-Asset Diversified Income Index Fund and First Trust NASDAQ Technology Dividend Index Fund

If the OG was not nervous about the market, I would have bought 100 shares. One thing is for certain. A 50 share purchase is not going to help or hurt me, but creates the psychologically beneficial impression that I am doing something rather than just sitting on my behind doing nothing which is actually what I am doing now.

This new ETF includes technology and telecommunications companies that pay dividends. The weighting will be about 80% in technology companies and 20% in telecommunications. For inclusion, the company must have at least a .5% yield and must have paid a regular common within the past 12 months. That low minimum qualifies Oracle for inclusion. ORCL: 31.83 -0.12 (-0.38%) Apple will be eligible for inclusion in the index next year.

This ETF is discussed in a Barrons' article. The author of that article claims that this index currently has a 3.3% yield. To arrive at the fund's yield, it would be necessary to subtract the expense ratio. According to the Prospectus at page 9, the fund anticipates paying quarterly dividends.

I took a snapshot of the top 10 holdings as of 8/24/12:

First Trust NASDAQ Technology Dividend Index Fund Holdings (TDIV)

The expense ratio is .5%. The fund had 59 holdings as of 8/25/12. I decided to nibble at this one as several large technology companies have recently instituted dividends and/or started to increase existing payouts significantly (e.g. Cisco). Many of them certainly have the cash and capacity to increase dividends at a more rapid rate than companies in other sectors.

CSCO Key Statistics: Cash per share $9.14; Cash $16.33B as of 7/28/12

ORCL Key Statistics: Cash per share $6.28; Cash 37.12B as of 5/31/12

MSFT Key Statistics: Cash per share $7.28; Cash 62.08B as of 6/30/12

AAPL Key Statistics: Cash per share $29.5; Cash 27.65B as of 6/30/12

INTC Key Statistics: Cash per share $2.73; Cash 13.65B as of 6/30/12

IBM Key Statistics: Cash per share $9.83; Cash 11.23B as of 6/30/12

TXN Key Statistics: Cash per share $2.05; Cash 2.33B as of 6/3012

Unfortunately, a lot of the cash is held by overseas subsidiaries of these companies, and is consequently not available for dividends unless the corporation wants to pay a large tax to bring funds back to the U.S.

If Romney is elected, I would expect a reduction in corporate tax rates and possibly a tax holiday for repatriation of those funds.

Previously, U.S. multinationals promised to create U.S. jobs in return for a 5.25% tax on repatriation as part of the 2004 American Jobs Creation Act, but of course failed to deliver on that promise. Instead, corporations used the repatriated funds to increase dividends, which is fine with their shareholders, and to line the pockets of their executives with increased pay and benefits. (Press Release with link to Senate report on this issue)

The windfall for the corporations was approximately $265B. New York Times The Congressional Research Service noted that there is no empirical evidence that there was any increase in investment or employment by those firms utilizing this one time tax break. repatriationholiday.pdf

I am not making a policy argument here. If the GOP wins, I suspect that large tech firms will be able to bring money back to the U.S. that can be used to accelerate their dividend increases. The plan will be sold to the public as a measure to create jobs, and many gullible people will accept that line of B.S. without questioning it.

TDIV: 19.91 -0.08 (-0.40%)

2. Hudson City (own: Regional Bank Basket Strategy): HCBK is one of the three "underperforming" stocks in my regional bank basket. Yesterday, Hudson City Bancorp announced that it was being acquired by M & T Bank (MTB). This seems to be a good long term deal for the MTB shareholders, as shown by yesterday's price gain. MTB Stock Quote

Under the deal, HCBK shareholders will receive consideration valued at .08403 M& T shares in the form of M & T stock or in cash. I have a generally favorable opinion about M & T. I The offer is subject to proration, so that no more than 60% of the aggregate consideration can be paid in M & T stock. Since I only own 111+ shares, I may end up selling this lot just to avoid the proration.

HCBK Stock Quote

I have few unfavorable comments to make about MTB. The company participated in TARP, always viewed unfavorably here at HQ. In addition, MTB has not redeemed the government's cumulative preferred shares. It is allowing the government to sell those shares to the public. Treasury Department Announces Public Offering of M&T Bank Corporation Preferred Stock; Underwriting Agreement, dated August 17, 2012 As previously noted, the government's preferred stock pays 5% over the first five years and then the coupon increases to 9%. Second quarter earnings fell to $1.82 per share from $2.16 in the 2011 second quarter. The capital ratios are at best okay:

10-Q/A

There are also many positives for M & T. It navigated the Near Depression period better than most banks and has significantly expanded its geographic footprint by acquiring other institutions that faltered, including Wilmington Trust. As of 6/30/2012, the efficiency ratio was good at 56.86%; nonaccrual loans were acceptable at 1.54% of total loans; and the average return on tangible assets for the last quarter was 1.3%. SEC Filed Press Release Under the circumstances, the net interest margin was okay at 3.74%, basically unchanged from a year ago.

Before HCBK became fell victim of the Fed's Jihad Against the Saving Class, the stock was trading over $16 per share back in October 2008. HCBK Interactive Chart This bank was highly dependent on outside funding sources and home mortgages. With the decline in rates, Hudson's net interest margin was negatively impacted far more than other regional banks that I own for those two reasons.

While it is just my personal opinion, I believe HCBK shareholders would be better off long term rejecting the MTB offer and simply wait for a more opportune interest rate environment before selling out. By selling out now, they in effect value the bank at 2003 prices. (see long term chart of HCBK; and WSJ) For that reason, I will vote against the merger.

HCBK: 7.45 +1.01 (+15.68%)

MTB: 89.81 +3.94 (+4.59%)

No comments:

Post a Comment