The last update for this basket was in October 2014: Update for Equity REIT Common and Preferred Stock Basket Strategy/OHI Earnings Report and Dividend Increase (10/27/14 Post)

For the reasons discussed in a March 2014 post, I started a tactical allocation shift into REIT common and preferred stocks starting in September 2013. Equity REIT Common and Preferred Stock Table as of 3/5/14 This particular shift started after prices had significantly corrected in the May to September 2013 time frame. Most of my best buys were made in December 2013 that marked the high point in the correction process.

I still own three of those, with closing prices today noted as well:

Snapshot at Item # 6 Bought: 100 Realty Income (O) at $36.96 (12/10/13 Post)

O: $49.31 -0.11 (-0.22%)

O: $49.31 -0.11 (-0.22%)

I viewed the 2013 correction to have two primary causes.

First, REIT valuations had hit stretched valuation levels by May 2013 based on historical norms,

Second, interest rates started to spike in May 2013, making alternative income investments more attractive compared to REITs for some investors. The 10 year treasury closed at a 1.66% yield on 5/1/13 and had risen to 3.04% by 12/31/13. Daily Treasury Yield Curve Rates

Aggregate P/FFO data can be found in Lazard's monthly Real Estate Report. The aggregate P/FFO has become somewhat elevated again.

Canadian REITs are undervalued compared to U.S. REITs based on P/FFO or P/AFFO and dividend yields. Many of the Canadian REITs have recently hit 52 week and/or all time lows. The latest downdraft in prices was concurrent with the abrupt decline in crude oil prices, as I have noted in recent posts discussing adds to my Canadian REIT positions.

REIT Basket Strategy: Added 100 Northwest Healthcare Properties REIT At C$8.3-Seeking Alpha;

Equity REIT Basket Strategy: Bought 50 Units Artis Real Estate Investment Trust At $12-Seeking Alpha;

Equity REIT Basket Strategy: Added 200 Of The Canadian REIT Dream Industrial At C$9.03-Seeking Alpha

Canadian REITs are undervalued compared to U.S. REITs based on P/FFO or P/AFFO and dividend yields. Many of the Canadian REITs have recently hit 52 week and/or all time lows. The latest downdraft in prices was concurrent with the abrupt decline in crude oil prices, as I have noted in recent posts discussing adds to my Canadian REIT positions.

REIT Basket Strategy: Added 100 Northwest Healthcare Properties REIT At C$8.3-Seeking Alpha;

Equity REIT Basket Strategy: Bought 50 Units Artis Real Estate Investment Trust At $12-Seeking Alpha;

Equity REIT Basket Strategy: Added 200 Of The Canadian REIT Dream Industrial At C$9.03-Seeking Alpha

I currently have a total realized gain of $3,107.79 (snapshots at Gateway Post: Equity REIT Common and Preferred Stock Basket) In my next update, I will have the 2014 dividend total for this basket.

Profits from Canadian REIT sells are reported here in USDs, which is the 1099 tax reporting requirement even though I am using CADs to buy and receiving CADs when I sell. So far, my CAD profit from those sales have been higher. The decline in the CAD vs. the USD results in a lower reported taxable profit.

I have purchased the following securities since the last update:

Added 200 of the Canadian REIT DIR_UN:CA at C$9.03 (11/26/14 Post)

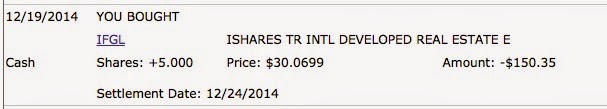

I also added 5 shares of an international real estate ETF, which I can buy commission free at Fidelity:

I also added 5 shares of an international real estate ETF, which I can buy commission free at Fidelity:

I have sold two positions since the last update:

The 100 share position in LXP, previously held in a taxable account, was sold due solely to moving that position to the ROTH IRA. I discussed in an SA Instablog the reasons for buying 100 more shares in the Fidelity Roth IRA and selling 101+ shares held in a taxable account. Lexington REIT (LXP) - South Gent | Seeking Alpha

I am not tracking reinvested dividend in the following table.

Click to Enlarge:

|

| REIT Basket as of 12/26/14 |

Closing Price 12/26/14: VNQ: $82.00 +0.29 (+0.35%) : Vanguard REIT ETF

I have a few problems in this basket. The unrealized losses on my Canadian REITs would more than offset my realized gains this year. Most have 9%+ yields at their current prices or slightly under that level. ARCP proved to be a mistake due to the accounting fraud that occurred after my purchase.

Yields Calculated by MarketWatch as of Last Closing Price (12/24/14):

13.27% Temple Hotels Inc. (TPH)(exposure in the oil patch)

The Toronto stock exchange was closed today, so the quotes for the Canadian REITs are from last Wednesday.

I have published several articles at SA discussing REIT purchases that are basically reprints of my my posts here, except for the introduction section in those articles.

No comments:

Post a Comment