Economy:

Negative economic news is coming in batches.

Negative economic news is coming in batches.

Existing-home sales fall for third-straight month, hit a 3-year low - MarketWatch; Existing-Home Sales Down 1.2% in January| www.nar.realtor

U.S. Core Durable Goods Order Unexpectedly Declined .7% in December

February 2019 Manufacturing Business Outlook Survey (reading of 17 last month to -4.1% this month)

December 2018 Housing starts to lowest level in more than 2 years (down 11.2% from November and -10.2% over the past 12 months)

The Stock Jocks have ignored all of the above when the focus is not on individual stocks, which may react badly to an earnings miss, but on major stock indexes.

The Bond Ghouls remain somewhat gloomy and far from enthusiastic about U.S. real GDP growth prospects and are sanguine about inflation.

The preceding negative data points do not provoke a breath-into-a-paper- bag response for me or a need to hook up to an IV loaded with chill juice.

I am expecting a slowdown in the first quarter similar to what has happened in recent years.

I also do not expect the U.S. economy, given its size, as capable of sustaining 3+% real GDP growth for long. If 2018 exceeds that number, and it may be close for the year, I would generally expect 2019 to slow to somewhere between 1.75% to 2.5% real GDP growth.

I would expect the annual average median in an expansion cycle to be in the 2% to 2.5% range.

The worry can start with a continuation of negative data into the spring and summer.

The data will be both positive and negative at times during an economic expansion, bouncing up and down and all around. The key is whether the overall dominant trend remains up.

I would question whether the dominant trend remains up with negative economic data flowing in bunches through the spring and into the summer.

Home Depot shares fall on fourth-quarter earnings miss and forecast of slower sales in 2019

CAT down after double downgrade at UBS-Seeking Alpha (UBS downgraded to sell with a 20% reduction in its price target)

++

China:

Trump: US will delay China tariffs scheduled to start on March 1 Donald claimed that "substantial" progress has been made in the negotiations.

Trump says he expects to sign a trade deal with China ‘fairly soon’ - The Washington Post

Trump Suggests ‘Signing Summit’ With Xi as China Talks Advance - Bloomberg

The market responded to Trump's comments by opening strong on Monday 2/25 and fading into the close.

There are several possible reasons for the big yawn: (1) it was expected that Trump would extend the deadline and would come up with reasons for doing so; (2) a resolution of the China trade dispute is already largely factored into stock prices; and/or (3) Trump's statements about progress are met with some skepticism. I would vote for some combination of all three explanations.

China had a different spin: China's Xinhua Agency Warns of `New Uncertainties' in U.S. Talks - Bloomberg (2/24/19).

More U.S. companies pulling back on China expansion amid trade uncertainty - MarketWatch

February 2019 Manufacturing Business Outlook Survey (reading of 17 last month to -4.1% this month)

December 2018 Housing starts to lowest level in more than 2 years (down 11.2% from November and -10.2% over the past 12 months)

The Stock Jocks have ignored all of the above when the focus is not on individual stocks, which may react badly to an earnings miss, but on major stock indexes.

The Bond Ghouls remain somewhat gloomy and far from enthusiastic about U.S. real GDP growth prospects and are sanguine about inflation.

The preceding negative data points do not provoke a breath-into-a-paper- bag response for me or a need to hook up to an IV loaded with chill juice.

I am expecting a slowdown in the first quarter similar to what has happened in recent years.

I also do not expect the U.S. economy, given its size, as capable of sustaining 3+% real GDP growth for long. If 2018 exceeds that number, and it may be close for the year, I would generally expect 2019 to slow to somewhere between 1.75% to 2.5% real GDP growth.

I would expect the annual average median in an expansion cycle to be in the 2% to 2.5% range.

The worry can start with a continuation of negative data into the spring and summer.

The data will be both positive and negative at times during an economic expansion, bouncing up and down and all around. The key is whether the overall dominant trend remains up.

I would question whether the dominant trend remains up with negative economic data flowing in bunches through the spring and into the summer.

Home Depot shares fall on fourth-quarter earnings miss and forecast of slower sales in 2019

CAT down after double downgrade at UBS-Seeking Alpha (UBS downgraded to sell with a 20% reduction in its price target)

++

China:

Trump: US will delay China tariffs scheduled to start on March 1 Donald claimed that "substantial" progress has been made in the negotiations.

Trump says he expects to sign a trade deal with China ‘fairly soon’ - The Washington Post

Trump Suggests ‘Signing Summit’ With Xi as China Talks Advance - Bloomberg

The market responded to Trump's comments by opening strong on Monday 2/25 and fading into the close.

There are several possible reasons for the big yawn: (1) it was expected that Trump would extend the deadline and would come up with reasons for doing so; (2) a resolution of the China trade dispute is already largely factored into stock prices; and/or (3) Trump's statements about progress are met with some skepticism. I would vote for some combination of all three explanations.

China had a different spin: China's Xinhua Agency Warns of `New Uncertainties' in U.S. Talks - Bloomberg (2/24/19).

More U.S. companies pulling back on China expansion amid trade uncertainty - MarketWatch

++++++

Markets and Market Commentary:

Charting a V-shaped reversal, S&P 500 hesitates at major resistance - MarketWatch

Charting a V-shaped reversal, S&P 500 hesitates at major resistance - MarketWatch

A 5% to 10% correction is vital for this stock market, warns Jefferies strategist - MarketWatch I am always suspicious of parabolic rises in the stock market. Straight up parabolas have a tendency to collapse upon themselves unless firmly rooted in supporting data. I do view the surge in the stock market since 12/24/18 to be based more on hope than underlying fundamentals. The primary support in that skyward, virtually non-stop trajectory has been a change in FED policy, removing for now the possibility of further rate hikes. But, why? The FED is seeing risks to the economy and slower growth.

Despite market comeback, traders worry about bull-killing earnings drop

‘Father of Reaganomics’ says ‘get out of the market’ — bond and stock market — ‘and put your money in cash’ - MarketWatch

Perma Bears, like David Stockman and John Hussman, are in an echo chamber inhabited by others of like opinions.

They draw sustenance from one another.

Like all arrogant and dogmatic people, their inherent flaws are that they discard or dismiss information inconsistent with their opinion which is held in high regard by them, fail utterly to place information in context, emphasize negative information and events far beyond their relevance and importance, and create their own facts.

Will there be a bloodbath in stocks? Yes.

After all there have been 3 since 1974 with two of those within the past 18 years.

When will the next one happen?

No human can answer that question, nor can those who lack omniscience know whether the next major decline will stop at 20%, 30%, 40%, 50% or 80+% or how long the decline will last before there is a bounce back to new highs or a retracement of most of the losses.

There was certainly a long wait after the October 1929 crash and the onset of the Great Depression.

Most recent sharp and major declines have had powerful and relatively quick snapback rallies.

The current stock rally began in earnest on 3/10/09 after the S & P 500 closed at 676.53 the previous day which was a Monday. The Barron's Magazine published that prior weekend was filled with gloom.

I noted in previous posts that the perma bear Alan Abelson, who wrote the main article "Up and Down Wall Street" until he passed, was touting David Rosenberg who was then recommending no exposure to stocks.

In April 2009, with the rally well under way, Rosenberg advised investors to avoid stocks since the S & P was going to fall to 475. More on Barron's and David Rosenberg; Merrill's Rosenberg: A New Bull Market? Are You Out Of Your Mind? - Business Insider Was that helpful advice?

John Hussman, another perma bear, manages the euphemistically named Hussman Strategic Growth Fund (HSGFX) which had an annualized average ANNUL TOTAL RETURN of -5.74% over the past 10 years through 2/21/19. Good or bad?

Has Hussman been right or wrong?

One answer to that question is that he has lost an annual average 5.74% per year over the past 10 years (-3.42% per year over the past 15).

If that is being right, I would prefer to be wrong with an average annual total return of 15.96% over the past 10 years with SPY. SPDR® S&P 500 ETF (SPY) Total Returns That is an annual difference of 21.7%.

Has that dismal performance caused Hussman to reassess his opinions and the facts used to support that opinion? The answer is of course no. The perma bear can not do a 180 since the fear is that the turn will occur close to a major decline.

For me, I have no need to take risks and have no desire to lose significant sums of money taking risks.

That is not equivalent to saying that I pay much attention to people like Hussman, Stockman or those who write columns at ZeroHedge.

Their game, and the source of their livelihoods, is to spin narratives of gloom which can be easily pierced by those who know and understand the complete story and are able to separate the wheat from the chaff.

‘Father of Reaganomics’ says ‘get out of the market’ — bond and stock market — ‘and put your money in cash’ - MarketWatch

They draw sustenance from one another.

Like all arrogant and dogmatic people, their inherent flaws are that they discard or dismiss information inconsistent with their opinion which is held in high regard by them, fail utterly to place information in context, emphasize negative information and events far beyond their relevance and importance, and create their own facts.

Will there be a bloodbath in stocks? Yes.

After all there have been 3 since 1974 with two of those within the past 18 years.

When will the next one happen?

No human can answer that question, nor can those who lack omniscience know whether the next major decline will stop at 20%, 30%, 40%, 50% or 80+% or how long the decline will last before there is a bounce back to new highs or a retracement of most of the losses.

There was certainly a long wait after the October 1929 crash and the onset of the Great Depression.

Most recent sharp and major declines have had powerful and relatively quick snapback rallies.

The current stock rally began in earnest on 3/10/09 after the S & P 500 closed at 676.53 the previous day which was a Monday. The Barron's Magazine published that prior weekend was filled with gloom.

I noted in previous posts that the perma bear Alan Abelson, who wrote the main article "Up and Down Wall Street" until he passed, was touting David Rosenberg who was then recommending no exposure to stocks.

In April 2009, with the rally well under way, Rosenberg advised investors to avoid stocks since the S & P was going to fall to 475. More on Barron's and David Rosenberg; Merrill's Rosenberg: A New Bull Market? Are You Out Of Your Mind? - Business Insider Was that helpful advice?

John Hussman, another perma bear, manages the euphemistically named Hussman Strategic Growth Fund (HSGFX) which had an annualized average ANNUL TOTAL RETURN of -5.74% over the past 10 years through 2/21/19. Good or bad?

Has Hussman been right or wrong?

One answer to that question is that he has lost an annual average 5.74% per year over the past 10 years (-3.42% per year over the past 15).

If that is being right, I would prefer to be wrong with an average annual total return of 15.96% over the past 10 years with SPY. SPDR® S&P 500 ETF (SPY) Total Returns That is an annual difference of 21.7%.

Has that dismal performance caused Hussman to reassess his opinions and the facts used to support that opinion? The answer is of course no. The perma bear can not do a 180 since the fear is that the turn will occur close to a major decline.

For me, I have no need to take risks and have no desire to lose significant sums of money taking risks.

That is not equivalent to saying that I pay much attention to people like Hussman, Stockman or those who write columns at ZeroHedge.

Their game, and the source of their livelihoods, is to spin narratives of gloom which can be easily pierced by those who know and understand the complete story and are able to separate the wheat from the chaff.

++++++++

Trump:

This tweet from Demagogue Don highlights his authoritarian personality and contempt for the free press:

Kellyanne Conway’s husband: Who’s more credible, Trump or the New York Times? 93% of voters are on same page - MarketWatch

At least Lying Don did not refer to this paper as the failing New York Times which is just one of his reality creations. The NYT reported 4th quarter earnings and revenues that exceeded expectations. The company added 265K digital subscribers during the quarter. The New York Times Company Reports 2018 Fourth-Quarter and Full-Year Results and Announces Dividend Increase

Trump told Lesley Stahl he bashes press to discredit negative stories about him

Lawsuits, Libel, and Lampooning: An Update on the War on the Press | Benton Foundation

The republicans have been engaged in a war against the free press starting with President Nixon and his VP Spiro Agnew who claimed that a Jewish cabal controlled the mainstream media.

Is 'The Post' Accurate? Did Nixon Ban Washington Post at White House?:

Nixon Targeted The Times, Tapes Show - latimes

Tapes Show Nixon Plan For Raid of Newspaper - The New York Times

Nixon's vice president asked Saudis for money to fight US ‘Zionists’-MSNBC | The Times of Israel (2/22/19 article)

Kellyanne Conway’s husband: Who’s more credible, Trump or the New York Times? 93% of voters are on same page - MarketWatch

At least Lying Don did not refer to this paper as the failing New York Times which is just one of his reality creations. The NYT reported 4th quarter earnings and revenues that exceeded expectations. The company added 265K digital subscribers during the quarter. The New York Times Company Reports 2018 Fourth-Quarter and Full-Year Results and Announces Dividend Increase

Trump told Lesley Stahl he bashes press to discredit negative stories about him

Lawsuits, Libel, and Lampooning: An Update on the War on the Press | Benton Foundation

The republicans have been engaged in a war against the free press starting with President Nixon and his VP Spiro Agnew who claimed that a Jewish cabal controlled the mainstream media.

Is 'The Post' Accurate? Did Nixon Ban Washington Post at White House?:

Nixon Targeted The Times, Tapes Show - latimes

Tapes Show Nixon Plan For Raid of Newspaper - The New York Times

Nixon's vice president asked Saudis for money to fight US ‘Zionists’-MSNBC | The Times of Israel (2/22/19 article)

Some Newly Uncovered Nixon Comments on the Subjects of Jews and Black People - The Atlantic (2013)

+++

We now know the precise number of republican House members who are conservatives. The number is 13. House passes bill rejecting Trump's border wall emergency | Reuters I did not think that there were so many in Trump's party.

One of the pseudo conservative GOP congressman is the totally classless Matt Gaetz (FL).

Gaetz denied that he was threatening Cohen or trying to change his testimony with that obvious threat. Viewed most charitably in favor of Gaetz, his email is borderline witness tampering and obstruction of justice. That probably qualifies him for at least a GOP senate seat in Florida and possibility a Presidential nod in a few years.

Michael Cohen is not someone who has any credibility left. That is an observation that no one will dispute. It is not surprising that Donald hired someone with Cohen's ethical qualities and praised his legal abilities until Cohen turned on him.

The Trumpsters in Congress, meaning virtually all GOP senators and representatives, are still worried that he may bring documentary evidence that supports his testimony about Trump, particularly when the documents can be independently authenticated as genuine by other witnesses who do not have Cohen's credibility problem. Cohen will present document to criminally implicate Trump - POLITICO; Cohen accuses Trump over WikiLeaks, Moscow project, hush payments | Reuters

When and if that happens, a few Trumpsters in competitive Senate and House races may find it difficult to explain in 2020 why they have remained so cozy with Donald, defending him at every turn no matter how much evidence is presented about his nefarious past.

There are reasons why the republicans do not want Donald to release his tax returns and will do whatever they can to stop democrats from gaining access to them. That would just open another front that they would prefer not to defend, so just sweep it under the rug like everything else when they had the power to do so. After all, Trump's support among republicans hovers around 90% and they want to get reelected.

I would note that Trump's long time accountant Allen Weisselberg, whose knowledge goes back to the Fred Trump era, is cooperating with the SUNY federal prosecutors. Allen Weisselberg, the Man Who Knows Donald Trump’s Financial Secrets, Has Agreed to Become a Coöperating Witness | The New Yorker

As I have discussed previously, the NYT presented evidence of gift tax fraud in a comprehensive article. Trump Engaged in Suspect Tax Schemes as He Reaped Riches From His Father - The New York Times; Tax Fraud By The Numbers: The Trump Timeline [UPDATED 2019]; Donald Trump, tax genius or tax con man? We need to see his returns: USA Today

++++++++++

1. Bought 100 SWZ at $7.53-Used Commission Free Trade:

Quote: Swiss Helvetia Fund Inc. (SWZ)

Closing Price Yesterday: SWZ $7.60 +$0.05 +0.66%

SWZ is a closed end fund that owns Swiss stocks.

Sponsor's website: SWZ Fund - Schroders

Top Ten Holdings as of 12/31/18

Data Date of Trade (2/25/19)

Closing Net Asset Value Per Share: $8.58

Closing Market Price = $7.55

Discount: -12%

Sourced: SWZ Swiss Helvetia Fund CEF Connect

While I have bought and sold this CEF many times over the years, the prior trade prices are no longer relevant given actions taken by this fund last year.

First, the fund declared and paid a stock dividend equal to $4.91 per share. Most of that dividend was paid in additional shares:

A share dividend acts like a stock split. The price and cost basis is adjusted down by the amount of the share dividend.

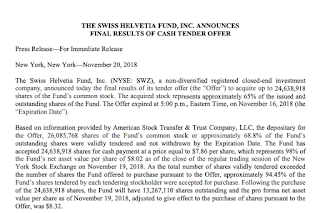

Second, the fund shrank by acquiring about 65% of its shares through a tender offer. The tender offer was at 98% of the fund's then net asset value per share:

I would prefer a buyback in open market transactions at greater than a 10% discount to net asset value per share, though I do not care about what SWZ did since I did not have a position when all of the foregoing occurred last year. I am only focused now on how the fund is configured for the future.

One of the problems for this fund has been the multi-year price stagnation of its top three holdings-Novartis, Roche and Nestle.

The net asset value of this fund will in part be determined by the CHF/USD currency exchange, since the fund is priced in USDs and the stocks are priced in Swiss Francs. CHF/USD Currency Chart. Swiss Franc to US Dollar Rates

Dividend History - SWZ Fund

+++

We now know the precise number of republican House members who are conservatives. The number is 13. House passes bill rejecting Trump's border wall emergency | Reuters I did not think that there were so many in Trump's party.

One of the pseudo conservative GOP congressman is the totally classless Matt Gaetz (FL).

Gaetz denied that he was threatening Cohen or trying to change his testimony with that obvious threat. Viewed most charitably in favor of Gaetz, his email is borderline witness tampering and obstruction of justice. That probably qualifies him for at least a GOP senate seat in Florida and possibility a Presidential nod in a few years.

Michael Cohen is not someone who has any credibility left. That is an observation that no one will dispute. It is not surprising that Donald hired someone with Cohen's ethical qualities and praised his legal abilities until Cohen turned on him.

The Trumpsters in Congress, meaning virtually all GOP senators and representatives, are still worried that he may bring documentary evidence that supports his testimony about Trump, particularly when the documents can be independently authenticated as genuine by other witnesses who do not have Cohen's credibility problem. Cohen will present document to criminally implicate Trump - POLITICO; Cohen accuses Trump over WikiLeaks, Moscow project, hush payments | Reuters

When and if that happens, a few Trumpsters in competitive Senate and House races may find it difficult to explain in 2020 why they have remained so cozy with Donald, defending him at every turn no matter how much evidence is presented about his nefarious past.

There are reasons why the republicans do not want Donald to release his tax returns and will do whatever they can to stop democrats from gaining access to them. That would just open another front that they would prefer not to defend, so just sweep it under the rug like everything else when they had the power to do so. After all, Trump's support among republicans hovers around 90% and they want to get reelected.

I would note that Trump's long time accountant Allen Weisselberg, whose knowledge goes back to the Fred Trump era, is cooperating with the SUNY federal prosecutors. Allen Weisselberg, the Man Who Knows Donald Trump’s Financial Secrets, Has Agreed to Become a Coöperating Witness | The New Yorker

As I have discussed previously, the NYT presented evidence of gift tax fraud in a comprehensive article. Trump Engaged in Suspect Tax Schemes as He Reaped Riches From His Father - The New York Times; Tax Fraud By The Numbers: The Trump Timeline [UPDATED 2019]; Donald Trump, tax genius or tax con man? We need to see his returns: USA Today

++++++++++

1. Bought 100 SWZ at $7.53-Used Commission Free Trade:

Quote: Swiss Helvetia Fund Inc. (SWZ)

Closing Price Yesterday: SWZ $7.60 +$0.05 +0.66%

SWZ is a closed end fund that owns Swiss stocks.

Sponsor's website: SWZ Fund - Schroders

Top Ten Holdings as of 12/31/18

Data Date of Trade (2/25/19)

Closing Net Asset Value Per Share: $8.58

Closing Market Price = $7.55

Discount: -12%

Sourced: SWZ Swiss Helvetia Fund CEF Connect

While I have bought and sold this CEF many times over the years, the prior trade prices are no longer relevant given actions taken by this fund last year.

First, the fund declared and paid a stock dividend equal to $4.91 per share. Most of that dividend was paid in additional shares:

A share dividend acts like a stock split. The price and cost basis is adjusted down by the amount of the share dividend.

Second, the fund shrank by acquiring about 65% of its shares through a tender offer. The tender offer was at 98% of the fund's then net asset value per share:

I would prefer a buyback in open market transactions at greater than a 10% discount to net asset value per share, though I do not care about what SWZ did since I did not have a position when all of the foregoing occurred last year. I am only focused now on how the fund is configured for the future.

One of the problems for this fund has been the multi-year price stagnation of its top three holdings-Novartis, Roche and Nestle.

The net asset value of this fund will in part be determined by the CHF/USD currency exchange, since the fund is priced in USDs and the stocks are priced in Swiss Francs. CHF/USD Currency Chart. Swiss Franc to US Dollar Rates

Dividend History - SWZ Fund

2. Eliminations and Pares:

A. Eliminated VNQ-Sold 10 VNQ at $84.3 (Commission Free for Vanguard Customers):

Quote: Vanguard Real Estate ETF Overview

Profit: $98.73

Item # 1.B. Bought 5 VNQ at $71.38 (1/23/19 Post)

Item # 3.A. Bought 5 VNQ at $77.71(11/14/18 Post)

Sponsor's Website: Vanguard (expense ratio .12%)

Closing Price Yesterday: VNQ $84.18 -$0.27 -0.32%

Last Round-Trips:

Item #2.A Sold 10 VNQ at $81.08 (7/5/18 Post)(profit snapshot = $82.15)

Item # 1.D Sold 10 VNQ at $79.89 and 10 at $80.06 (6/14/18 Post)(profit snapshot = $52.2)

Item # 3 Sold 10 at $83.36-a Roth IRA Account: Update For Equity REIT Basket Strategy As Of 3/21/16 - South Gent | Seeking Alpha (profit snapshot = $72.63)

Item # 3 Sold 10 at $80.74: Update For Equity REIT Basket Strategy As Of 11/5/15 - South Gent | Seeking Alpha (profit snapshot = $65.39) That post contains a discussion on the reasons for owning REITs.

I highlighted the prices to make a point about a channel trading for a security that is stuck in that channel. There were no capital gain distributions that would account for the price stagnation.

Trading Profits (10 share lots): $371.1.

I prefer to own individual REIT stocks and simply view VNQ as a trading vehicle.

B. Pared the BDC SUNS By Selling Highest Cost Lot at $16.69-Used Fidelity Commission Free Trading:

I pared the position in my Fidelity account and eliminated it in my Schwab account.

Closing Price Yesterday: SUNS $17.15 -$0.20 -1.15%

Quote: Solar Senior Capital Ltd.

Position Before Pare: Average Cost Per Share = $16.12

Position After Pare: Average Cost Per Share = $15.88

Profit: $2.09

Item # 1.A. Bought 30 SUNS at $16.62-Used Commission Free Trade (9/9/18 Post)

Last Purchase Discussions:

Item #1C. Bought 10 SUNS at $15.78, 10 at $15.68 and 10 at $15.3-Used Commission Free Trades (12/12/18 Post)(discussed third quarter report in that post);

Item # 3.B. Bought 20 SUNS at $16.3 and 10 at $15.81 (10/31/18 Post)

Dividend: Monthly at $.1175 per share or $1.41 annually

Based on the current price, I have stopped dividend reinvestment.

Dividend Yield at $15.88 Total Cost Per Share = 8.88%

Last Reported Net Asset Value Per Share = $16.3 (Q/E 12/30/18)

An investor needs to decide what is the goal when buying a BDC stock. I do view the goal as current income but total return in excess of the dividend yield.

When that is the goal, rather than a more narrow focus on current income, any profit, no matter how small, achieves that goal. A subsidiary goal is to lower my average cost per share by buying dips and selling rips. When that objective is accomplished, it is easier to escape with a total return in excess of the dividend yield.

Among the externally managed BDCs, Ares Capital (ARCC) has been the easiest for me to achieve that total return objective.

Last Earnings Report: Q/E 12/31/18

Solar Senior Capital Ltd. Announces Quarter and Fiscal Year Ended December 31, 2018 Financial Results; Declares Monthly Distribution of $0.1175 per Share for March 2019

This report was released after my two pares discussed herein.

NAV per share fell to $16.30 from $16.98 as of 12/31/2017. Management claimed in the earnings call that there was a "sell-off in the liquid leverage loan market in the fourth quarter" that "resulted in a technical markdown of our portfolio's fair market value." (page 3 Transcript)

98% of investments were in first liens.

"Solar Senior's new target leverage is 1.25x to 1.5x debt to equity under the reduced asset coverage requirement."

Leveraged at .63x net debt to equity.

Net investment income for the quarter was reported at $.35 per share.

The weighted average yield on a "fair value basis" was 10.5% as of 12/31/18.

Solar Senior Capital (SUNS) CEO Michael Gross on Q4 2018 Results - Earnings Call Transcript | Seeking Alpha

Form 10-K (2018 Annual Report, listing investments starting at page 85; risk summary starts at page 24 and ends at page 55)

Last Sell Discussion:

Item # 2.B. at $17.45 on ex-dividend date (3/1/17 Post)(profit snapshot = $117.48)- Item # 1 Bought 50 SUNS at $15.06-Update For Portfolio Management And Positioning As Of 10/16/15 - South Gent | Seeking Alpha

C. Eliminated SUNS in my Schwab Account-Sold 112+ at 16.72+:

History This Account:

I thought the average cost per share in this account was too high for a longer term hold.

Profit Snapshot: $28.89

I will consider buying 100 in this account, where I no longer have commission free trades, when and if the price sinks 10% below the last reported net asset value per share.

In the preceding snapshot, note that a $.1 loss was disallowed under the "wash sale rule".

Since I reinvested a dividend within 30 days of this sell transaction, which was by the way sold at a profit, there had to be accounting for disallowing part of the loss realized on the first lot bought several months ago.

It is just asinine and creates a lot of work and complexity that is superfluous. Dividend reinvestments should not trigger the 30 day wash rule and that kind of look back in time.

A. Eliminated VNQ-Sold 10 VNQ at $84.3 (Commission Free for Vanguard Customers):

Quote: Vanguard Real Estate ETF Overview

Profit: $98.73

Item # 1.B. Bought 5 VNQ at $71.38 (1/23/19 Post)

Item # 3.A. Bought 5 VNQ at $77.71(11/14/18 Post)

Sponsor's Website: Vanguard (expense ratio .12%)

Closing Price Yesterday: VNQ $84.18 -$0.27 -0.32%

Last Round-Trips:

Item #2.A Sold 10 VNQ at $81.08 (7/5/18 Post)(profit snapshot = $82.15)

Item # 1.D Sold 10 VNQ at $79.89 and 10 at $80.06 (6/14/18 Post)(profit snapshot = $52.2)

Item # 3 Sold 10 at $83.36-a Roth IRA Account: Update For Equity REIT Basket Strategy As Of 3/21/16 - South Gent | Seeking Alpha (profit snapshot = $72.63)

Item # 3 Sold 10 at $80.74: Update For Equity REIT Basket Strategy As Of 11/5/15 - South Gent | Seeking Alpha (profit snapshot = $65.39) That post contains a discussion on the reasons for owning REITs.

I highlighted the prices to make a point about a channel trading for a security that is stuck in that channel. There were no capital gain distributions that would account for the price stagnation.

Trading Profits (10 share lots): $371.1.

I prefer to own individual REIT stocks and simply view VNQ as a trading vehicle.

B. Pared the BDC SUNS By Selling Highest Cost Lot at $16.69-Used Fidelity Commission Free Trading:

I pared the position in my Fidelity account and eliminated it in my Schwab account.

Closing Price Yesterday: SUNS $17.15 -$0.20 -1.15%

Quote: Solar Senior Capital Ltd.

Position Before Pare: Average Cost Per Share = $16.12

Position After Pare: Average Cost Per Share = $15.88

Profit: $2.09

Item # 1.A. Bought 30 SUNS at $16.62-Used Commission Free Trade (9/9/18 Post)

Last Purchase Discussions:

Item #1C. Bought 10 SUNS at $15.78, 10 at $15.68 and 10 at $15.3-Used Commission Free Trades (12/12/18 Post)(discussed third quarter report in that post);

Item # 3.B. Bought 20 SUNS at $16.3 and 10 at $15.81 (10/31/18 Post)

Dividend: Monthly at $.1175 per share or $1.41 annually

Based on the current price, I have stopped dividend reinvestment.

Dividend Yield at $15.88 Total Cost Per Share = 8.88%

Last Reported Net Asset Value Per Share = $16.3 (Q/E 12/30/18)

An investor needs to decide what is the goal when buying a BDC stock. I do view the goal as current income but total return in excess of the dividend yield.

When that is the goal, rather than a more narrow focus on current income, any profit, no matter how small, achieves that goal. A subsidiary goal is to lower my average cost per share by buying dips and selling rips. When that objective is accomplished, it is easier to escape with a total return in excess of the dividend yield.

Among the externally managed BDCs, Ares Capital (ARCC) has been the easiest for me to achieve that total return objective.

Last Earnings Report: Q/E 12/31/18

Solar Senior Capital Ltd. Announces Quarter and Fiscal Year Ended December 31, 2018 Financial Results; Declares Monthly Distribution of $0.1175 per Share for March 2019

This report was released after my two pares discussed herein.

NAV per share fell to $16.30 from $16.98 as of 12/31/2017. Management claimed in the earnings call that there was a "sell-off in the liquid leverage loan market in the fourth quarter" that "resulted in a technical markdown of our portfolio's fair market value." (page 3 Transcript)

98% of investments were in first liens.

"Solar Senior's new target leverage is 1.25x to 1.5x debt to equity under the reduced asset coverage requirement."

Leveraged at .63x net debt to equity.

Net investment income for the quarter was reported at $.35 per share.

The weighted average yield on a "fair value basis" was 10.5% as of 12/31/18.

Solar Senior Capital (SUNS) CEO Michael Gross on Q4 2018 Results - Earnings Call Transcript | Seeking Alpha

Form 10-K (2018 Annual Report, listing investments starting at page 85; risk summary starts at page 24 and ends at page 55)

Last Sell Discussion:

Item # 2.B. at $17.45 on ex-dividend date (3/1/17 Post)(profit snapshot = $117.48)- Item # 1 Bought 50 SUNS at $15.06-Update For Portfolio Management And Positioning As Of 10/16/15 - South Gent | Seeking Alpha

C. Eliminated SUNS in my Schwab Account-Sold 112+ at 16.72+:

History This Account:

I thought the average cost per share in this account was too high for a longer term hold.

Profit Snapshot: $28.89

I will consider buying 100 in this account, where I no longer have commission free trades, when and if the price sinks 10% below the last reported net asset value per share.

In the preceding snapshot, note that a $.1 loss was disallowed under the "wash sale rule".

Since I reinvested a dividend within 30 days of this sell transaction, which was by the way sold at a profit, there had to be accounting for disallowing part of the loss realized on the first lot bought several months ago.

It is just asinine and creates a lot of work and complexity that is superfluous. Dividend reinvestments should not trigger the 30 day wash rule and that kind of look back in time.

3. Short Term Bonds/CDs Ladder Basket Strategy:

March 2019 Maturities:

SU = Senior Unsecured Bond ($1K par value per bond)

CD = Certificate of Deposit ($1K par value per CD)-FDIC Insured

MI = Monthly Interest PaymentsCD = Certificate of Deposit ($1K par value per CD)-FDIC Insured

Treasury: U.S. Treasury Debt ($1K par value per bill, note or bond)

IR: Investment Rate for Treasury Bills bought at auction

IR: Investment Rate for Treasury Bills bought at auction

2 Exxon 1.708% SU 3/1/19 (bought December 2017)

2 Wells Faro 1.9% CDs MI 3/1/19 (13 month CDs)

1 Deere 1.95% SU 3/4 (bought January 2018)

2 Franklin Synergy 2.2% CDs MI 3/7 (8 month CDs)

2 Comenity 1.5% CDs MI 3/7 (18 month CDs)

2 Cathay BK 1.6% CDs MI 3/7 (18 month CDs)

2 Stryker 2% SU 3/8/19 (January 2018)

2 AT & T 2.3% SU 3/11 (bought April 2018)

1 GATX 2.5% SU 3/15 (bought March 2018)

2 Berkshire Hathaway 1.7% SU 3/15 (bought December 2017)

2 Wells Fargo 1.55% CDs MI 3/15 (2 Year CD)

1 Dow Chemical 2.25% SU 3/15 (bought December 2017)

2 Treasury 1% Coupon 3/15

2 Xilinx 2.12% SU 3/15 (bought June 2018)

2 Exxon 1.819% SU 3/15 (bought December 2017)

2 American Express 2.125% SU 3/18 (bought May 2018)

2 JP Morgan 1.85% SU 3/22 (bought December 2017)

2 Bank of Hope 1.6% CDs MI 3/22 (18 month CDs)

3 Caterpillar 1.9% SU 3/22 (bought 2 January 2018 and 1 May 2018)

2 BOFI 2.3% CDs MI 3/28 (9 month CDs)

2 Franklin Synergy 1.65% CDs MI (19 month CDs)

1 Treasury 1.5% 3/31/19

$41K

A. Bought 3 Treasury 1.75% Coupon Maturing on 9/30/19:

YTM = 2.483%

This purchase is a replacement for 3 Southern Company bonds that were scheduled to mature in September but were redeemed this month. I own those bonds in another account.

Almost all of U.S. treasury buys are made in my Schwab account.

While Schwab has a $1 per bond commission fee for corporate bonds, there is a $10 minimum charge which I see no reason to pay when my small lot purchases can be made in either my Fidelity or IB account at $1 per bond without a minimum charge.

A. Bought 3 Treasury 1.75% Coupon Maturing on 9/30/19:

YTM = 2.483%

This purchase is a replacement for 3 Southern Company bonds that were scheduled to mature in September but were redeemed this month. I own those bonds in another account.

Almost all of U.S. treasury buys are made in my Schwab account.

While Schwab has a $1 per bond commission fee for corporate bonds, there is a $10 minimum charge which I see no reason to pay when my small lot purchases can be made in either my Fidelity or IB account at $1 per bond without a minimum charge.

B. Bought 3 Six Month Treasury Bills at Auction Maturing on 8/22/19:

IR = 2.52%

Auction Results (2/19/19):

C. Sold 1 U.S. Bank 2.95% Junior Bond Maturing on 7/15/22:

Profit Snapshot: +$12.83

I bought this bond on 11/20/18: Item # 4.B. (12/2/18 Post) I would buy it back at greater than 1% below my last purchase price.

FINRA Page: Bond Detail

Sold at 99.285

YTM at 99.285 = 3.172%

Proceeds at 99.185

Bought at a TC of 97.902 (YTM at 3.568%)

As mentioned previously, this bond is labelled "senior subordinated" which is just sounds better than junior bond. This bond would be junior in priority to all senior unsecured debt.

D. Bought 1 Citigroup 2.45% SU Maturing on 1/10/20:

I now own 4. The other two are owned in Vanguard accounts including one in a Roth IRA account.

I am rolling Citigroup senior unsecured bonds in this account. I have 1 maturing in April, so I am redeploying the proceeds to be received into another one maturing in early January 2020:

I will keep my Citigroup SU bond position below $10K and in short term maturities, mindful of Citigroup's near death experience in 2008, and based on my opinion that large U.S. financial institutions have a substantial infestation of Masters of Disasters.

Citigroup bonds can generally be bought in 1 bond lots at or near the best available ask price.

FINRA Page: Bond Detail (prospectus linked)

Issuer: Citigroup Inc. (C)

C Analyst Estimates

Credit Ratings:

After I took the preceding snapshot, Moody's raised its rating one notch to A3. Moody's upgrades Citigroup to A3 from Baa1, outlook stable (2/21/19)

Bought at a Total Cost of 99.723

YTM at TC Then at 2.767%

Current Yield at TC = 2.4568%

IR = 2.52%

Auction Results (2/19/19):

C. Sold 1 U.S. Bank 2.95% Junior Bond Maturing on 7/15/22:

Profit Snapshot: +$12.83

I bought this bond on 11/20/18: Item # 4.B. (12/2/18 Post) I would buy it back at greater than 1% below my last purchase price.

FINRA Page: Bond Detail

Sold at 99.285

YTM at 99.285 = 3.172%

Proceeds at 99.185

Bought at a TC of 97.902 (YTM at 3.568%)

As mentioned previously, this bond is labelled "senior subordinated" which is just sounds better than junior bond. This bond would be junior in priority to all senior unsecured debt.

D. Bought 1 Citigroup 2.45% SU Maturing on 1/10/20:

I now own 4. The other two are owned in Vanguard accounts including one in a Roth IRA account.

I am rolling Citigroup senior unsecured bonds in this account. I have 1 maturing in April, so I am redeploying the proceeds to be received into another one maturing in early January 2020:

|

| Snapshot 1/19/19 Date of Purchase |

Citigroup bonds can generally be bought in 1 bond lots at or near the best available ask price.

FINRA Page: Bond Detail (prospectus linked)

Issuer: Citigroup Inc. (C)

C Analyst Estimates

Credit Ratings:

After I took the preceding snapshot, Moody's raised its rating one notch to A3. Moody's upgrades Citigroup to A3 from Baa1, outlook stable (2/21/19)

Bought at a Total Cost of 99.723

YTM at TC Then at 2.767%

Current Yield at TC = 2.4568%

4. Sold Highest Cost ELC Lot and Bought 1 Entergy Texas First Mortgage Bond:

In this exchange, I sacrifice some current yield but reduce my potential interest risk exposure.

A. Sold 30 of 60 ELC at $24.58-Used Commission Free Trade:

Quote: Entergy Louisiana LLC First Mortgage Bonds 4.875% Series due 2066

Closing Price Yesterday: ELC $24.65 +$0.05 +0.20%

ELC is a first mortgage bond issued by the Entergy (ETR) subsidiary Entergy Louisiana that matures in 2066 unless redeemed earlier at the issuer's option.

Profit Snapshot: +$20.22

Remaining Lot: Total cost per share = $21.82

Item #3.A. Bought 10 ELC at $21.37-Used Commission Free Trade (12/12/18 Post); Item # 4.A. Added 20 ELC at $22.04-Used Commission Free Trade (12/17/18 Post)

ELC is subject to the small ball trading rule. If the price sinks below $21.27, I am allowed to buy more. That precondition is written in concrete.

B. Bought 1 Entergy Texas 3.45% First Mortgage Bond Maturing on 12/1/27-In A Roth IRA Account:

I did not like the order book spread between the bid and ask prices.

The first lien attaches to "substantially all" of the issuer's property.

Normally I would not buy at the ask price when the spread is this large. It is generally futile or too time consuming to try and buy 1 bond somewhere in between those two prices. In any event, Vanguard does not permit online limit orders. The customer has to either hit the price shown in the book and in the quantity available.

I went ahead and bought this bond at the ask price since Entergy Texas just sold some slightly longer dated first mortgage bonds with a 4% coupon, near my YTM for this purchase. Prospectus January 2019 (4% due in 2029)

Entergy Texas first mortgage bonds are rated lower by Moody's than the Entergy Louisiana first mortgage bonds. I do not see any reason to question that lower rating. Moody's has a Baa1 rating for the Entergy Texas FM while S & P has it at A. I am not currently concerned about credit risk.

The January 2019 prospectus linked above has recent financial data:

FINRA Page for 2017 Bond: Bond Detail (prospectus not linked)

Prospectus

This bond is subject to a make whole for an early optional redemption:

The make whole provision is not relevant now as shown in the bond's price. When and if interest rates fall sufficiently, the provision becomes relevant when it results in a premium price.

Bought at a Total Cost of 96.643 (bought at 96.443)

YTM at TC then at 3.905%

Current Yield at 3.5698%

Entergy Texas does have an exchange traded first mortgage bond. Entergy Texas Inc. 5.625% First Mtg. Bonds That one is a $25 par value. The issuer has the option to call on or after 6/1/19 at par plus unpaid interest. Prospectus I expect that call option to be exercised.

However, the proceeds received from the January offering of first mortgage bonds will be applied to repay the $500M in 7.125% FM bonds that matured on 2/1/19:

While the exchange traded FM bond is not mentioned, there will be enough proceeds left over to redeem that bond in June which was issued in the original principal amount of $135M.

I own $1K par value Entergy Louisiana first mortgage bonds. I last discussed a purchase here: Item # 3.B. Bought 1 Entergy Louisiana 3.3% First Mortgage Bond Maturing on 12/1/2022 (4/23/18 Post)

C. Bought 1 Entergy Texas 3.45% First Mortgage Bond Maturing on 12/1/27:

This is the same bond discussed above, except this purchase was made in a taxable account.

Bought at a Total Cost of 96.165

YTM at TC Then at 3.972%

Current Yield at TC = 3.5876%

I may buy up to 5 but will want lower prices before adding.

In this exchange, I sacrifice some current yield but reduce my potential interest risk exposure.

A. Sold 30 of 60 ELC at $24.58-Used Commission Free Trade:

Quote: Entergy Louisiana LLC First Mortgage Bonds 4.875% Series due 2066

Closing Price Yesterday: ELC $24.65 +$0.05 +0.20%

ELC is a first mortgage bond issued by the Entergy (ETR) subsidiary Entergy Louisiana that matures in 2066 unless redeemed earlier at the issuer's option.

Profit Snapshot: +$20.22

Remaining Lot: Total cost per share = $21.82

Item #3.A. Bought 10 ELC at $21.37-Used Commission Free Trade (12/12/18 Post); Item # 4.A. Added 20 ELC at $22.04-Used Commission Free Trade (12/17/18 Post)

ELC is subject to the small ball trading rule. If the price sinks below $21.27, I am allowed to buy more. That precondition is written in concrete.

PAR VALUE: $25

Interest Payments: Quarterly at $.304688 per share

Yield at a $21.82 Total Cost Per Share = 5.59%

Trades Flat

Optional Call: On or after 9/1/2021 at par value plus accrued and unpaid interest

Last Ex Interest Date: 11/29/18

Maturity Date if Not Called: 9/1/2066

Credit Ratings: A2/A

Security: First Lien on substantially all Entergy Louisiana Assets

Category: Exchange Traded Baby Bonds within the broader category of Exchange Traded Bonds

Category: Exchange Traded Baby Bonds within the broader category of Exchange Traded Bonds

B. Bought 1 Entergy Texas 3.45% First Mortgage Bond Maturing on 12/1/27-In A Roth IRA Account:

I did not like the order book spread between the bid and ask prices.

|

| Vanguard Order Book |

Normally I would not buy at the ask price when the spread is this large. It is generally futile or too time consuming to try and buy 1 bond somewhere in between those two prices. In any event, Vanguard does not permit online limit orders. The customer has to either hit the price shown in the book and in the quantity available.

I went ahead and bought this bond at the ask price since Entergy Texas just sold some slightly longer dated first mortgage bonds with a 4% coupon, near my YTM for this purchase. Prospectus January 2019 (4% due in 2029)

Entergy Texas first mortgage bonds are rated lower by Moody's than the Entergy Louisiana first mortgage bonds. I do not see any reason to question that lower rating. Moody's has a Baa1 rating for the Entergy Texas FM while S & P has it at A. I am not currently concerned about credit risk.

The January 2019 prospectus linked above has recent financial data:

FINRA Page for 2017 Bond: Bond Detail (prospectus not linked)

Prospectus

This bond is subject to a make whole for an early optional redemption:

The make whole provision is not relevant now as shown in the bond's price. When and if interest rates fall sufficiently, the provision becomes relevant when it results in a premium price.

Bought at a Total Cost of 96.643 (bought at 96.443)

YTM at TC then at 3.905%

Current Yield at 3.5698%

Entergy Texas does have an exchange traded first mortgage bond. Entergy Texas Inc. 5.625% First Mtg. Bonds That one is a $25 par value. The issuer has the option to call on or after 6/1/19 at par plus unpaid interest. Prospectus I expect that call option to be exercised.

However, the proceeds received from the January offering of first mortgage bonds will be applied to repay the $500M in 7.125% FM bonds that matured on 2/1/19:

While the exchange traded FM bond is not mentioned, there will be enough proceeds left over to redeem that bond in June which was issued in the original principal amount of $135M.

I own $1K par value Entergy Louisiana first mortgage bonds. I last discussed a purchase here: Item # 3.B. Bought 1 Entergy Louisiana 3.3% First Mortgage Bond Maturing on 12/1/2022 (4/23/18 Post)

C. Bought 1 Entergy Texas 3.45% First Mortgage Bond Maturing on 12/1/27:

This is the same bond discussed above, except this purchase was made in a taxable account.

Bought at a Total Cost of 96.165

YTM at TC Then at 3.972%

Current Yield at TC = 3.5876%

I may buy up to 5 but will want lower prices before adding.

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics: ERROR CREEP and the INVESTING PROCESS Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.

Selective Insurance has sold $300M in a 5.375% SU bond maturing in 2049. The company intends to use the net proceeds to redeem all of its $185M 5.875% notes due in 2043 "at a redemption price equal to 100% of their principal amount, plus accrued and unpaid interest thereon to, but excluding, the date of redemption"

ReplyDeletehttps://www.prnewswire.com/news-releases/selective-insurance-group-announces-the-pricing-of-300-million-senior-notes-300803584.html

The bond referenced for redemption is the exchange traded SGZA. I own 100 shares with a total cost of $24.56 per share. I will simply allow the company to take that bond away from me at its $25 par value plus accrued and unpaid interest.

I have catching up to do! So you're seeing a slow down in economic numbers.

ReplyDeleteThe problem is overseas. Can or has overseas brought USA down into recession before? Or does USA tend to uplift overseas if USA is doing okay?

The Agnew revelations seemed to get nearly no attention (such as on twitter). I suspect at some point they'll suddenly seem very precedent. The past has a way of doing that.

I arranged to listen to the hearing today and straighten up. I didn't get very much straightening done. But I did hear the hearing. The market had no reaction. I don't get it. Though on the blog, a Trump supporter is touting the "he's a liar and doesn't matter." During Nixon the market did well too, until the very end?

I was frustrated with most of both sides' questions. But it all turned out some confirmation of what papers have been reporting. Someone should have asked how that cellphone wound up in Prague without Cohen. There has to be an explanation.

Land: The McClatchy D.C. Bureau reported last December that Cohen's cellphone was used near Prague and an Eastern European intelligence agency picked up a conversation among Russians that Cohen was then in Prague. If true, that would partially confirm the Steele dossier on that point.

Deletehttps://www.mcclatchydc.com/news/investigations/article219016820.html

The story gained almost no traction in the U.S. media.

The recent disclosures about Spiro Agnew, who plead guilty to tax fraud, received even less coverage.

I did not watch Cohen's testimony.

I did review the documents that he submitted with his testimony. IMO, they did not add anything to what was already known.

Cohen's testimony will not change any opinions.

Trump's many negative qualities were known, or knowable to anyone receptive to facts, before the election.

The problem is that tens of millions have been conditioned to ignore or dismiss facts revealed in the press and to even make a conscious effort to avoid any contact with that information.

Cohen called Donald a liar and a con man. But that was known or knowable before 62+ million people voted for him and those observations have only been confirmed since his inauguration.

The stock market did tank in 1974, but that was in response to a recession rather than Nixon's problems. If anything, the Stock Jocks were relieved that Gerald Ford replaced Nixon.

The stock and bond markets were already in long term bear markets before Watergate caused by problematic inflation and the FED's failure to address that issue.

CPI

1968 4.3%

1969 5.5%

1970 5.8%

1971 4.3%

1972 3.3%

1973 6.2%

1974 11.1%

https://www.minneapolisfed.org/community/financial-and-economic-education/cpi-calculator-information/consumer-price-index-and-inflation-rates-1913

China and the U.S. have propped up the world economies over the past decades. Both economies are slowing down, starting in the last quarter and continuing to the present. No one can rationally expect Europe and Japan to pick up the slack. The change in the FED's monetary policy is based on a recognition that there are downside risks to the U.S. economy, including the tariff wars, and an ongoing slowdown. The Stock Jocks have focused entirely on the FED's monetary policy change rather than the reasons for it which will negatively impact earnings growth this year and cause many companies to report negative Y-O-Y net income, though buybacks may allow them reported Y-O-Y E.P.S. growth.

Last quarter talk was that earnings were continuing to do fine. This negative earrings trend seems new. It gets my attention.

DeleteSo question is, is this slow down likely to be short term, a quarter or two.

I'd read that the economy was in an upswing during Nixon, and that the market took some dives out of political worry (but didn't have any longer term effect). So the idea of inflation and concern about the economy before he resigned, is new info. I must not have all the pieces yet.

I'd heard of the info in the McClatchy last year, though whatever media didn't relay them completely clearly. I believe that Cohen wasn't in Prague, but his phone was. I suspect it's was a distraction from whatever did happen in those few days, that they wanted to cover up. I just wanted someone to ask him "so could your phone have been in Prague?"

I found Cohen's testimony useful. At first I thought it wasn't much. But it's lit a fire under the house to start doing investigations. Apparently some had a "wait for the SC report" attitude, as though they aren't a separate pathway.

By itself it doesn't shift Trump supporters one bit.

Land: Generally, the analysts backload earnings growth into the second half, which, more often than not, prove to be overly optimistic, but no one seems to mine as long as the economy keeps growing at a healthy pace without much inflation and with interest rates remaining well below historical norms.

DeleteSee, e.g. my post from 2016 discussing predictions made on 12/31/15 and the actual numbers for 2016.

https://seekingalpha.com/instablog/434935-south-gent/4898841-update-portfolio-positioning-management-7-24-16

This year so far is shaping up differently. Future forecasts are being cut:

https://seekingalpha.com/instablog/434935-south-gent/4898841-update-portfolio-positioning-management-7-24-16

At a minimum, the Y-O-Y earnings growth experienced in 2018 over 2017 attributable to the corporate tax cuts will not be present when companies start reporting earnings this year.

I expect to see more anemic growth numbers this year and more examples, like the recent one from Apple, where the company shows decent E.P.S. growth but a decline in revenues and net income. The E.P.S. number will be engineered up through share buybacks, using in large part the tax savings rather than borrowings. Many companies had been increasing their debt to fund those buybacks and to increase dividends. That is not going to work for many of them long term and in many cases will only create a a relatively short term facade of success.

I will be continuing to sell into this stock rally. The question is whether I will move from selling higher cost lots to a more substantive pare through an elimination of a mutual fund or two. I am not there yet.

Starwood Property Trust Inc. (STWD)

ReplyDelete$22.55 +$0.50 +2.27%

Last Updated: Feb 28, 2019 at 12:26 p.m. EST

https://www.marketwatch.com/investing/stock/stwd

STWD is one of my high dividend plays that I view as risky, with buying and selling shares governed by the small ball trading playbook. In the current chain, the lowest cost was purchased at $19.4 on 12/24/18. That was the apex of the stock market's most recent decline.

The share price pop today is due to a better than expected "core E.P.S." for the 4th quarter:

https://seekingalpha.com/news/3438521-starwood-property-plus-3_0-percent-q4-core-eps-beats

https://www.prnewswire.com/news-releases/starwood-property-trust-reports-results-for-the-quarter-and-year-ended-december-31-2018-300803884.html

Easterly Government Properties (DEA)

ReplyDelete$18.13 +$0.37 +$2.08%

DEA reported 4th quarter results earlier today:

https://www.businesswire.com/news/home/20190228005226/en/

DEA has enjoyed a good run since bottoming near $15 last Christmas Eve. I own shares in two accounts with one account being governed by the small ball trading book. The lowest price in that chain was a 10 share purchase at $15.74 on 12/21/18.

T2 Biosystems, Inc. (TTOO)

ReplyDelete$4.34 +$0.58 (+15.43%)

https://finance.yahoo.com/quote/TTOO?p=TTOO

This stock is a holding in my small cap lottery ticket basket strategy, though the company is the medical diagnostic's business.

The pop today was based on this news:

https://globenewswire.com/news-release/2019/02/27/1743737/0/en/FDA-Grants-T2-Biosystems-Breakthrough-Device-Designation-for-the-T2Resistance-Panel-Expected-Availability-through-CE-Mark-in-2019.html

Like the other stocks in that basket strategy, TTOO is a long way from earning profit.

I have published a new post:

ReplyDeletehttps://tennesseeindependent.blogspot.com/2019/03/observations-and-sample-of-recent.html