What to make of these viral racist rants? - CNN.com

Racist rant inside Walmart goes viral - YouTube

Man yells at stranger for speaking Spanish - YouTube

2 dead in stabbing after intervening when man yelled anti-Muslim slurs at women, police say - CBS News

Symptoms of a disease.

++++++++

Kushner and the Russians:

Why on earth would Kushner want to communicate with the Russians using Russia's facilities in order to evade detection by U.S. intelligence? Espionage or a cover up of past election interference trails would certainly be two explanations.

Why did he have to communicate with the Russian Ambassador, believed to be a Russian spymaster, before the inauguration?

Why not wait until after Trump became President and then invite the Russian Ambassador to a secure location in the White House?

Russian ambassador told Moscow that Kushner wanted secret communications channel with Kremlin (MSN publication of WP article)

Michael Hayden: Jared Kushner back channel chat would be 'off the map' - CNN

In early December 2016, the approximate time of the meeting with the Russian ambassador, Moscow arrested a Russian security expert and two high ranking officials who were involved in cyber operations. Timeline: Everything We Know About Russia and President Trump

They were charged with providing information to the U.S:

Russians Charged With Treason Worked in Office Linked to Election Hacking - The New York Times ("Those arrested by the agency’s internal affairs bureau included Sergei Mikhailov, a deputy director of the Center for Information Security, the agency’s computer security arm, and Ruslan Stoyanov, a senior researcher at a prominent Russian computer security company, Kaspersky Lab.")

Senator Graham (R-SC) angrily dismissed the WP article as suspicious and then attacked Comey for his "intervention" in the election. The GOP wanted Hillary to be indicted before the election.

Graham assumed in his latest rant that the Russian communication was intercepted over an "open channel". There would be other ways to intercept a communication from the Russian embassy to Moscow, including, but not limited to, sometime after its arrival in Moscow. That assumption allowed Mr. Graham to erect a straw man argument.

Graham did not explain why Russia would want the U.S. to know about Kushner's request, when they were hoping for much better relations after Trump won the election (he was their guy and Putin hated Hilary), nor did he explain the consistency of his argument with the silence emanating from the White House.

Republican politicians like Graham and other GOP surrogates will increase their defense shield around Trump as more evidence accumulates and will also accelerate their attacks on Comey in the coming days and months since his testimony would support an obstruction of justice charge against Trump based on the news reports.

If the WP story was untrue, as Graham was attempting to argue, why would two Administration officials defend the back channel approach shortly after the revelation? Homeland security chief Kelly defends Kushner’s alleged ‘back channel’ to the Russians: It’s ‘a good thing’ - The Washington Post; McMaster 'not concerned' following Kushner reports - POLITICO; General McMaster, Step Down—and Let Trump Be Trump - POLITICO Magazine

To my knowledge, there has been no denial of the story from the White House or Kushner.

If untrue, why not just deny it?

If true, then the White House could admit and explain, or provide an alternative story like Kushner requested a back channel but not through Russian facilities which is the really bad part of the story. The approach so far is just attack everybody that is causing Trump trouble.

Trump's Response (a non-denial denial-just attack the Free Press):

So Donald is telling Trump Nation that the reporters from the Washington Post, New York Times, NBC, and CNN, all card carrying charter members of the Fake News Media according to the Donald, possibly have no sources at all and are simply writing fiction about Donald, Kushner and the Russians. I can not believe that a President of the U.S. has made that claim once, let alone over and over again, as if repetition alone makes the allegation true.

Donald, who has extremely strong authoritarian tendencies, is of course the real Fake News creator. Accuse others of doing what he routinely does, something that the mind doctors call psychological projection.

There is no publicly available evidence-yet-that proves that Kushner aided and abetted Russia's efforts to elect his father-in-law. There is a growing amount of smoke that is blowing in that direction, but the dots have not yet been linked with what I would characterize as evidence.

The first three articles linked below offer a potentially interesting avenue for investigation which the FBI is apparently pursuing.

FBI Russia investigation looking at Kushner role - CNN ("Federal investigators have been taking a closer look at the Trump campaign's data analytics operation, which was supervised by Kushner, officials say, and are examining whether Russian operatives used people associated with the campaign -- wittingly or unwittingly -- to try to help Russia's own data targeting.")

Note that the preceding article does not state there was cooperation but only that the FBI is investigating that possibility.

Russia's US Social Media Hacking: Inside the Information War | Time.com

Did Russians Target Democratic Voters, With Kushner’s Help? Newsweek

Jared Kushner now a focus in Russia investigation - The Washington Post

Exclusive: Trump son-in-law had undisclosed contacts with Russian envoy - sources | Reuters ("FBI investigators are examining whether Russians suggested to Kushner or other Trump aides that relaxing economic sanctions would allow Russian banks to offer financing to people with ties to Trump, said the current U.S. law enforcement official.")

Russian bank directly linked to Putin helped finance a Trump hotel

Kushner needs to be compelled to testify publicly under oath before the Senate Intelligence Committee. Will the republicans allow that to happen?

Senate Intelligence Committee requests Trump campaign documents - The Washington Post (why is that happening now?)

Russian Once Tied to Trump Aide Seeks Immunity to Cooperate With Congress - The New York Times

It is anyone's guess on how long the Stock Jocks will ignore the growing risks of political instability fanned and fueled by a man clearly unfit to be President, though admittedly that opinion is not shared by the $62.9+M adults who voted for him. 2016 National Popular Vote Final

So far, stock investors have only managed to look the other way and to yawn on occasion.

++++++++++

Trump: It is All About ME, ME, ME:

According to Donald, he hit a home run on his first foreign trip as President.

Watch President Trump push a prime minister aside - CNN

I could just hear those still functioning brain cells saying like "Get out of my way loser, you are in MY PHOTO OP".

Then there was the Macron handshake. Trump, Macron handshake turns into showdown - CBS News (or what Maureen Dowd called “I’ll-rip-your-shoulder-out-and-show-you-who’s-boss” handshake)

Macron later compared Trump to Putin and the Turkish President Erdogan: Trump handshake 'not innocent' - Macron

Trump certainly has far more admiration for Putin and Erdogan than for the leaders of western Democracies.

Trump in Brussels: 'The Germans Are Bad, Very Bad' - SPIEGEL ONLINE

Trump meant to say that the Germans were mean to the U.S. in selling their automobiles here.

Trump complained to the Belgian PM about his difficulty in getting permits to build golf courses.

Merkel: Europeans not completely rely on the U.S. - CNN ( "The times when we could completely rely on others are, to an extent, over. I experienced that in the last a few days, and therefore I can only say that we Europeans must really take our fate into our own hands." In order words, do not trust Trump)

He also talked about how much he paid for his shoes. Boorish.

I was wondering how many Presidents before Donald had their portrait painted before they become President.

Trump makes legendary artist do portrait his way - NY Daily News

Trump among Kinstler’s celebrity portraits | Easton Courier

But how many lived in a home modeled on the Hall of Mirrors at Versailles? Just one I would say.

God's gift to women? In his mind, that is certainly the case. Trump recorded having extremely lewd conversation about women in 2005 Original - YouTube

+++++++++

Jeff Sessions:

Sessions will ask for Supreme Court review, after 4th Circuit Court of Appeals (Based in Richmond Virginia) upholds Trump travel ban - CBS News

Jeff Sessions "amazed" that "island" judge could block travel ban - CBS News (referring to a judge based in Hawaii)

Jeff Sessions Issues Harsh New Sentencing Guidelines for Justice Department Prosecutors | National News | US News (will need to build more federal prisons)

Jeff Sessions says he's 'surprised' Americans aren't embracing his anti-marijuana stance - Washington Times

+++++++++

Republicans Rally Around one of Their Own-Greg Gianforte Wins Of Course in the Montana Special Election:

Greg Gianforte: Fox News team witnesses GOP House candidate 'body slam' reporter | Fox News

Voters weigh in after Montana House candidate allegedly assaults reporter - Videos - CBS News (video contains interview with Fox news reporter Alicia Acuna who witnessed the attack).

Gianforte's version was that the reporter basically attacked him:

Greg Gianforte Blames ‘Liberal Journalist’

Jacobs: Gianforte statement worse than assault

No republican politician asked Gianforte to quit the race, nor has any republican politician said he should step down if he wins and is later convicted of assaulting a reporter for asking a question.

Needless to say, Gianforte's conduct would have resulted in an immediate dismissal in any other occupation other than a republican running for office which has far different standards for fitness and acceptable conduct.

As expected, Gianforte won a decisive victory and commentators noted that his unprovoked physical assault on a news reporter had no measurable impact on the race which is what I expected as noted earlier:

Gianforte wins Montana's House seat, apologizes to reporter - CBS News ("based on CBS News estimates as the vote was coming in, there didn't appear to be a large difference between the early/mail vote and Election Day vote overall. And turnout was comparable to that of a midterm election.")

Anecdotal evidence consisting of interviews with Montana republicans who voted on election day showed they thought the reporter had it coming or did not believe the news media reports about what had happened, notwithstanding the audio recording of the attack and eye witness accounts including one from a Fox station. Facts do not matter to them and never will.

It is not surprising that most republicans would disbelieve accurate factual information coming from the news media. The GOP has been successful in persuading tens of millions to distrust and ignore the free press so that their alternate reality and reality creations are accepted without question by the masses. Just get your "facts" from Sean Hannity, Russ Limbaugh, Ann Coulter and Fox and Friends.

{Ann figured out what caused the Near Depression. I can understand her appeal in Trump's America since she put it so succinctly and was not burdened by facts. This is what Ann had to say: "Instead of looking at "outdated criteria," such as the mortgage applicant's credit history, banks were encouraged to consider nontraditional measures of credit-worthiness, such as having a good jump shot or having a missing child named "Caylee." Ann Coulter - September 24, 2008 - THEY GAVE YOUR MORTGAGE TO A LESS QUALIFIED MINORITY. Now poor Caylee later turned up dead-Death of Caylee Anthony)

If Greg Gianforte had attacked someone other than a "liberal" reporter, like a 90 year nun in a wheelchair who asked Greg about the CBO score on Trumpcare, Paul Ryan and other republicans may have been able to muster a response more serious than calling Gianforte's behavior unacceptable while adding "we all make mistakes" to take the sting away from "unacceptable".

After all, as Donald has said, the U.S. press is the "Enemy of the People". Trump again calls media 'enemy of the people'. So he is encouraging attacks on that enemy, meaning anyone who reports on what he does not want anyone to know, facts that contradict his incessant reality creations, and the real implications of his policies rather than those that are made up.

Republicans rebuke but stand by Montana GOP candidate charged with assault - The Washington Post

My thought on the matter is that Gianforte needs to find one of those liberal reporters, (or better yet, a "feminist liberal" reporter) the day before the next election, beat him or her into a pulp so that their mamma can not recognize them, and then his margin of victory would likely increase after showing that he can deal with those uppity reporters better than Trump.

Three republican newspapers in Montana pulled their endorsement. One of them, the Billings Gazette, said sorry, sort of, for ignoring Gianforte's past interactions with reporters which apparently fell short of a physical assault. You have to actually beat up a reporter before a Montana newspaper starts to contemplate the possibility that a republican may be unfit for office. That is the new normal in Trump's America.

I would add that Gianforte refused to publicly answer whether he would have voted for Trumpcare, saying he needed more time to know more facts, but he privately praised the legislation to donors.

G.O.P. House Candidate in Montana Is Caught on Tape Praising Health Bill - The New York Times

He apparently never answered the question posed by Jacobs which was just fine with Montana voters who could care less.

After winning decisively, Gianforte issued an apology to the reporter. Boys will be boys after all. Gianforte: 'I made a mistake, I'm sorry' One of his supporters yelled back that he made no mistake.

Texas governor jokes about shooting reporters - CBS News

+++++

From the Nixon Playbook?

Comey's Tell-All Testimony Runs Risk of White House Roadblocks - Bloomberg {the return of the executive privilege claim coming used by Nixon to impede the investigation of his crimes? United States v. Nixon (full text) :: 418 U.S. 683 (1974)}

FBI declines to provide requested materials to House Oversight, Chaffetz issues new June 8 deadline - CNN

++++++++++

Letter Written by Three Republican EPA administrators: Trump is putting us on a dangerous path - The Washington Post (Trump "has chosen ignorance over knowledge", well of course he has; why learn anything when you have twitter)

+++++++

1. Short Term Bond/CD Ladder Basket Strategy:

Racist rant inside Walmart goes viral - YouTube

Man yells at stranger for speaking Spanish - YouTube

2 dead in stabbing after intervening when man yelled anti-Muslim slurs at women, police say - CBS News

Symptoms of a disease.

++++++++

Kushner and the Russians:

Why on earth would Kushner want to communicate with the Russians using Russia's facilities in order to evade detection by U.S. intelligence? Espionage or a cover up of past election interference trails would certainly be two explanations.

Why did he have to communicate with the Russian Ambassador, believed to be a Russian spymaster, before the inauguration?

Why not wait until after Trump became President and then invite the Russian Ambassador to a secure location in the White House?

Russian ambassador told Moscow that Kushner wanted secret communications channel with Kremlin (MSN publication of WP article)

Michael Hayden: Jared Kushner back channel chat would be 'off the map' - CNN

In early December 2016, the approximate time of the meeting with the Russian ambassador, Moscow arrested a Russian security expert and two high ranking officials who were involved in cyber operations. Timeline: Everything We Know About Russia and President Trump

They were charged with providing information to the U.S:

Russians Charged With Treason Worked in Office Linked to Election Hacking - The New York Times ("Those arrested by the agency’s internal affairs bureau included Sergei Mikhailov, a deputy director of the Center for Information Security, the agency’s computer security arm, and Ruslan Stoyanov, a senior researcher at a prominent Russian computer security company, Kaspersky Lab.")

Senator Graham (R-SC) angrily dismissed the WP article as suspicious and then attacked Comey for his "intervention" in the election. The GOP wanted Hillary to be indicted before the election.

Graham assumed in his latest rant that the Russian communication was intercepted over an "open channel". There would be other ways to intercept a communication from the Russian embassy to Moscow, including, but not limited to, sometime after its arrival in Moscow. That assumption allowed Mr. Graham to erect a straw man argument.

Graham did not explain why Russia would want the U.S. to know about Kushner's request, when they were hoping for much better relations after Trump won the election (he was their guy and Putin hated Hilary), nor did he explain the consistency of his argument with the silence emanating from the White House.

Republican politicians like Graham and other GOP surrogates will increase their defense shield around Trump as more evidence accumulates and will also accelerate their attacks on Comey in the coming days and months since his testimony would support an obstruction of justice charge against Trump based on the news reports.

If the WP story was untrue, as Graham was attempting to argue, why would two Administration officials defend the back channel approach shortly after the revelation? Homeland security chief Kelly defends Kushner’s alleged ‘back channel’ to the Russians: It’s ‘a good thing’ - The Washington Post; McMaster 'not concerned' following Kushner reports - POLITICO; General McMaster, Step Down—and Let Trump Be Trump - POLITICO Magazine

To my knowledge, there has been no denial of the story from the White House or Kushner.

If untrue, why not just deny it?

If true, then the White House could admit and explain, or provide an alternative story like Kushner requested a back channel but not through Russian facilities which is the really bad part of the story. The approach so far is just attack everybody that is causing Trump trouble.

Trump's Response (a non-denial denial-just attack the Free Press):

So Donald is telling Trump Nation that the reporters from the Washington Post, New York Times, NBC, and CNN, all card carrying charter members of the Fake News Media according to the Donald, possibly have no sources at all and are simply writing fiction about Donald, Kushner and the Russians. I can not believe that a President of the U.S. has made that claim once, let alone over and over again, as if repetition alone makes the allegation true.

Donald, who has extremely strong authoritarian tendencies, is of course the real Fake News creator. Accuse others of doing what he routinely does, something that the mind doctors call psychological projection.

There is no publicly available evidence-yet-that proves that Kushner aided and abetted Russia's efforts to elect his father-in-law. There is a growing amount of smoke that is blowing in that direction, but the dots have not yet been linked with what I would characterize as evidence.

The first three articles linked below offer a potentially interesting avenue for investigation which the FBI is apparently pursuing.

FBI Russia investigation looking at Kushner role - CNN ("Federal investigators have been taking a closer look at the Trump campaign's data analytics operation, which was supervised by Kushner, officials say, and are examining whether Russian operatives used people associated with the campaign -- wittingly or unwittingly -- to try to help Russia's own data targeting.")

Note that the preceding article does not state there was cooperation but only that the FBI is investigating that possibility.

Russia's US Social Media Hacking: Inside the Information War | Time.com

Did Russians Target Democratic Voters, With Kushner’s Help? Newsweek

Jared Kushner now a focus in Russia investigation - The Washington Post

Exclusive: Trump son-in-law had undisclosed contacts with Russian envoy - sources | Reuters ("FBI investigators are examining whether Russians suggested to Kushner or other Trump aides that relaxing economic sanctions would allow Russian banks to offer financing to people with ties to Trump, said the current U.S. law enforcement official.")

Russian bank directly linked to Putin helped finance a Trump hotel

Kushner needs to be compelled to testify publicly under oath before the Senate Intelligence Committee. Will the republicans allow that to happen?

Russian Once Tied to Trump Aide Seeks Immunity to Cooperate With Congress - The New York Times

It is anyone's guess on how long the Stock Jocks will ignore the growing risks of political instability fanned and fueled by a man clearly unfit to be President, though admittedly that opinion is not shared by the $62.9+M adults who voted for him. 2016 National Popular Vote Final

So far, stock investors have only managed to look the other way and to yawn on occasion.

++++++++++

Trump: It is All About ME, ME, ME:

According to Donald, he hit a home run on his first foreign trip as President.

Watch President Trump push a prime minister aside - CNN

I could just hear those still functioning brain cells saying like "Get out of my way loser, you are in MY PHOTO OP".

Then there was the Macron handshake. Trump, Macron handshake turns into showdown - CBS News (or what Maureen Dowd called “I’ll-rip-your-shoulder-out-and-show-you-who’s-boss” handshake)

Macron later compared Trump to Putin and the Turkish President Erdogan: Trump handshake 'not innocent' - Macron

Trump certainly has far more admiration for Putin and Erdogan than for the leaders of western Democracies.

Trump in Brussels: 'The Germans Are Bad, Very Bad' - SPIEGEL ONLINE

Trump meant to say that the Germans were mean to the U.S. in selling their automobiles here.

Trump complained to the Belgian PM about his difficulty in getting permits to build golf courses.

Merkel: Europeans not completely rely on the U.S. - CNN ( "The times when we could completely rely on others are, to an extent, over. I experienced that in the last a few days, and therefore I can only say that we Europeans must really take our fate into our own hands." In order words, do not trust Trump)

He also talked about how much he paid for his shoes. Boorish.

Trump makes legendary artist do portrait his way - NY Daily News

Trump among Kinstler’s celebrity portraits | Easton Courier

But how many lived in a home modeled on the Hall of Mirrors at Versailles? Just one I would say.

God's gift to women? In his mind, that is certainly the case. Trump recorded having extremely lewd conversation about women in 2005 Original - YouTube

+++++++++

Jeff Sessions:

Sessions will ask for Supreme Court review, after 4th Circuit Court of Appeals (Based in Richmond Virginia) upholds Trump travel ban - CBS News

Jeff Sessions "amazed" that "island" judge could block travel ban - CBS News (referring to a judge based in Hawaii)

Jeff Sessions Issues Harsh New Sentencing Guidelines for Justice Department Prosecutors | National News | US News (will need to build more federal prisons)

Jeff Sessions says he's 'surprised' Americans aren't embracing his anti-marijuana stance - Washington Times

+++++++++

Republicans Rally Around one of Their Own-Greg Gianforte Wins Of Course in the Montana Special Election:

Greg Gianforte: Fox News team witnesses GOP House candidate 'body slam' reporter | Fox News

Voters weigh in after Montana House candidate allegedly assaults reporter - Videos - CBS News (video contains interview with Fox news reporter Alicia Acuna who witnessed the attack).

Gianforte's version was that the reporter basically attacked him:

Greg Gianforte Blames ‘Liberal Journalist’

Jacobs: Gianforte statement worse than assault

No republican politician asked Gianforte to quit the race, nor has any republican politician said he should step down if he wins and is later convicted of assaulting a reporter for asking a question.

Needless to say, Gianforte's conduct would have resulted in an immediate dismissal in any other occupation other than a republican running for office which has far different standards for fitness and acceptable conduct.

As expected, Gianforte won a decisive victory and commentators noted that his unprovoked physical assault on a news reporter had no measurable impact on the race which is what I expected as noted earlier:

Gianforte wins Montana's House seat, apologizes to reporter - CBS News ("based on CBS News estimates as the vote was coming in, there didn't appear to be a large difference between the early/mail vote and Election Day vote overall. And turnout was comparable to that of a midterm election.")

Anecdotal evidence consisting of interviews with Montana republicans who voted on election day showed they thought the reporter had it coming or did not believe the news media reports about what had happened, notwithstanding the audio recording of the attack and eye witness accounts including one from a Fox station. Facts do not matter to them and never will.

It is not surprising that most republicans would disbelieve accurate factual information coming from the news media. The GOP has been successful in persuading tens of millions to distrust and ignore the free press so that their alternate reality and reality creations are accepted without question by the masses. Just get your "facts" from Sean Hannity, Russ Limbaugh, Ann Coulter and Fox and Friends.

{Ann figured out what caused the Near Depression. I can understand her appeal in Trump's America since she put it so succinctly and was not burdened by facts. This is what Ann had to say: "Instead of looking at "outdated criteria," such as the mortgage applicant's credit history, banks were encouraged to consider nontraditional measures of credit-worthiness, such as having a good jump shot or having a missing child named "Caylee." Ann Coulter - September 24, 2008 - THEY GAVE YOUR MORTGAGE TO A LESS QUALIFIED MINORITY. Now poor Caylee later turned up dead-Death of Caylee Anthony)

If Greg Gianforte had attacked someone other than a "liberal" reporter, like a 90 year nun in a wheelchair who asked Greg about the CBO score on Trumpcare, Paul Ryan and other republicans may have been able to muster a response more serious than calling Gianforte's behavior unacceptable while adding "we all make mistakes" to take the sting away from "unacceptable".

After all, as Donald has said, the U.S. press is the "Enemy of the People". Trump again calls media 'enemy of the people'. So he is encouraging attacks on that enemy, meaning anyone who reports on what he does not want anyone to know, facts that contradict his incessant reality creations, and the real implications of his policies rather than those that are made up.

Republicans rebuke but stand by Montana GOP candidate charged with assault - The Washington Post

My thought on the matter is that Gianforte needs to find one of those liberal reporters, (or better yet, a "feminist liberal" reporter) the day before the next election, beat him or her into a pulp so that their mamma can not recognize them, and then his margin of victory would likely increase after showing that he can deal with those uppity reporters better than Trump.

Three republican newspapers in Montana pulled their endorsement. One of them, the Billings Gazette, said sorry, sort of, for ignoring Gianforte's past interactions with reporters which apparently fell short of a physical assault. You have to actually beat up a reporter before a Montana newspaper starts to contemplate the possibility that a republican may be unfit for office. That is the new normal in Trump's America.

I would add that Gianforte refused to publicly answer whether he would have voted for Trumpcare, saying he needed more time to know more facts, but he privately praised the legislation to donors.

G.O.P. House Candidate in Montana Is Caught on Tape Praising Health Bill - The New York Times

He apparently never answered the question posed by Jacobs which was just fine with Montana voters who could care less.

After winning decisively, Gianforte issued an apology to the reporter. Boys will be boys after all. Gianforte: 'I made a mistake, I'm sorry' One of his supporters yelled back that he made no mistake.

Texas governor jokes about shooting reporters - CBS News

+++++

From the Nixon Playbook?

Comey's Tell-All Testimony Runs Risk of White House Roadblocks - Bloomberg {the return of the executive privilege claim coming used by Nixon to impede the investigation of his crimes? United States v. Nixon (full text) :: 418 U.S. 683 (1974)}

FBI declines to provide requested materials to House Oversight, Chaffetz issues new June 8 deadline - CNN

++++++++++

Letter Written by Three Republican EPA administrators: Trump is putting us on a dangerous path - The Washington Post (Trump "has chosen ignorance over knowledge", well of course he has; why learn anything when you have twitter)

+++++++

1. Short Term Bond/CD Ladder Basket Strategy:

A. Bought 1 UST .875% Maturing on 1/15/18:

YTM at Total Cost (99.9060) = 1.006%

A. Bought 2 Public Service Electric & Gas 2.25% First Mortgage Bond Maturing on 9/15/26:

Bought 1 in a Taxable Account ($1 Commission):

Bought 1 in a Taxable Account ($1 Commission):

Issuer: Wholly Owned Subsidiary of Public Service Enterprise Group Inc. (PEG)

PEG Public Service Enterprise Group Inc Page at Morningstar

PEG Public Service Enterprise Group Inc Page at Morningstar

Finra Page: Bond Detail (prospectus not linked)

Credit Ratings:

Moody's at Aa3 Moody's

S & P at A

YTM at Total Cost (94.387) = 2.939%

Current Yield = 2.38%

Lien:

Public Service Enterprise Group 2016 Annual Report

B. Bought 1 Public Service E & G FM Maturing in 2026 in a Roth IRA Account ($2 Commission):

See Discussion in "A" above.

YTM at Total Cost (94.668) = 2.904%

Current Yield = 2.38%

Current Yield = 2.38%

C. Bought 2 AT &T 3.4% Senior Unsecured Bonds Maturing on 5/15/25:

Issuer: AT&T Inc. (T)

AT&T Page at Morningstar

FINRA Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa1

Moody's assigns Baa1 to AT&T's new notes; ratings remain on review for downgrade

S & P at BBB+

Fitch at A- (negative credit watch)

Fitch Rates AT&T's Sr. Unsecured Note Offering 'A-'; Remains on Rating Watch Negative | Reuters

YTM at Total Cost (97.683) = 3.786%

Current Yield = 3.48%

AT&T 2017 First Quarter Report

AT&T 2016 Annual Report

AT &T SEC Filings

T Analyst Estimates

D. Bought 2 Old Republic 3.875% Senior Unsecured Bonds Maturing on 8/26/26:

Issuer: Old Republic International Corp. (ORI)

Old Republic International Page at Morningstar

FINRA Page: Bond Detail (prospectus not linked)

Prospectus

Credit Ratings:

Moody's at Baa2

Moody's upgrades Old Republic's debt ratings; stable outlook

S & P at BBB+

YTM at Total Cost (99.944) = 3.882%

Current Yield = 3.88%

2017 First Quarter Earnings Report

ORI Analyst Estimates

Old Republic SEC Filings

ORI 2016 Annual Report (debt is discussed starting at page 87)

I also own 50 common shares, bought at $17.86, and discussed that purchase here.

E. Bought 2 Dominion 2.75% Senior Unsecured Bonds Maturing on 9/15/22:

Issuer: Dominion Resources Inc. (Virginia) (D) (now called Dominion Energy)

Dominion Resources Page at Morningstar

Finra Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa2

Moody's Affirms Dominion Resources' ratings on Questar Acquisition Announcement

S & P at BBB

Fitch at BBB+

Fitch Rates Dominion Resources Senior Notes 'BBB+

YTM at Total Cost (99.752) = 2.8%

Current Yield = 2.76%

Dominion's 2017 First Quarter Report

Dominion 2016 Annual Report

Dominion SEC Filings

D Analyst Estimates

Earlier in May, Dominion sold a 2.579% subordinated note maturing in 2020.

F. Paired Trade: Bought 1 Dominion 2.75% Senior Unsecured Bond and Sold 1 2% UST Maturing in 2026- A ROTH IRA ACCOUNT:

For the Dominion Bond, see previous discussion. This trade occurred several days after the first one discussed above.

YTM at Total Cost (99.257) = 2.901%

Current Yield = 2.77%

G. Added 1 Ventas Realty 3.5% Senior Unsecured Bond Maturing on 2/1/25:

Issuer: Operating Partnership of Ventas Inc. (VTR)-A REIT

Fully Guaranteed by VTR

VTR Page at Morningstar

FINRA Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa1

Moody's affirms Ventas's Baa1 senior debt rating; stable outlook

S & P at BBB+

FITCH at BBB+

Credit Ratings | ventasreit

YTM at Total Cost (99.073) = 3.628%

Current Yield: 3.53%

"Ventas, Inc., an S&P 500 company, is a leading real estate investment trust. Its diverse portfolio of approximately 1,300 assets in the United States, Canada and the United Kingdom consists of seniors housing communities, medical office buildings, life science and innovation centers, inpatient rehabilitation and long-term acute care facilities, general acute care hospitals and skilled nursing facilities. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States."

Ventas Portfolio

2017 First Quarter Report

VTR Analyst Estimates

Ventas SEC Filings

Ventas 2016 Annual Report (debt discussed starting at page 114)

My prior 1 bond purchase was at 97.484 and was discussed in Item #1.A (3/28/17 Post).

3. Trading Strategy for Specific Securities:

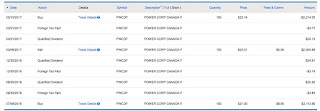

A. Bought Back 100 PWCDF at $22.14-Used Commission Free Trade:

Closing Price Day of Purchase (5/10/17): $22.14 -$.42 or -1.86% PWCDF Historical Prices

I previously sold a 100 share lot in the same account after capturing the first quarter dividend:

Item # 4.A. Sold 100 PWCDF at $23.51: Stocks, Bonds & Politics 3/20/17 (profit snapshot=+$237)-Bought 100 PWCDF at $21.05: Update For Portfolio Positioning And Management As Of 7/9/16 - South Gent | Seeking Alpha

I have discussed the complex organizational charts in the prior posts. I have included here two snapshots showing first the organizational chart of Power Corporation of America and then the chart for the publicly traded Power Financial:

Power Corporation Organizational Chart:

Power Financial: Power Corporation owns a 65.6% interest

Several of the companies included in the prior snapshot are publicly traded:

Power Financial Corp. (Canada: Toronto)

Great-West Lifeco Inc. Stock Quote (Canada: Toronto)

IGM Financial Inc. (Canada: Toronto)

Groupe Bruxelles Lambert S.A. (Belgium: Brussels)

Pargesa Holding S.A. (Switzerland: SWX)

Imerys (France: Paris)(this company has been in the news, along with JNJ recently, as a manufacturer of talc used in baby powder)

2017 First Quarter Power Corporation of Canada Earnings:

"At March 31, 2017, Power Corporation held a 65.6% economic interest in Power Financial. Power Financial's contribution to Power Corporation's adjusted net earnings was $329 million for the quarter, compared with $313 million in 2016."

Power Financial Corporation | Home

The earnings reports will contain some noise, such as a write-down somewhere down in the long food chain shown in the organizational charts or a large capital gain realized by an indirect subsidiary.

Investments Owned Directly: Unrealized Gain at C$443M

Power Corporation of Canada | May 12, 2017 - Power Corporation Reports First Quarter Financial Results and Dividend Increase of 7% - Press Releases

The 7% increase in the quarterly dividend brings the penny rate up to C$.3585 per share.

The yield will vary depending on the CAD/USD exchange rate.

If the CAD/USD was at 1, then C$.3585 would equal USD$.3585 which would result in a 6.477% yield at a total cost per share of U.S.$22.14.

However at the current rate of .7436, the USD value is reduced to U.S.$.267 which results in a 4.82% yield.

Given the weakness in the CAD/USD since crude oil started to crater during the 2014 summer, the USD priced ordinary shares have underperformed the shares priced in CADs.

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics: ERROR CREEP and the INVESTING PROCESS Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.

Issuer: AT&T Inc. (T)

AT&T Page at Morningstar

FINRA Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa1

Moody's assigns Baa1 to AT&T's new notes; ratings remain on review for downgrade

S & P at BBB+

Fitch at A- (negative credit watch)

Fitch Rates AT&T's Sr. Unsecured Note Offering 'A-'; Remains on Rating Watch Negative | Reuters

YTM at Total Cost (97.683) = 3.786%

Current Yield = 3.48%

AT&T 2017 First Quarter Report

AT&T 2016 Annual Report

AT &T SEC Filings

T Analyst Estimates

D. Bought 2 Old Republic 3.875% Senior Unsecured Bonds Maturing on 8/26/26:

Issuer: Old Republic International Corp. (ORI)

Old Republic International Page at Morningstar

FINRA Page: Bond Detail (prospectus not linked)

Prospectus

Credit Ratings:

Moody's at Baa2

Moody's upgrades Old Republic's debt ratings; stable outlook

S & P at BBB+

YTM at Total Cost (99.944) = 3.882%

Current Yield = 3.88%

2017 First Quarter Earnings Report

ORI Analyst Estimates

Old Republic SEC Filings

ORI 2016 Annual Report (debt is discussed starting at page 87)

I also own 50 common shares, bought at $17.86, and discussed that purchase here.

E. Bought 2 Dominion 2.75% Senior Unsecured Bonds Maturing on 9/15/22:

Issuer: Dominion Resources Inc. (Virginia) (D) (now called Dominion Energy)

Dominion Resources Page at Morningstar

Finra Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa2

Moody's Affirms Dominion Resources' ratings on Questar Acquisition Announcement

S & P at BBB

Fitch at BBB+

Fitch Rates Dominion Resources Senior Notes 'BBB+

YTM at Total Cost (99.752) = 2.8%

Current Yield = 2.76%

Dominion's 2017 First Quarter Report

Dominion 2016 Annual Report

Dominion SEC Filings

D Analyst Estimates

Earlier in May, Dominion sold a 2.579% subordinated note maturing in 2020.

For the Dominion Bond, see previous discussion. This trade occurred several days after the first one discussed above.

YTM at Total Cost (99.257) = 2.901%

Current Yield = 2.77%

G. Added 1 Ventas Realty 3.5% Senior Unsecured Bond Maturing on 2/1/25:

Issuer: Operating Partnership of Ventas Inc. (VTR)-A REIT

Fully Guaranteed by VTR

VTR Page at Morningstar

FINRA Page: Bond Detail (prospectus linked)

Credit Ratings:

Moody's at Baa1

Moody's affirms Ventas's Baa1 senior debt rating; stable outlook

S & P at BBB+

FITCH at BBB+

Credit Ratings | ventasreit

YTM at Total Cost (99.073) = 3.628%

Current Yield: 3.53%

"Ventas, Inc., an S&P 500 company, is a leading real estate investment trust. Its diverse portfolio of approximately 1,300 assets in the United States, Canada and the United Kingdom consists of seniors housing communities, medical office buildings, life science and innovation centers, inpatient rehabilitation and long-term acute care facilities, general acute care hospitals and skilled nursing facilities. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States."

Ventas Portfolio

2017 First Quarter Report

VTR Analyst Estimates

Ventas SEC Filings

Ventas 2016 Annual Report (debt discussed starting at page 114)

My prior 1 bond purchase was at 97.484 and was discussed in Item #1.A (3/28/17 Post).

3. Trading Strategy for Specific Securities:

A. Bought Back 100 PWCDF at $22.14-Used Commission Free Trade:

Closing Price Day of Purchase (5/10/17): $22.14 -$.42 or -1.86% PWCDF Historical Prices

I previously sold a 100 share lot in the same account after capturing the first quarter dividend:

Item # 4.A. Sold 100 PWCDF at $23.51: Stocks, Bonds & Politics 3/20/17 (profit snapshot=+$237)-Bought 100 PWCDF at $21.05: Update For Portfolio Positioning And Management As Of 7/9/16 - South Gent | Seeking Alpha

Prior POW:TO/PWCDF Trades:

Item # 1. Sold 400 POW:TO at C$31.05: Update For Portfolio Positioning And Management As Of 4/29/16 - South Gent | Seeking Alpha (USD Profit = $360.45)

Item # 2 Sold 100 PWCDF at $28.07 (11/22/14 Post) (profit snapshot=+$210.03)-Bought Back Power Corporation Of Canada At $25.81

Item # 5 SOLD Taxable Accounts: 100 PWCDF at $28.83 (8/2/14 Post)(profit snapshot+$138.71)-Item # 4 Bought 100 PWCDF at $27.29 (7/12/14 Post)

Trading Profits to Date: $946.09

I have discussed the complex organizational charts in the prior posts. I have included here two snapshots showing first the organizational chart of Power Corporation of America and then the chart for the publicly traded Power Financial:

Power Corporation Organizational Chart:

Power Financial: Power Corporation owns a 65.6% interest

Several of the companies included in the prior snapshot are publicly traded:

Power Financial Corp. (Canada: Toronto)

Great-West Lifeco Inc. Stock Quote (Canada: Toronto)

IGM Financial Inc. (Canada: Toronto)

Groupe Bruxelles Lambert S.A. (Belgium: Brussels)

Pargesa Holding S.A. (Switzerland: SWX)

Imerys (France: Paris)(this company has been in the news, along with JNJ recently, as a manufacturer of talc used in baby powder)

2017 First Quarter Power Corporation of Canada Earnings:

"At March 31, 2017, Power Corporation held a 65.6% economic interest in Power Financial. Power Financial's contribution to Power Corporation's adjusted net earnings was $329 million for the quarter, compared with $313 million in 2016."

Power Financial Corporation | Home

The earnings reports will contain some noise, such as a write-down somewhere down in the long food chain shown in the organizational charts or a large capital gain realized by an indirect subsidiary.

Investments Owned Directly: Unrealized Gain at C$443M

Power Corporation of Canada | May 12, 2017 - Power Corporation Reports First Quarter Financial Results and Dividend Increase of 7% - Press Releases

The 7% increase in the quarterly dividend brings the penny rate up to C$.3585 per share.

The yield will vary depending on the CAD/USD exchange rate.

If the CAD/USD was at 1, then C$.3585 would equal USD$.3585 which would result in a 6.477% yield at a total cost per share of U.S.$22.14.

However at the current rate of .7436, the USD value is reduced to U.S.$.267 which results in a 4.82% yield.

Given the weakness in the CAD/USD since crude oil started to crater during the 2014 summer, the USD priced ordinary shares have underperformed the shares priced in CADs.

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics: ERROR CREEP and the INVESTING PROCESS Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.

"the return of the executive privilege claim coming used by Nixon to impede the investigation"

ReplyDeleteI'll play devil's advocate here, and hope that our host sees fit to approve:

It's good to remember that the most extreme example of the claim of executive privilege was claimed by... Thomas Jefferson.

There are three big problems in studying executive privilege:

1. Analyses of the question are often written by lawyers, who often become polemical out of habit.

2. The question often has current political significance, which prevents people from being objective and unbiased.

3. Executive privilege is rarely discussed in the general context of other privileges, attorney-client, doctor-lawyer, marital, etc. Would the readers here really like to see a world in which ANY judge or ANY congressman could obtain details of the construction of atomic bombs in a patent or other intellectual property suit?

Thanks.

D.

D: The very brief reference to executive privilege made in this post specifically referred to asserting executive privilege to keep Comey from testifying about his conversations with Trump. I obviously was not delving into a broad discussion of executive privilege.

DeleteNixon's assertion of executive privilege was part of his effort to cover up his criminal actions, particularly his effort to obstruct the ongoing FBI's Watergate investigation.

My brief reference to executive privilege dealt specifically with a possible Trump executive privilege claim involving his conversations with Comey, where Comey was allegedly asked to end the Flynn investigation and to pledge loyalty to Trump. When Comey refused, he was fired.

Trump also claimed publicly that Comey told him on three occasions that he was not the subject of an investigation and included that claim in his letter firing Comey.

If executive privilege was asserted to prevent disclosure of those conversations, either through Comey's testimony or through the production of his memos, then the parallel with Nixon's assertion would be appropriate but Trump's assertion would be far more egregious and unfounded.

http://www.factcheck.org/2017/05/trump-vs-comey/

As to Thomas Jefferson, I would not refer to the Aaron Burr subpoena issued to Jefferson and his initial response as the most extreme example.

See Garry Wills discussion in

http://www.nybooks.com/articles/1974/07/18/executive-privilege-jefferson-burr-nixon-ehrlichma/

"If executive privilege was asserted to prevent disclosure of those conversations, ..."

DeleteAnd it seems to me Trump would have a hard time claiming the conversations were "privileged" when he already disclosed them himself.

https://thinkprogress.org/trumps-tweets-interviews-could-cost-him-executive-privilege-d49d667290e7

C: Yes that is correct.

DeleteThere is no executive privilege covering those conversations. If there arguably was a privilege, then it has already been waived by Trump.

An invocation of the privilege to prevent Comey's testimony or the production of those memos would be part of a cover up which was the case in Nixon's claim as well. The smoking gun tape was not produced until the Supreme Court's decision rejecting Nixon's executive privilege claim, which happened after the House Judiciary Committee passed articles of impeachment. Nixon had prepared a partial transcript of 20 tapes and did not include that discussion in his partial transcripts made in an effort to avoid producing the tapes.

http://www.historyplace.com/unitedstates/impeachments/nixon.htm

When the evidence was produced and made public on 8/4/1974, Nixon was cooked and had no choice but to resign rather than to contest the impeachment articles in the House and then in a Senate trial.

That tape is available on the internet:

https://www.youtube.com/watch?v=_oe3OgU8W0s

The GOP congressman who voted against the Nixon impeachment articles in the Judiciary Committee then announced they would vote for them. GOP senators told Nixon that it would have no more than 15 senators vote for acquittal. He resigned on 8/8/74.

Trump has indeed disclosed aspects of those Comey discussions in tweets, his letter firing Comey, and in other statements including those made in the Lester Holt interview.

The invocation of a privilege can not be both a sword and a shield.

Hello southgent,

ReplyDeleteI wonder if you had any thoughts on the risk of inversion of the yield curve later this year.

Here is a small video from David Rosenberg the economist from Canada.

He has some interesting things to say about the presidency and about the fact that technology may well replace a lot of jobs in this country.

He also discusses the risk of a recession related to the yield curve inverting.

Sorry to bother you on Memorial Day. Most people think it's just a holiday.

Best, Sam

http://www.newsmax.com/Finance/StreetTalk/David-Rosenberg-Yield-Curve/2017/05/24/id/792135/

Sam: An inversion of the yield curve has been a valid warning of an impending recession.

ReplyDeleteIf you look at chart showing the ten year treasury minus the 2 year, there is an inversion before recessions, but the time period between the inversion and the recession can vary meaningfully, something which Rosenberg fails to note. Given the time difference, it would be hard to say that the events causing the inversion were invariably causing the recession as well.

https://fred.stlouisfed.org/series/T10Y2Y

An increase in the FF rate may not translate into an increase in the ten year yield. The 10 year treasury initially went down in yield when the FED started to raise the FF rate in June 2004.

I do not see an inversion as likely this year or next. This FED will stop raising the short term FF rate before that happens.

There are context differences between current and past conditions which are important IMO.

The ten year yield now is abnormally low as is the FF rate. The FF rate is being gradually increased from one abnormally low yield to another less abnormal one. That rate is just moving off a zero, which is not going to have the same impact as going from 4% to 8%, or from 1% to 5.25% which is what happened in 2004-2006.

In addition, I do not believe the ten year yield reflects a market determined rate, but is instead heavily influenced by extremely abnormal monetary policies maintained for an extended period both her and abroad. The FF rate is artificial as well given current economic conditions.

Consequently, since the current context is different, I would not jump to a conclusion that a recession will occur within 18 months after a yield curve inversion since I do not see fundamentally how economic conditions would worsen due to a rise in the FF rate from zero to 2%.

A recession is far more likely to be caused by normal economic cycle conditions. Demand starts to shrink for a variety of reasons; layoffs and bankruptcies of marginal players then occur which causes further decreases in demand due to job losses; consumers with jobs become more cautious and decrease their spending which causes more layoffs and business closures; and lenders become more strict causing even more marginal companies to go out of business.

I would pay attention to the FED survey of bank lending officers. Tightening of credit standards may be a better signal now than yield inversion.

https://www.federalreserve.gov/data/sloos/sloos.htm

Charts:

https://fred.stlouisfed.org/release?rid=191

E.G. Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Small Firms

https://fred.stlouisfed.org/series/DRTSCIS

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms

https://fred.stlouisfed.org/series/DRTSCILM

The payrolls report for May will be released next Friday. The current estimate is for 185K more jobs. Motor vehicle sales are to be released next Thursday. Those sales may have already peaked.

http://www.marketwatch.com/economy-politics/calendars/economic?link=MW_Nav_EP

I would pay particular attention now to consumer spending numbers.

Those numbers can be found in a variety of government reports including the recently revised GDP report and the monthly reports on personal income and spending.

https://www.bea.gov/newsreleases/national/pi/2017/pi0317.htm

The first quarter numbers are not good as shown in the previously linked release.

https://fred.stlouisfed.org/graph/?g=mJz

I have frequently been critical of how Rosenberg uses data.

E.g.

https://tennesseeindependent.blogspot.com/2010/08/more-on-barrons-and-david-rosenberggold.html

https://tennesseeindependent.blogspot.com/search?q=rosenberg+

I mentioned in the prior comment that the government's monthly report on personal income and spending is worth a review. That report contains information on personal spending, income and PCE inflation.

DeleteThe April report was released today:

https://www.bea.gov/newsreleases/national/pi/2017/pdf/pi0417.pdf

PCE increased by .4% as did disposable personal income. Adjusted for a .2% increase in PCE prices, the real inflation adjusted increases for both PCE and DPI were .2%. (See Tables 5 and 9 in previous link) The personal savings rate was reported at 5.3% (table 1), unchanged for the past three months through April.

The PCE number is IMO okay, but does not relieve concerns about a potential slowdown. April was the month that many consumers received their tax refunds and spending normally picks up in the early Spring. The .2% real growth number can not be characterized as robust or even good.

Brad Thomas believes that Omega Healthcare dropped last week based on a "media" report, which he does not link, that questions the liquidity of a major tenant. That tenant, which accounts for 7% of revenue, is a private company called Signature.

ReplyDeletehttps://seekingalpha.com/article/4077090-demographics-lie-neither-dividends

Brad has called OHI a blue chip in the past.

Since OHI's tenants are not blue chip, I question how a collection of non-blue chip tenants creates a blue chip REIT.

Brad tries to put lipstick on one of the pigs, Genesis Healthcare, in that article. Genesis (GEN) closed at $1.86 last Friday, creating a market cap of $288M and long term debt of $1.1+B as of 3/31/17. Losing money every quarter too.

It was the bankruptcy of Genesis around 2000, as well as other OHI tenants, that caused OHI's near death experience then.

The bankruptcies resulted in a government reimbursement change that was sufficient to send a large number of over-leveraged operators into BK.

I also do not get his continued use of FFO when OHI has a large non-cash revenue component that is included in its FFO and AFFO numbers. The company only backs out the non-cash pretend revenue in its FAD number.

https://tennesseeindependent.blogspot.com/2017/01/omega-healthcare-ohi.html

There are good reasons why large investors will not have the same favorable opinion about OHI as SA authors.

I do not leave comments at SA anymore. I did read a few to that article.

I will respond to one commenter here, since the GOP's plan will have a significant impact on Medicaid reimbursements.

One commenter correctly points out that Trump's budget slows the increase of Medicaid expenditures.

However, millions of medicaid participants will lose their coverage over the next 10 years compared to Obamacare. The losses in Medicaid coverage are basically tied to the GOP's termination of enhanced federal matching funds and a new per capita-based cap on Medicaid payments. Together those items reduce Medicaid spending by about $834B by reducing the Medicaid insured population compared to where it would be under current law:

"CBO and JCT estimate that, in 2018, 14 million more people would be uninsured under H.R. 1628 than under current law. The increase in the number of uninsured people relative to the number projected under current law would reach 19 million in 2020 and 23 million in 2026. In 2026, an estimated 51 million people under age 65 would be uninsured, compared with 28 million who would lack insurance that year under current law."

https://www.cbo.gov/publication/52752

CBO estimates that there will be 14M fewer Medicaid enrollees by 2026:

Page 17

https://www.cbo.gov/system/files/115th-congress-2017-2018/costestimate/hr1628aspassed.pdf

That is a cut in Medicaid enrollment even as spending increases in nominal terms, made worse by the expansion of the population over the next ten years.

Another error made by the commenter is the statement that the increase in total outlays under the GOP's plan is faster than the expected per year increases in CPI, a clearly erroneous straw man argument used by the commenter.

Medical cost inflation rises at a faster rate than CPI and the population size is also increasing, probably somewhere close to 1% per year, but a more precise estimate will have to wait for the next Census in 2010.

Anyone interested in facts rather than parroting republican dogma promulgated by Trump's budget director can see the differences between the CPI number and the medical inflation rates in the CPI reports.

The information can be found in Table 2:

https://www.bls.gov/news.release/cpi.t02.htm

This report from PWC has a chart showing the medical cost inflation rate over time:

https://www.pwc.com/us/en/health-industries/health-research-institute/behind-the-numbers.html

While nominally increasing Medicaid outlays, the plan will reduce the number of covered persons and will reduce the Medicaid share of GDP from about 2% to 1.7%.

OHI: I did not find a media report discussing Omega and its tenant signature.

DeleteYesterday, Omega released a statement denying "recent media coverage" that it had engaged Alvarez & Marsal as a financial advisor "in relation to matters involving Omega’s Signature Holdings II LLC-operated facilities."

http://www.businesswire.com/news/home/20170530005671/en/

That denial, disseminated prior to the market open yesterday (5/30) has not positively impacted OHI's price.

$31.48-0.10 (-0.33%)

As of 10:59AM EST

The stock price rose $.02 yesterday.

One reason for the stocks non-response is that you can not make filet mignon out of ham salad.

Does a pool of subprime mortgage loans become a AAA credit because the pool is well diversified?

+++

Possibly it is stating to dawn on some investors that NIM is likely to decrease for regional banks rather than expand rapidly which became the herd consensus after Donald's win.

SPDR S&P Regional Banking ETF (KRE)

$51.58 -$0.68 (-1.30%)

As of 11:05AM EDT

https://finance.yahoo.com/quote/KRE/history?p=KRE

KRE's 2017 closing high was at $59.36 (3/1/17)

The closing price on 11/8/16 was at $43.97.

I sold into the rally and my regional bank basket is now over $25K below my minimum $40K out-of-pocket exposure for this basket.

There are some stocks that are starting to become rationally priced IMO, but I am not yet willing to nibble on previously sold positions yet.

Snapshots of profits and losses at

Total Realized Gains as of 4/7/2017= +$37,607.64

https://tennesseeindependent.blogspot.com/2011/10/regional-bank-basket-strategy-gateway.html

So what is the bond market signaling about the economy?

ReplyDeleteThe ten year treasury yield dived today to a 2.21% yield, spending the regular trading session making a series of lower highs and lower lows.

http://www.marketwatch.com/investing/bond/tmubmusd10y?countrycode=bx

The German 10 year fell below .3%:

http://www.marketwatch.com/investing/bond/tmbmkde-10y?countrycode=bx

I am selling into the investment grade corporate bond rally a few lower coupon bonds maturing mostly in the 2019-2022 range, realizing small gains.

Prior to today, I would used the proceeds to buy higher coupon bonds that have greater current yields and YTMs. Invariably, I had to extend the maturity into the 2023 to 2027 range to pick up more yield and to accept a somewhat lower investment grade rating as well.

I could not find anything that I wanted to buy in the secondary market today, though I did buy one 3.1% VZ SU maturing in 2024 offered at par value under Fidelity's corporate notes program.

The Bond Ghouls have changed their opinion about Donald, whereas the Stock Jocks still believe in him and the GOP working wonders.

To fix a date, the Bond Ghouls started to have second thoughts starting in late January 2017 when the ten year yield was near 2.5%:

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2017

The yield on 1/3/17 was 2.45%. The lowest daily closing yield was at 2.18% on 4/18/17. Looks like we are headed to a new yearly low yield soon just as the FED appears to be ready to raise the FF range by .25% in a few days:

The probability of a .25% increase after the June 14th meeting is at 88.8% based on the CME tool.

http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

The 10 year treasury yield on 11/8 was 1.88% and at 2.07% on 11/9/17.

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2016

Interactive Brokers: I sent an email notifying IB that an incorrect foreign tax rate was applied to my Roche and Orkla dividends.

ReplyDeleteI received a response today denying my request for compensation since IB stated in its policies that an ADR fee would be withheld to pay the custodians.

I sent this reply back to them:

"I did not request compensation, nor did I complain about the ADR fees paid to the custodians. If my email had been read, I was simply pointing out that IB did not assert my tax treaty rights to a 15% withholding rate as better brokers do. I received both the Orkla and Roche dividends, for example, in my Fidelity account, with a 15% tax withholding.

The ADR fee is a separate line item from the foreign tax withholding. My remedy with IB was self-help. I sold 4 ADR positions after recognizing that the tax withholding issue was a systemic problem at IB that would not be corrected by management. For a variety of reasons, including this minor tax withholding problem, IB is no longer competitive except when I buy foreign stocks and currency. It is easy for me to secure 500 free trades at other brokers now, which I have done by sending them $100K in new money. Both Schwab and Fidelity now charge $4.95 per stock order, which I do not pay, provide free quotes, some research, the same $1 per bond commission, and a far better trading experience and platform navigability. IB has a really big problem. It is not for me to solve it for you.

This CNN story has not yet been duplicated or confirmed by stories published by the other card carrying members of the Fake News Media Club yet (e.g. NYT, NBC, CBS, WP, etc):

ReplyDelete"Sources: Russians discussed potentially 'derogatory' information about Trump and associates during campaign"

http://www.cnn.com/2017/05/30/politics/russians-trump-campaign-information/index.html

Spicer did not provide specific answers to questions involving the alleged Kushner request to use Russian facilities to communicate with Moscow in order to avoid detection by U.S. intelligence. Spicer basically referred to the statements by Homeland's John Kelly and National Security Advisor H.R. McMaster that they had no problem with a back channel which is sort of a non-admission admission. hat is about as close as Trump will come to admitting that the story is true. It would be easy for Kushner to release a statement denying the material details in the story, but he remains silent. So we are subjected to a bunch of jive instead.

Spicer's spiel, which will make sense to Trump Nation, is to complain about Fake news and not answer questions simply and directly, but to issue evasive responses like this non-response response:

"Your question pre-supposes facts that have not been confirmed. I'm not going to get into confirming stuff." Y

Yes or no Sean, it is really easier when you try it rather than twisting yourself constantly into a pretzel.

Someone is writing Spicer's lines now. He frequently refers to written text in front of him.

Euro Area inflation Y-O-Y declined to 1.4% in May from April's reading of 1.9%.

ReplyDeletehttp://ec.europa.eu/eurostat/documents/2995521/8054142/2-31052017-BP-EN.pdf/839d5fa7-891d-4bc0-b652-2661f9f07cca

Euro Area May unemployment was reported by Eurostat at 9.3% down from 9.4% in April:

http://ec.europa.eu/eurostat/documents/2995521/8054122/3-31052017-AP-EN.pdf/4f221477-8be9-46a0-a949-071b79490118

The Euro Area includes 19 nations that use the Euro. Another 9 nations are part of the EU but use their own national currencies (e.g. Sweden, Norway, Poland)

April Unemployment rates:

Italy 11.1%

France 9.5%.

Spain 17.8%

Greece 23.2%

Germany at 3.9%

I would not get too excited about the economic progress being made in Europe.

VERIZON 1.1% SU MATURING ON 11/1/17:

ReplyDeleteVZ has elected to redeem early under the make whole provision.

I own two of these bonds

The redemption will be on 6/30/17. I suspect that the redemption amount may be a tiny slither over par value.

This makes no sense to me, but I am fine that this bond will be redeemed early given its low coupon. The proceeds can be redeployed at higher rates.

I bought at a total cost of 99.904 (1/12/17).

OHI: The most recent dive in OHI's price started on 5/25/17. It seems like the price is starting to stabilize with lower volume:

ReplyDeleteMay 31 $31.32 2,103,355

May 30 $31.58 2,078,900

May 26 $31.56 5,739,400

May 25 $31.99 5,551,300

May 24 $33.31 2,957,300

I used a commission free trade to buy 5 shares at 31.35 today, bringing my share balance up to 188+ shares bought between $28.39 and $32.89.

I will dump those shares on a pop. Previously, I waited to dump my position when the price went over $37. I am more circumspect and cautious now.

I view OHI as being too risky for my IRA currently. I sold the remaining shares owned in the Roth at $33.96 (4/7/17):

https://tennesseeindependent.blogspot.com/2017/05/observations-and-sample-of-recent_8.html

++

MACK:

I mentioned earlier selling 50 of my 150 shares prior to the ex dividend date.

For the 100 remaining shares, I received a $105.52 special dividend on 5/26. The dividend was not reinvested by Schwab as I requested.

March 31, 2017 Close:

$1.815-0.55 (-23.26%)

Volume 11,050,020

Avg. Volume 2,153,945

The price was already adjusted for the dividend prior to today.

I used 1/2 of the dividend and a commission free trade to buy 50 shares today at $1.82.

Institutional investors are not optimistic that MACK's remaining pipeline drugs will be successful, and do not believe MACK will receive any of the two major milestone payments for Onivyde which was sold to Ipsen:

"Merrimack received $575 million in cash upon closing"

$140M of that amount was used to fund the special dividend.

http://www.prnewswire.com/news-releases/merrimack-declares-140m-special-dividend-in-connection-with-recently-completed-asset-sale-300435502.html

The press release linked below discusses the three remaining pipeline drugs and how MACK intends to use the remaining cash.

http://www.prnewswire.com/news-releases/merrimack-launches-as-new-refocused-research--clinical-development-company-with-resources-to-advance-prioritized-lead-pipeline-candidates-mm-121-mm-141-and-mm-310-300433404.html

I have no idea whether the market is right in its negative assessments of the pipeline and potential milestone payments. I say that after reading the NIH's summaries of ongoing Onivyde studies, focusing on the pancreatic cancer indication.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4881920/

I can only say that the $1.82 price does not reflect good news from either the pipeline or the milestone payments.

What happened here is a lesson in that MACK finally got a drug approved, ONIVYDE, and sales did not live up to expectations which resulted in selling the drug and hoping for additional monies based on what Ipsen may succeed at doing.

The milestones are composed of: $225 million for U.S. Food and Drug Administration ("FDA") approval in first-line pancreatic cancer, $150 million for FDA approval in small cell lung cancer and $75 million for FDA approval in any third indication. In a previous press release, MACK said it would return 100% of those amount, when and if received and net of taxes. Based on the then existing share count and prior to taxes, the amount would equal $3.46 per share. Possibly the market believes the $75M milestone is possible.

http://www.prnewswire.com/news-releases/merrimack-concludes-strategic-review-announces-plan-to-divest-assets-and-sharpen-strategic-focus-300387483.html

And the current market cap would not be consistent with one of the remaining pipeline candidates being approved by the FDA.

This is a lottery ticket. I will use the remaining $50 in the special dividend to buy at a lower price using a commission free trade.

+++++++

http://www.cnn.com/2017/05/31/politics/fbi-comey-testimony/index.html

https://www.bloomberg.com/politics/articles/2017-05-31/eu-leaders-turn-to-china-after-trump-visit-clouds-u-s-relations

"On Wednesday, a White House spokesman said all future questions regarding the Russia matter would be handled by Trump’s personal attorney." WP

I have published a new post:

ReplyDeletehttps://tennesseeindependent.blogspot.com/2017/06/observations-and-sample-of-recent.html