Big Picture: No Change

Stable Vix Pattern (Bullish):

Recent Developments:

In a surprising development, the National Retail Federation reported that retail sales declined 11% over the Thanksgiving holiday including "Black Friday" Bloomberg WSJ Some analysts do not believe the trade group's numbers, given the improving employment picture and lower gas prices. WSJ I would work under the assumption that the estimate provided by the NRF is close to being accurate. It remains to be seen whether or not the weakness will persist through Christmas.

Moody's downgraded Japan's debt to A1 from Aa3.

ADP reported that private sector employers added 208,000 jobs in November.

The ISM services index rose to 59.3% in November, up from 57.1 in October. The new orders component increased to 61.4 from 59.1. Business activity/production increased to 64.4 from 60.

FYI, I discussed earlier buying as a Lotto 50 shares of RRST, an Israeli company. Bought 50 RRST at $7.4-Lotto I received a dividend payment. The withholding rate appears to be 25%, which is something to keep in mind. I googled the issue and confirmed that rate for U.S. residents: Israeli Withholding Taxes on Dividends

******************

1. Bought 50 MLPG at $36-Roth IRA (see Disclaimer):

Snapshot of Trade:

Quote Prior to Order:

Closing Price 12/1/14: $36.13 -$2.05 (-5.37%)

MLPG Historical Prices

The closing price on 11/26/14 was $40.15. In two trading days, the price for this MLP infrastructure ETN declined by 10.34% to my $36 purchase price.

Security Description: The UBS AG E-TRACS linked to Alerian Natural Gas MLP Index (MLPG) is an exchange traded note issued by UBS that tracks an index of the 20 largest, by market capitalization, natural gas infrastructure MLPs.

An ETN is a senior unsecured note, which subjects the owner to the credit risk of the issuer.

Sponsor's Website: ETRACS Alerian Natural Gas MLP Index ETN

Free Writing Prospectus Filed with SEC in 2011

The sponsor charges a .85% annual tracking fee.

Prior Trades: At the time of this trade, I owned 50 shares in a taxable account. Item # 1 Added 50 of the ETN MLPG at $35.15 (8/31/13 Post). I intend to sell those shares when and if the price recovers to $40+, as I transition ownership to the Roth IRA and out of a taxable account.

I regretted flipping shares in the Roth IRA, viewed as the more appropriate vehicle for owning this security. Item # 6 Sold 50 MLPG at $35.77-Roth IRA (2/17/14 Post)(snapshot of profit=$211.48 +$89.48 in dividends)-Item # 4 Bought 50 MLPG at $31.26-ROTH IRA (2/27/13 Post)

Distributions: Distributions are paid quarterly at a variable rate.

For 2014, the total amounted to $1.7721 per share, down slightly from the $1.7804 paid in 2013.

One of the components in the index tracked by this ETN slashed their distribution rate in February 2014, as discussed in the risk section below, so the slight decline in the 2014 annual rate from 2013 is not surprising for that reason.

The distribution rate in 2012 was $1.5022. While it is not certain, I would anticipate that the annual distribution per share will trend up over time, assuming no more major slashes from one of the indexes components.

That anticipation is based on a review of the dividend histories. Nasdaq provides a history of dividend payments for publicly traded companies. The following are links to distribution histories for some of the components:

Williams Partners L.P. (WPZ) Dividend Date & History

Regency Energy Partners LP (RGP) Dividend Date & History

TC PipeLines, LP (TCP) Dividend Date & History

Enterprise Products Partners L.P. (EPD) Dividend Date & History (not adjusted for 2 for 1 split)

EQT Midstream Partners, LP (EQM) Dividend Date & History

ONEOK Partners, L.P. (OKS) Dividend Date & History

Atlas Pipeline Partners, L.P. (APL) Dividend Date & History

Since the penny distribution rate will be variable, I calculated the dividend yield simply by taking the total for the last four distributions ($1.7721) and assumed a total cost per share of $36. With those assumptions, the dividend yield is about 4.92%.

I owned 50 shares of MLPG in a taxable account in 2013, and the one distribution paid was not classified as "qualified":

Rationale:

As noted in the sponsor's fact sheet, the distributions are reported as ordinary income in a 1099 and the owner of this security will not receive a K-1 form. This is a major selling point for me since I hate fooling with K-1s at tax time.

The distributions are tax exempt in the Roth IRA. I intend to sell the 50 share lot owned in the taxable account when and if the price recovers to $40 or so.

The most important reason is my opinion that infrastructure companies are the best way to play the long term natural gas super cycle. The Natural Gas Super Cycle: Bought Back First Trust ISE-Revere Natural Gas Index Fund | Seeking Alpha Perhaps, I could have a waited a few weeks before buying back a 50 share FCG lot.

While U.S. oil consumption is still well below levels hit in 2005-2006, natural gas consumption has been steadily increasing.

United States - U.S. Energy Information Administration (EIA)

Natural gas has to be processed, transported and stored and those functions are provided by the infrastructure MLPs. I selected MLPG to purchase since it is the closest pure natural gas infrastructure ETN. Other investors are apparently not as interested in this theme since the daily volume in MLPG is anemic.

I also like the diversification of an index. I find MLPs hard to analyze. I frequently read long articles written by accounting experts who disagree about the accuracy of an MLP's accounting. I have never taken a course in accounting, nor have I read a book on the subject. I am a generalist when it comes to investing and do not have the time or the inclination to learn about individual MLPs, at least at the moment.

While I am certainly no expert in natural gas infrastructure MLPs, the 10%+ decline in MLPG over just two trading days made no sense to me. These companies are not directly exposed to natural gas prices. They are not E & P companies.

The natural gas pipeline is more like a toll road, collecting fees for those traveling along its path and more natural gas is being consumed in the U.S.

I also do not view natural gas to be interchangeable with oil. A spike down in crude prices should not have more than a temporary impact on natural gas prices that are more correlated to the unique demand and uses for natural gas. The assumption underlying the recent decline in natural gas prices appears to be that demand for natural gas will fall as users substitute oil. Perhaps, there may be a few users who could substitute oil for natural gas.

Who has the choice to use oil when it is cheaper than natural gas for the intended use? If you have natural gas heating in your home or business, can you switch now to heating oil? How many vehicles have the option to switch to gasoline from natural gas? Are gas turbines in combined cycle generation plants going to start using oil and how is that going to take place?

In the past, there was far more oil fired generation than now. Those generating stations are mostly confined to Hawaii and the Northeast now. Oil-fired generation -Platts; High cost, oil-fired generation creates potential for shift in Hawaiian electric sources-U.S. Energy Information Administration (EIA); "Duke Energy to shut down oil-fired power plant in Ohio" Florida Blasts Away Old Oil Power Plant; "Georgia Power to close 15 coal, oil units"-ajc.com; "NRG shutting Norwalk oil-fired power plant" | HartfordBusiness.com Those plants are rapidly becoming relics from the past.

Risks:

(1) Credit Risk of the Issuer: An ETN is a senior unsecured note. As such, the owner of MLPG is subject to the credit risk of UBS. If UBS goes bankrupt the owner of this security will be in the same position as all other owners of the issuer's unsecured senior debt. While the amount of recovery in such an eventuality is unknowable, I generally would anticipate around 15 to 25 cents on the dollar after a prolonged period in bankruptcy where nothing would be paid to the owners of the issuer's debt.

While this may be a minimal risk now, the owners of Lehman's unsecured senior notes found out the hard way about this risk after that firm's collapse and bankruptcy filing.

(2) Market Risk: As an example of market risk, Boardwalk Pipeline Partners, LP (BWP), one of the constituents in the index being tracked by MLPG, had a really bad day on 2/10/14, declining $11.08 to close at $13.01. Boardwalk partners cut its distribution by 80% to 10 cents per share. The reason given by the company was that increased natural gas production was reducing transportation rates and revenues from storage services. Boardwalk Announces Fourth Quarter 2013 Results And Announces Quarterly Distribution Of $0.10 Per.Unit; Bloomberg. The BWP price has recovered a tad since that fiasco and is still owned by MLPG.

(3) Early Redemption Risk: One risk mentioned by the sponsor is that UBS may elect to redeem the ETN at anytime now. (click "key considerations" tab at the sponsor's website). UBS may redeem it early based on the performance of the index less the "accrued" tracking fee. Technically, this security is a senior unsecured note that has a par value of $25 and matures on 7/9/2040.

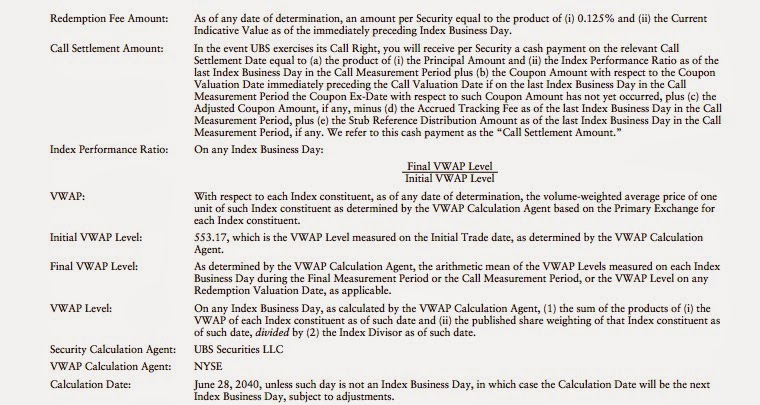

The call settlement amount is explained in the prospectus and is to complicated to explain here, so I just took a snapshot:

This may be a link to a current quote for the VWAP level referenced in the forgoing snapshot that is a component of the redemption calculation: Alerian Natural Gas MLP Index VWAP Level On the day of my purchase, the VWAP level closed at 795.73. The VWAP level on the Initial Trade date was 553.17.

There is even a more detailed description starting at page S-3 of the Prospectus. When an intelligent investor reads the foregoing summary of the redemption calculation, the eyes irresistibly start to roll back into the head and meaningful comprehension is at best limited.

If I become aware of an optional redemption notice, I will consider selling MLPG rather than waiting for UBS to do its computation. I can only hope that UBS does not call the note early, and consequently I will not have to worry about the redemption price. The chance is nil that I will own MLPG on the redemption date in 2040.

(4) More Warnings from the Sponsor: The sponsor claims that this security is only appropriate for an investor who answers the following questions in the affirmative:

That warning is like reading the pamphlet that comes with most prescription medicines. After reading how the medicine can cause virtually every known malady known to humans, why take the medicine at all?

In short, I do not like the risks associated with ETN products, including the added credit risk of the sponsor in addition to the risks associated with the companies included in the index being tracked by the ETN.

If I am going to invest in the MLP space, I have no choice but to choose my poison.

Poison comes in three flavors in my view: direct ownership of MLPs, ETNs and ETFs. Some would add a 4th: CEFs.

I could invest in the MLPs directly, where I can at least secure their tax advantages. However, since I prepare my own tax return, and prefer to limit my aggravation to the extent possible during that preparation process, I quit fooling with MLPs and their K-1 that arrived shortly before April 15.

My last MLP was Linn Energy sold at $25.9 back in 2010. Item # 1 Sold 100 LINE at $25.9 (6/26/14 Post-profit snapshot $971.97) I have not own a MLP directly since that time.

I am too cheap to pay an accountant a $1,000 to prepare the return, so owning MLP's directly is not the poison that I choose, at least until I am no longer sufficiently compos mentis to prepare my return and have to hire a CPA.

The last alternative is probably the worst one, owning MLP's in the ETF legal structure. Congress has made some silly rule that a fund can not have more than a 25% weighting in MLPs and qualify as a pass through entity at the corporate level. The MLP ETF has to be organized as a regular "C" corporation and consequently must accrue and pay taxes at the corporate level. Seeking Alpha, Motley Fool, WSJ It is my understanding that the fund will account for that accrued tax liability in the fund's net asset value. This is a link to the tax accruals for YMLP, an ETF MLP: YMLP Tax Accruals. A discussion of the ETF MLP's tax deferral liability and how it can impact net asset value per share can be found starting at page 5 of the Global X MLP ETF (MLPA:) prospectus: MLPA Prospectus

The MLP ETF does avoid the K-1 hassle and the various risks linked to ETNs, which I view as potentially material.

5. Vulnerability to Rising Rates: Many investors view MLPs as bond substitutes and their current yield could become unattractive to them compared to alternatives after a sustained rise in rates. One fund manager in the space estimated that the "average" MLP price would decline by 10% for every one percent increase in rates. WSJ That impact did not happen in 2013 when interest rates started to rise in May. The J P Morgan Alerian MLP ETN (AMJ) had a total return of 28.51% in 2013, based on net asset value, according to Morningstar.

MLPG's total return in 2013 was 35.72% based on net asset value.

Still, I would not discount the potential negative impact from competitive yield products during a persistent rate increase cycle.

A rise in rates would negatively impact their borrowing costs.

Closing Price 12/3/14: MLPG: $37.69 +0.40 (+1.09%)

2. Elevated CORR to REIT Basket Strategy from Lottery Ticket Basket: Added 100 Shares at $6.5 (Equity REIT Common and Preferred Stock Basket)(see Disclaimer):

Snapshot of Trade:

Prior Trade: I discussed this REIT at length in a recent SA Instablog: Lottery Ticket Basket Strategy-Bought 40 CORR At $7 - South Gent | Seeking Alpha That 40 shares will be transferred from the LT Basket to the REIT Basket. CORR is unique in that it is an infrastructure REIT.

I am not going to repeat that earlier discussion here, but will simply summarize the reasons for the slight upgrade in the risk/benefit assessment that permitted this 100 share buy. I still have the same concerns about the risks, as described in that post. I simply have a slightly more positive view of the potential benefits.

Since I purchased these shares, CORR agreed to acquire MoGas Pipeline for $125 million and has closed that acquisition. SEC Filed Press Release Dated 11/24/14 That is a large acquisition for such a small company.

This acquisition is discussed in an article published at Benzinga.

Part of the funding was raised by a share offering priced to the public at $6.8 per share. The underwriter's paid $6.443 per share, Prospectus The underwriter's exercised the entire over allotment option of 1.95 million shares, bringing the total offering to 14.95M shares sold at $6.8. After that offering, CORR had 46,598,904 shares outstanding.

In conjunction with this acquisition, CORR raised its quarterly dividend to $.135 from $.13. CorEnergy to Acquire MoGas Pipeline for $125 Million With the decline in price to $6.5 from my first purchase at $7, and the slight dividend increase, the yield improved to about 8.3% at a total cost per share of $6.5. The increase in yield and the dividend increase were two reasons for the promotion to the REIT Basket Strategy.

Another reason is that I was able to buy shares at a lower price than the $6.8 public offering price.

Another reason is that this security appears to have suffered from the downdraft in infrastructure stocks, discussed in Item #1 above, for no fundamental reason that I can discern.

Recent Earnings Report: For the 2014 third quarter, CORR reported both FFO and AFFO of $.16 per share. Revenues increased to $9.345+M from $7.574M in the 2013 third quarter. SEC Filed Press Release

CORR-9/30/14 10-Q

Closing Price 12/3/14: CORR: $6.50 -0.06 (-0.91%)

CORR Historical Prices

In a surprising development, the National Retail Federation reported that retail sales declined 11% over the Thanksgiving holiday including "Black Friday" Bloomberg WSJ Some analysts do not believe the trade group's numbers, given the improving employment picture and lower gas prices. WSJ I would work under the assumption that the estimate provided by the NRF is close to being accurate. It remains to be seen whether or not the weakness will persist through Christmas.

Moody's downgraded Japan's debt to A1 from Aa3.

ADP reported that private sector employers added 208,000 jobs in November.

The ISM services index rose to 59.3% in November, up from 57.1 in October. The new orders component increased to 61.4 from 59.1. Business activity/production increased to 64.4 from 60.

FYI, I discussed earlier buying as a Lotto 50 shares of RRST, an Israeli company. Bought 50 RRST at $7.4-Lotto I received a dividend payment. The withholding rate appears to be 25%, which is something to keep in mind. I googled the issue and confirmed that rate for U.S. residents: Israeli Withholding Taxes on Dividends

******************

1. Bought 50 MLPG at $36-Roth IRA (see Disclaimer):

Snapshot of Trade:

Quote Prior to Order:

Closing Price 12/1/14: $36.13 -$2.05 (-5.37%)

MLPG Historical Prices

The closing price on 11/26/14 was $40.15. In two trading days, the price for this MLP infrastructure ETN declined by 10.34% to my $36 purchase price.

Security Description: The UBS AG E-TRACS linked to Alerian Natural Gas MLP Index (MLPG) is an exchange traded note issued by UBS that tracks an index of the 20 largest, by market capitalization, natural gas infrastructure MLPs.

An ETN is a senior unsecured note, which subjects the owner to the credit risk of the issuer.

Sponsor's Website: ETRACS Alerian Natural Gas MLP Index ETN

Free Writing Prospectus Filed with SEC in 2011

The sponsor charges a .85% annual tracking fee.

Prior Trades: At the time of this trade, I owned 50 shares in a taxable account. Item # 1 Added 50 of the ETN MLPG at $35.15 (8/31/13 Post). I intend to sell those shares when and if the price recovers to $40+, as I transition ownership to the Roth IRA and out of a taxable account.

I regretted flipping shares in the Roth IRA, viewed as the more appropriate vehicle for owning this security. Item # 6 Sold 50 MLPG at $35.77-Roth IRA (2/17/14 Post)(snapshot of profit=$211.48 +$89.48 in dividends)-Item # 4 Bought 50 MLPG at $31.26-ROTH IRA (2/27/13 Post)

Distributions: Distributions are paid quarterly at a variable rate.

For 2014, the total amounted to $1.7721 per share, down slightly from the $1.7804 paid in 2013.

One of the components in the index tracked by this ETN slashed their distribution rate in February 2014, as discussed in the risk section below, so the slight decline in the 2014 annual rate from 2013 is not surprising for that reason.

The distribution rate in 2012 was $1.5022. While it is not certain, I would anticipate that the annual distribution per share will trend up over time, assuming no more major slashes from one of the indexes components.

That anticipation is based on a review of the dividend histories. Nasdaq provides a history of dividend payments for publicly traded companies. The following are links to distribution histories for some of the components:

Williams Partners L.P. (WPZ) Dividend Date & History

Regency Energy Partners LP (RGP) Dividend Date & History

TC PipeLines, LP (TCP) Dividend Date & History

Enterprise Products Partners L.P. (EPD) Dividend Date & History (not adjusted for 2 for 1 split)

EQT Midstream Partners, LP (EQM) Dividend Date & History

ONEOK Partners, L.P. (OKS) Dividend Date & History

Atlas Pipeline Partners, L.P. (APL) Dividend Date & History

Since the penny distribution rate will be variable, I calculated the dividend yield simply by taking the total for the last four distributions ($1.7721) and assumed a total cost per share of $36. With those assumptions, the dividend yield is about 4.92%.

I owned 50 shares of MLPG in a taxable account in 2013, and the one distribution paid was not classified as "qualified":

Rationale:

As noted in the sponsor's fact sheet, the distributions are reported as ordinary income in a 1099 and the owner of this security will not receive a K-1 form. This is a major selling point for me since I hate fooling with K-1s at tax time.

The distributions are tax exempt in the Roth IRA. I intend to sell the 50 share lot owned in the taxable account when and if the price recovers to $40 or so.

The most important reason is my opinion that infrastructure companies are the best way to play the long term natural gas super cycle. The Natural Gas Super Cycle: Bought Back First Trust ISE-Revere Natural Gas Index Fund | Seeking Alpha Perhaps, I could have a waited a few weeks before buying back a 50 share FCG lot.

While U.S. oil consumption is still well below levels hit in 2005-2006, natural gas consumption has been steadily increasing.

United States - U.S. Energy Information Administration (EIA)

Natural gas has to be processed, transported and stored and those functions are provided by the infrastructure MLPs. I selected MLPG to purchase since it is the closest pure natural gas infrastructure ETN. Other investors are apparently not as interested in this theme since the daily volume in MLPG is anemic.

I also like the diversification of an index. I find MLPs hard to analyze. I frequently read long articles written by accounting experts who disagree about the accuracy of an MLP's accounting. I have never taken a course in accounting, nor have I read a book on the subject. I am a generalist when it comes to investing and do not have the time or the inclination to learn about individual MLPs, at least at the moment.

While I am certainly no expert in natural gas infrastructure MLPs, the 10%+ decline in MLPG over just two trading days made no sense to me. These companies are not directly exposed to natural gas prices. They are not E & P companies.

The natural gas pipeline is more like a toll road, collecting fees for those traveling along its path and more natural gas is being consumed in the U.S.

I also do not view natural gas to be interchangeable with oil. A spike down in crude prices should not have more than a temporary impact on natural gas prices that are more correlated to the unique demand and uses for natural gas. The assumption underlying the recent decline in natural gas prices appears to be that demand for natural gas will fall as users substitute oil. Perhaps, there may be a few users who could substitute oil for natural gas.

Who has the choice to use oil when it is cheaper than natural gas for the intended use? If you have natural gas heating in your home or business, can you switch now to heating oil? How many vehicles have the option to switch to gasoline from natural gas? Are gas turbines in combined cycle generation plants going to start using oil and how is that going to take place?

In the past, there was far more oil fired generation than now. Those generating stations are mostly confined to Hawaii and the Northeast now. Oil-fired generation -Platts; High cost, oil-fired generation creates potential for shift in Hawaiian electric sources-U.S. Energy Information Administration (EIA); "Duke Energy to shut down oil-fired power plant in Ohio" Florida Blasts Away Old Oil Power Plant; "Georgia Power to close 15 coal, oil units"-ajc.com; "NRG shutting Norwalk oil-fired power plant" | HartfordBusiness.com Those plants are rapidly becoming relics from the past.

Risks:

(1) Credit Risk of the Issuer: An ETN is a senior unsecured note. As such, the owner of MLPG is subject to the credit risk of UBS. If UBS goes bankrupt the owner of this security will be in the same position as all other owners of the issuer's unsecured senior debt. While the amount of recovery in such an eventuality is unknowable, I generally would anticipate around 15 to 25 cents on the dollar after a prolonged period in bankruptcy where nothing would be paid to the owners of the issuer's debt.

While this may be a minimal risk now, the owners of Lehman's unsecured senior notes found out the hard way about this risk after that firm's collapse and bankruptcy filing.

(2) Market Risk: As an example of market risk, Boardwalk Pipeline Partners, LP (BWP), one of the constituents in the index being tracked by MLPG, had a really bad day on 2/10/14, declining $11.08 to close at $13.01. Boardwalk partners cut its distribution by 80% to 10 cents per share. The reason given by the company was that increased natural gas production was reducing transportation rates and revenues from storage services. Boardwalk Announces Fourth Quarter 2013 Results And Announces Quarterly Distribution Of $0.10 Per.Unit; Bloomberg. The BWP price has recovered a tad since that fiasco and is still owned by MLPG.

(3) Early Redemption Risk: One risk mentioned by the sponsor is that UBS may elect to redeem the ETN at anytime now. (click "key considerations" tab at the sponsor's website). UBS may redeem it early based on the performance of the index less the "accrued" tracking fee. Technically, this security is a senior unsecured note that has a par value of $25 and matures on 7/9/2040.

The call settlement amount is explained in the prospectus and is to complicated to explain here, so I just took a snapshot:

This may be a link to a current quote for the VWAP level referenced in the forgoing snapshot that is a component of the redemption calculation: Alerian Natural Gas MLP Index VWAP Level On the day of my purchase, the VWAP level closed at 795.73. The VWAP level on the Initial Trade date was 553.17.

There is even a more detailed description starting at page S-3 of the Prospectus. When an intelligent investor reads the foregoing summary of the redemption calculation, the eyes irresistibly start to roll back into the head and meaningful comprehension is at best limited.

If I become aware of an optional redemption notice, I will consider selling MLPG rather than waiting for UBS to do its computation. I can only hope that UBS does not call the note early, and consequently I will not have to worry about the redemption price. The chance is nil that I will own MLPG on the redemption date in 2040.

(4) More Warnings from the Sponsor: The sponsor claims that this security is only appropriate for an investor who answers the following questions in the affirmative:

That warning is like reading the pamphlet that comes with most prescription medicines. After reading how the medicine can cause virtually every known malady known to humans, why take the medicine at all?

In short, I do not like the risks associated with ETN products, including the added credit risk of the sponsor in addition to the risks associated with the companies included in the index being tracked by the ETN.

If I am going to invest in the MLP space, I have no choice but to choose my poison.

Poison comes in three flavors in my view: direct ownership of MLPs, ETNs and ETFs. Some would add a 4th: CEFs.

I could invest in the MLPs directly, where I can at least secure their tax advantages. However, since I prepare my own tax return, and prefer to limit my aggravation to the extent possible during that preparation process, I quit fooling with MLPs and their K-1 that arrived shortly before April 15.

My last MLP was Linn Energy sold at $25.9 back in 2010. Item # 1 Sold 100 LINE at $25.9 (6/26/14 Post-profit snapshot $971.97) I have not own a MLP directly since that time.

I am too cheap to pay an accountant a $1,000 to prepare the return, so owning MLP's directly is not the poison that I choose, at least until I am no longer sufficiently compos mentis to prepare my return and have to hire a CPA.

The last alternative is probably the worst one, owning MLP's in the ETF legal structure. Congress has made some silly rule that a fund can not have more than a 25% weighting in MLPs and qualify as a pass through entity at the corporate level. The MLP ETF has to be organized as a regular "C" corporation and consequently must accrue and pay taxes at the corporate level. Seeking Alpha, Motley Fool, WSJ It is my understanding that the fund will account for that accrued tax liability in the fund's net asset value. This is a link to the tax accruals for YMLP, an ETF MLP: YMLP Tax Accruals. A discussion of the ETF MLP's tax deferral liability and how it can impact net asset value per share can be found starting at page 5 of the Global X MLP ETF (MLPA:) prospectus: MLPA Prospectus

The MLP ETF does avoid the K-1 hassle and the various risks linked to ETNs, which I view as potentially material.

5. Vulnerability to Rising Rates: Many investors view MLPs as bond substitutes and their current yield could become unattractive to them compared to alternatives after a sustained rise in rates. One fund manager in the space estimated that the "average" MLP price would decline by 10% for every one percent increase in rates. WSJ That impact did not happen in 2013 when interest rates started to rise in May. The J P Morgan Alerian MLP ETN (AMJ) had a total return of 28.51% in 2013, based on net asset value, according to Morningstar.

MLPG's total return in 2013 was 35.72% based on net asset value.

Still, I would not discount the potential negative impact from competitive yield products during a persistent rate increase cycle.

A rise in rates would negatively impact their borrowing costs.

Closing Price 12/3/14: MLPG: $37.69 +0.40 (+1.09%)

2. Elevated CORR to REIT Basket Strategy from Lottery Ticket Basket: Added 100 Shares at $6.5 (Equity REIT Common and Preferred Stock Basket)(see Disclaimer):

Snapshot of Trade:

Prior Trade: I discussed this REIT at length in a recent SA Instablog: Lottery Ticket Basket Strategy-Bought 40 CORR At $7 - South Gent | Seeking Alpha That 40 shares will be transferred from the LT Basket to the REIT Basket. CORR is unique in that it is an infrastructure REIT.

I am not going to repeat that earlier discussion here, but will simply summarize the reasons for the slight upgrade in the risk/benefit assessment that permitted this 100 share buy. I still have the same concerns about the risks, as described in that post. I simply have a slightly more positive view of the potential benefits.

Since I purchased these shares, CORR agreed to acquire MoGas Pipeline for $125 million and has closed that acquisition. SEC Filed Press Release Dated 11/24/14 That is a large acquisition for such a small company.

This acquisition is discussed in an article published at Benzinga.

Part of the funding was raised by a share offering priced to the public at $6.8 per share. The underwriter's paid $6.443 per share, Prospectus The underwriter's exercised the entire over allotment option of 1.95 million shares, bringing the total offering to 14.95M shares sold at $6.8. After that offering, CORR had 46,598,904 shares outstanding.

In conjunction with this acquisition, CORR raised its quarterly dividend to $.135 from $.13. CorEnergy to Acquire MoGas Pipeline for $125 Million With the decline in price to $6.5 from my first purchase at $7, and the slight dividend increase, the yield improved to about 8.3% at a total cost per share of $6.5. The increase in yield and the dividend increase were two reasons for the promotion to the REIT Basket Strategy.

Another reason is that I was able to buy shares at a lower price than the $6.8 public offering price.

Another reason is that this security appears to have suffered from the downdraft in infrastructure stocks, discussed in Item #1 above, for no fundamental reason that I can discern.

Recent Earnings Report: For the 2014 third quarter, CORR reported both FFO and AFFO of $.16 per share. Revenues increased to $9.345+M from $7.574M in the 2013 third quarter. SEC Filed Press Release

CORR-9/30/14 10-Q

Closing Price 12/3/14: CORR: $6.50 -0.06 (-0.91%)

CORR Historical Prices

No comments:

Post a Comment