News Release: Personal Income and Outlays for August 2017

Fewer auto sales dent consumer spending in August, inflation still weak, PCE shows - MarketWatch

+++++++++

Market Commentary:

Fewer auto sales dent consumer spending in August, inflation still weak, PCE shows - MarketWatch

+++++++++

Market Commentary:

Get set for a ‘favorable’ backdrop for stocks until at least 2019, says Blackstone’s Wien - MarketWatch

Wein is assuming that low inflation and interest rates, a major component of the "favorable" backdrop, will continue. That remains to be seen.

There is underway an uptrend in U.S. interest rates that started on 9/9/17. 10-Year Treasury Constant Maturity Rate -St. Louis Fed; 2017 Daily Treasury Yield Curve Rates

The two prior uptrends since 1/1/15 have petered out near 2.6%. I try to get ahead of these moves, up and down, by adjusting my bond allocations. I am fully aware of what happens to bonds when the 10 year moves just from an abnormally low level of 2.05% (rate as of 9/7) to a less abnormal rate of 2.6%.

What level will impact stock multiples? That is guesswork. During the interest rate spike in 2013, bonds and bond like investments cratered in price but stocks had a banner year. However, stocks were a lot less pricey in 2013 than now using traditional valuation measures.

Any way you look at it, this stock market is overvalued: Goldman: CNBC

Shiller PE Ratio

Is the Stock Market Cheap? - dshort - Advisor Perspectives

Context is important and context changes.

As of 9/29/17, Birinyi Associates calculated the trailing P.E. of the S & P 500 at 24.22 and the forward 12 month P/E based on Non-GAAP earnings estimates at 19.19: P/Es & Yields on Major Indexes - Markets Data Center For the Old Geezer crowd, those ratios eight years into an economic expansion are extremely high. The OG's are not likely to view recessions as being repealed by New Age Economics.

The Stock Jocks are hoping that the corporate tax rates will be slashed to such a decree that earnings will significantly increase. That assumes that the GOP will be successful in slashing the corporate tax rate while raising the tax obligations of several million individual taxpayers; that any slash will hold when the Democrats regain control which will happen within the next ten years; and recessions can not happen when tax rates for corporations are lower.

Wein is assuming that low inflation and interest rates, a major component of the "favorable" backdrop, will continue. That remains to be seen.

There is underway an uptrend in U.S. interest rates that started on 9/9/17. 10-Year Treasury Constant Maturity Rate -St. Louis Fed; 2017 Daily Treasury Yield Curve Rates

The two prior uptrends since 1/1/15 have petered out near 2.6%. I try to get ahead of these moves, up and down, by adjusting my bond allocations. I am fully aware of what happens to bonds when the 10 year moves just from an abnormally low level of 2.05% (rate as of 9/7) to a less abnormal rate of 2.6%.

What level will impact stock multiples? That is guesswork. During the interest rate spike in 2013, bonds and bond like investments cratered in price but stocks had a banner year. However, stocks were a lot less pricey in 2013 than now using traditional valuation measures.

Any way you look at it, this stock market is overvalued: Goldman: CNBC

Shiller PE Ratio

Is the Stock Market Cheap? - dshort - Advisor Perspectives

Context is important and context changes.

As of 9/29/17, Birinyi Associates calculated the trailing P.E. of the S & P 500 at 24.22 and the forward 12 month P/E based on Non-GAAP earnings estimates at 19.19: P/Es & Yields on Major Indexes - Markets Data Center For the Old Geezer crowd, those ratios eight years into an economic expansion are extremely high. The OG's are not likely to view recessions as being repealed by New Age Economics.

The Stock Jocks are hoping that the corporate tax rates will be slashed to such a decree that earnings will significantly increase. That assumes that the GOP will be successful in slashing the corporate tax rate while raising the tax obligations of several million individual taxpayers; that any slash will hold when the Democrats regain control which will happen within the next ten years; and recessions can not happen when tax rates for corporations are lower.

+++++

How to Create an Illusion That the GOP's Tax Plan Will Not Add Trillions to the Debt:

Non-partisan organizations, who are in the business of projecting federal deficits, calculate that the GOP's tax plan would add to the deficits. (e.g. Big 6 Tax Framework Could Cost $2.2 Trillion Over Ten Years| Committee for a Responsible Federal Budget)

The following linked articles explains one method being considered by GOP to mask the cost of tax cuts. This One Word Is Worth $500 Billion as Congress Debates Tax Cuts-NBC News; Current Policy Gimmick Would Add Half-Trillion to Debt | Committee for a Responsible Federal Budget ("Using a current policy baseline disguises a half-trillion dollar tax cut as "paid for" even though deficits would increase.")

The primary arguments used by the GOP is that the tax cuts will pay for themselves and their trickle down theory. So when corporations and rich folks receive huge tax cuts, they will meaningfully share the benefits with the middle class and non-stock owners.

How to Create an Illusion That the GOP's Tax Plan Will Not Add Trillions to the Debt:

Non-partisan organizations, who are in the business of projecting federal deficits, calculate that the GOP's tax plan would add to the deficits. (e.g. Big 6 Tax Framework Could Cost $2.2 Trillion Over Ten Years| Committee for a Responsible Federal Budget)

The following linked articles explains one method being considered by GOP to mask the cost of tax cuts. This One Word Is Worth $500 Billion as Congress Debates Tax Cuts-NBC News; Current Policy Gimmick Would Add Half-Trillion to Debt | Committee for a Responsible Federal Budget ("Using a current policy baseline disguises a half-trillion dollar tax cut as "paid for" even though deficits would increase.")

The primary arguments used by the GOP is that the tax cuts will pay for themselves and their trickle down theory. So when corporations and rich folks receive huge tax cuts, they will meaningfully share the benefits with the middle class and non-stock owners.

++++++++

Trump States That the GOP's TAX Plan Will not Help Him or the Wealthy:

I discussed this topic in my last post and in a comment to that post.

The following statements made by Trump is so demonstrably false on an important topic that it is conceivable that a few Trump voters will start to question whether Trump is trustworthy:

Tax reform "is not good for me, believe me", adding further in a speech last week that the GOP's "framework" will protect "middle income households, not the wealthy or well connected".

Trump Says Tax Plan 'Not Good for Me, Believe Me' - YouTube

That is just an outrageous lie and, yet, the True Believers Do Believe Donald which is unfortunate for the country and for most of them too.

Trump and other members of the top 1% would be the major beneficiaries of the GOP's plan, which should surprise no one. Donald has done nothing for the middle class his entire life.

The bottom tax rate is raised from 10% to 12% while the top rate is reduced from 39.6% to 35%.

The tax rate would be reduced from 35% to 25% for business income received from pass through entities used by Trump.

For a married couple filing jointly without that kind of income, the 25% rate under existing law would apply to income over $75,900 and below $153,100. Trump's 2005 return revealed that he had $109+M of business income (lines 12 and 17)

Trump 2005 Tax Return (2 pages only).pdf;

Trump 2005 Tax Return May Have Understated Salary By Millions | Fortune

The proposed 25% on business income is a maximum rate. Most small businesses in the U.S. using pass through structures would not have taxable income subject to a 25%+ individual tax rate. This provision is aimed to reduce the taxes even further for the wealthy, and Donald Trump in particular.

The state and local income deduction would be eliminated along with all or most other individual tax deductions and credits other than mortgage interest, retirement contributions and charitable contributions. The plan refers to leaving "tax incentives" for mortgage interest, which I found to be coy and open to interpretation.

The exemption deduction would be eliminated by rolling it into the higher standard deduction. The additional standard deduction amount ($1250) for those over 65 would be eliminated as well. Last year, the exemption amount for each child was $4,050. The GOP gives the following reason for eliminating that exemption:

The GOP wants to eliminate exemptions for adults as well, arguing that this elimination will make the system fairer and simpler. Currently, the taxpayer has to add the number of exemptions in line 6, which may be a brain strain for some, and then multiply the total by $4,200 on line 26 even more of an unwarranted brain exercise:

Lines 6 and 26 1040A Form:

2016 Form 1040A

And is it fair and honest for republicans to claim that the GOP is almost doubling the standard deduction without mentioning the exemption takeaways? Have you heard a single republican politician mention the increase in the standard deduction but then adds that the increase is taken away in large part by eliminating exemptions? If you have, leave a link in the comment section below. They are just too deep into a deception mode to be even casually forthcoming.

I would just add here that those who itemize can still take the exemptions under current law, but would lose the exemptions under the GOP's plan.

How do republican politicians sell a plan that benefits primarily the super rich and large corporations to the average voter? Lying works just fine.

I am not making this stuff up, but merely quoting from the GOP's "tax reform" plan: Here’s the GOP tax plan - Axios

There is currently a child tax credit and the GOP plans to do something with that credit that purportedly would make it more beneficial. The Child Tax Credit currently has income limits and a phase out as income rises. Child Tax Credit Guide (2017): How Much Are You Eligible For? - SmartAsset What is their details of their plan? It is still a secret.

The AMT would also be eliminated, which would save Trump tens of millions in taxes, notwithstanding his false statements to the contrary.

In his 2005 tax return, the only one that is in the public domain, showed that the AMT cost Trump $31.26+M in additional taxes, raising his total effective tax rate to 24% from 4%. (line 45).

It is correct for the GOP to claim that the AMT is increasingly catching upper middle income households. What is the AMT? | Tax Policy Center

That issue could be addressed by increasing the exemption amount rather than eliminating the AMT, but that will not save Trump and a few other wealthy individuals tens of millions in taxes.

The estate tax, which is paid only by the wealthy now, would be eliminated.

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break

This is just another Trump outrageous and contemptible lie:

"To protect millions of small businesses and the American farmer, we are finally ending the crushing, the horrible, the unfair estate tax, or as it is often referred to, the death tax." (emphasis added)

The actual number is that only slightly more than 5,000 estates per year currently pay any federal estate tax rather than "millions" as claimed by Donald. Of that amount, about 80 owners of small businesses and farms will have to pay any estate tax. For those who have trouble with math, you can believe me when I say that 80 is a smaller number than "millions".

This tax break is for Donald, which he denies of course, and a few others, mostly large contributors to the GOP. Yet the True Believers cheered when Donald made his knowingly false assertion about "millions" receiving a benefit from the estate tax elimination. Lying works so easily.

Donald Trump's Pants on Fire claim about the estate tax, small businesses and farms | PolitiFact

The Tax Policy Center estimates that almost 30% of taxpayers with incomes between $50K and $130K would suffer a TAX INCREASE under the GOP's plan. A majority of taxpayers with incomes between $150K to $300K would experience a TAX INCREASE. Who receives most the benefits? 80% of the benefits would be received by the top 1% which is an obvious point. GOP tax plan would provide major gains for richest 1%, uneven benefits for the middle class, report says - The Washington Post

Yet, the GOP is doing all of this to help the middle class.

Just ask Paul Ryan who claimed over the weekend that this plan was intended to primarily benefit the middle class. Ryan says middle class tax cut is top goal, but can't guarantee everyone will get one - CBS News (Ryan claims that the "main goal" is to "help the people who are working paycheck to paycheck and keep more of their own hard-earned dollars." B.S.)

Page 8 of the TPC Report:

The impacts will of course vary. The impact on single parent with three kids, a decent income (too high for the child tax credit), and residing in a high tax state would be different than a single person with no kids, earning the same income, in a low tax state.

Then, there is this statement where the GOP taketh away more from individual taxpayers:

That language apparently envisions taking away the foreign tax credit for dividends. If that is done, the plan would wipe out my tax savings from the standard deduction increase, as adjusted down for the elimination of the extra standard deduction for those over 65 and the exemption elimination, and would cause me to pay more taxes if I continued to own those stocks.

If the individual foreign tax credit is taken away to help pay for the reduction in corporate taxes, I would probably immediately sell every foreign stock where the host country has a withholding tax to avoid double taxation on the same dividend. That would exclude the U.K. and any Canadian non-pass through entity owned in a IRA account. All of the my Canadian REITs would be sold.

Under Trump’s Plan, Tax Cuts Shrink Over Time for Everyone but the Richest - The New York Times

Mnuchin, Mulvaney say it’s too early to criticize GOP tax plan - MarketWatch (But why is the plan such a sketchy outline in October 2017? As I pointed out in my last post, Reagan signed his tax plan into law seven months after his first inauguration.)

Will the Trump voters hold the GOP accountable for serving up another tax plan that benefits primarily the super rich and raises taxes for millions in the middle and upper-middle class?

Will they continue to believe the Paul Ryan's B.S. that the plan's main goal is to help them?

Lying works for politicians, far better than telling the truth, though it would be somewhat harder for politicians to pull it off successfully if journalists were actually informed and willing to confront them with facts as they spew their lies.

Since the True Believers only digest information supplied by Fox and similar outlets, it would also be necessary for those outlets to hire real journalists willing to make an effort to gather accurate information and to relay it to their audience, which will never happen because it would cost those outlets a major loss of viewers who are no longer receiving confirmations of their biases.

Most Trump voters will not believe accurate media stories that point out the false statements made by Trump, others in his administration and GOP politicians like Paul Ryan. That is what several decades of GOP brainwashing has done.

For those leaving in an alternate reality now, the "mainstream" media is the enemy of the people and can not be trusted to tell the truth. Just repeat the phrase "Fake News" over and over again. Maybe as many as 1/3rd of voters have opinions that are based at least in significant measure on accurate information. The rest are enveloped in reality creations hatched in FantasyLand.

In a recent poll, 79% of republicans believe Trump is honest. National (US) Poll - September 27, 2017 - Trump Is Not Fit To Be Preside | Quinnipiac University Connecticut

The GOP did not lose its influence over the white middle class voters with their voucher plan for Medicare, passed in the House with almost no republican no votes, that would have almost doubled annual premiums for those forced out of traditional medicare and into the GOP's voucher program (that is, those then under 55 upon their eligibility). This plan, when looked at objectively, was more welfare for the rich and a path toward bankruptcy for the middle class in their golden years. Make America Great Again by giving huge tax breaks to the richest Americans. That's the real plan.

Proposed Changes to Medicare in the “Path to Prosperity”: Overview and Key Questions | The Henry J. Kaiser Family Foundation (click link at the bottom)("Under the proposal, a typical 65-year-old retiring in 2022 would be expected to devote nearly half their monthly Social Security checks toward health care costs, more than double what they would spend under current Medicare law, according to the analysis.")

++++++++++

Will Any High Ranking Trust Appointee Last for One Year?:

Tom Price Resigns as Health and Human Services Secretary - NBC News

Health Secretary Tom Price says he will partly reimburse $400,000 worth of travel on charter planes - LA Times

Price took military jets to Europe, Asia for over $500K - POLITICO; White House approved $500K for Tom Price's military jet travel: Report - CBS News

What about Pruitt, the anti-environmental protection Director of the Environmental Protection Agency?

EPA's Scott Pruitt used private planes for government business - CNN (why was it necessary for the EPA Director to meet with the Vatican?)

EPA’s Pruitt took charter, military flights that cost taxpayers more than $58,000 - The Washington Post

3 Cabinet officials under fire for taking costly flights - CBS News

E.P.A. to Spend Nearly $25,000 on a Soundproof Booth for Pruitt - The New York Times

Scott Pruitt Spent Much of Early Months at E.P.A. Traveling Home, Report Says - The New York Times

Environmental IntegrityEIP Requests EPA Investigation of Administrator Pruitt’s Travel to Oklahoma | Environmental Integrity

Yes, drain that swamp Donald starting with the people you hired.

++++++++++

Trump kids' ski vacation incurs over $300,000 in security costs - CBS News

Congress Allocates $120 Million for Trump Family’s Security Costs - The New York Times

+++++

Portfolio Management:

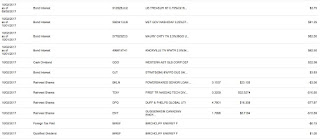

One important component of my portfolio management is to generate a constant flow of income. The following two snapshots show income received in one taxable account so far today. The CD interest payments are made monthly. The $1K par value taxable bond lots are either 1 or 2 bonds. The municipal bond lots are $5K par value positions, except for the 2027 Montgomery County ($15K par value) and the 2027 Williamson County lot ($15K par value). The larger lots will generally have shorter maturity dates. The Williamson County bonds are rated AAA. I live in that county. The Hercules and First American bonds are vintage purchases. The remainder were bought this year.

Schwab is one day behind in processing this kind of information:

The Vanguard taxable account had far less activity since I own no CDs in that account and fewer bonds. I have a higher cash allocation in that account mostly concentrated in the Vanguard Prime MM fund, which is my highest yielding MM fund, and the settlement fund Vanguard Federal Prime which has a lower current annualized 7 day yield of .98%.

The individual amounts are not viewed as significant. I am concerned about the aggregate amount and the constant flow. So far, I am not having to spend any of my cash flow and consequently can reinvest it into more securities that generate income.

++++++

Trump States That the GOP's TAX Plan Will not Help Him or the Wealthy:

I discussed this topic in my last post and in a comment to that post.

The following statements made by Trump is so demonstrably false on an important topic that it is conceivable that a few Trump voters will start to question whether Trump is trustworthy:

Tax reform "is not good for me, believe me", adding further in a speech last week that the GOP's "framework" will protect "middle income households, not the wealthy or well connected".

Trump Says Tax Plan 'Not Good for Me, Believe Me' - YouTube

That is just an outrageous lie and, yet, the True Believers Do Believe Donald which is unfortunate for the country and for most of them too.

Trump and other members of the top 1% would be the major beneficiaries of the GOP's plan, which should surprise no one. Donald has done nothing for the middle class his entire life.

The bottom tax rate is raised from 10% to 12% while the top rate is reduced from 39.6% to 35%.

The tax rate would be reduced from 35% to 25% for business income received from pass through entities used by Trump.

For a married couple filing jointly without that kind of income, the 25% rate under existing law would apply to income over $75,900 and below $153,100. Trump's 2005 return revealed that he had $109+M of business income (lines 12 and 17)

Trump 2005 Tax Return (2 pages only).pdf;

Trump 2005 Tax Return May Have Understated Salary By Millions | Fortune

The proposed 25% on business income is a maximum rate. Most small businesses in the U.S. using pass through structures would not have taxable income subject to a 25%+ individual tax rate. This provision is aimed to reduce the taxes even further for the wealthy, and Donald Trump in particular.

The state and local income deduction would be eliminated along with all or most other individual tax deductions and credits other than mortgage interest, retirement contributions and charitable contributions. The plan refers to leaving "tax incentives" for mortgage interest, which I found to be coy and open to interpretation.

The exemption deduction would be eliminated by rolling it into the higher standard deduction. The additional standard deduction amount ($1250) for those over 65 would be eliminated as well. Last year, the exemption amount for each child was $4,050. The GOP gives the following reason for eliminating that exemption:

The GOP wants to eliminate exemptions for adults as well, arguing that this elimination will make the system fairer and simpler. Currently, the taxpayer has to add the number of exemptions in line 6, which may be a brain strain for some, and then multiply the total by $4,200 on line 26 even more of an unwarranted brain exercise:

Lines 6 and 26 1040A Form:

2016 Form 1040A

And is it fair and honest for republicans to claim that the GOP is almost doubling the standard deduction without mentioning the exemption takeaways? Have you heard a single republican politician mention the increase in the standard deduction but then adds that the increase is taken away in large part by eliminating exemptions? If you have, leave a link in the comment section below. They are just too deep into a deception mode to be even casually forthcoming.

I would just add here that those who itemize can still take the exemptions under current law, but would lose the exemptions under the GOP's plan.

How do republican politicians sell a plan that benefits primarily the super rich and large corporations to the average voter? Lying works just fine.

I am not making this stuff up, but merely quoting from the GOP's "tax reform" plan: Here’s the GOP tax plan - Axios

There is currently a child tax credit and the GOP plans to do something with that credit that purportedly would make it more beneficial. The Child Tax Credit currently has income limits and a phase out as income rises. Child Tax Credit Guide (2017): How Much Are You Eligible For? - SmartAsset What is their details of their plan? It is still a secret.

The AMT would also be eliminated, which would save Trump tens of millions in taxes, notwithstanding his false statements to the contrary.

In his 2005 tax return, the only one that is in the public domain, showed that the AMT cost Trump $31.26+M in additional taxes, raising his total effective tax rate to 24% from 4%. (line 45).

It is correct for the GOP to claim that the AMT is increasingly catching upper middle income households. What is the AMT? | Tax Policy Center

That issue could be addressed by increasing the exemption amount rather than eliminating the AMT, but that will not save Trump and a few other wealthy individuals tens of millions in taxes.

The estate tax, which is paid only by the wealthy now, would be eliminated.

IRS Announces 2017 Estate And Gift Tax Limits: The $11 Million Tax Break

This is just another Trump outrageous and contemptible lie:

"To protect millions of small businesses and the American farmer, we are finally ending the crushing, the horrible, the unfair estate tax, or as it is often referred to, the death tax." (emphasis added)

The actual number is that only slightly more than 5,000 estates per year currently pay any federal estate tax rather than "millions" as claimed by Donald. Of that amount, about 80 owners of small businesses and farms will have to pay any estate tax. For those who have trouble with math, you can believe me when I say that 80 is a smaller number than "millions".

This tax break is for Donald, which he denies of course, and a few others, mostly large contributors to the GOP. Yet the True Believers cheered when Donald made his knowingly false assertion about "millions" receiving a benefit from the estate tax elimination. Lying works so easily.

Donald Trump's Pants on Fire claim about the estate tax, small businesses and farms | PolitiFact

The Tax Policy Center estimates that almost 30% of taxpayers with incomes between $50K and $130K would suffer a TAX INCREASE under the GOP's plan. A majority of taxpayers with incomes between $150K to $300K would experience a TAX INCREASE. Who receives most the benefits? 80% of the benefits would be received by the top 1% which is an obvious point. GOP tax plan would provide major gains for richest 1%, uneven benefits for the middle class, report says - The Washington Post

Yet, the GOP is doing all of this to help the middle class.

Just ask Paul Ryan who claimed over the weekend that this plan was intended to primarily benefit the middle class. Ryan says middle class tax cut is top goal, but can't guarantee everyone will get one - CBS News (Ryan claims that the "main goal" is to "help the people who are working paycheck to paycheck and keep more of their own hard-earned dollars." B.S.)

Page 8 of the TPC Report:

The impacts will of course vary. The impact on single parent with three kids, a decent income (too high for the child tax credit), and residing in a high tax state would be different than a single person with no kids, earning the same income, in a low tax state.

Then, there is this statement where the GOP taketh away more from individual taxpayers:

That language apparently envisions taking away the foreign tax credit for dividends. If that is done, the plan would wipe out my tax savings from the standard deduction increase, as adjusted down for the elimination of the extra standard deduction for those over 65 and the exemption elimination, and would cause me to pay more taxes if I continued to own those stocks.

If the individual foreign tax credit is taken away to help pay for the reduction in corporate taxes, I would probably immediately sell every foreign stock where the host country has a withholding tax to avoid double taxation on the same dividend. That would exclude the U.K. and any Canadian non-pass through entity owned in a IRA account. All of the my Canadian REITs would be sold.

Under Trump’s Plan, Tax Cuts Shrink Over Time for Everyone but the Richest - The New York Times

Mnuchin, Mulvaney say it’s too early to criticize GOP tax plan - MarketWatch (But why is the plan such a sketchy outline in October 2017? As I pointed out in my last post, Reagan signed his tax plan into law seven months after his first inauguration.)

Will the Trump voters hold the GOP accountable for serving up another tax plan that benefits primarily the super rich and raises taxes for millions in the middle and upper-middle class?

Will they continue to believe the Paul Ryan's B.S. that the plan's main goal is to help them?

Lying works for politicians, far better than telling the truth, though it would be somewhat harder for politicians to pull it off successfully if journalists were actually informed and willing to confront them with facts as they spew their lies.

Since the True Believers only digest information supplied by Fox and similar outlets, it would also be necessary for those outlets to hire real journalists willing to make an effort to gather accurate information and to relay it to their audience, which will never happen because it would cost those outlets a major loss of viewers who are no longer receiving confirmations of their biases.

Most Trump voters will not believe accurate media stories that point out the false statements made by Trump, others in his administration and GOP politicians like Paul Ryan. That is what several decades of GOP brainwashing has done.

For those leaving in an alternate reality now, the "mainstream" media is the enemy of the people and can not be trusted to tell the truth. Just repeat the phrase "Fake News" over and over again. Maybe as many as 1/3rd of voters have opinions that are based at least in significant measure on accurate information. The rest are enveloped in reality creations hatched in FantasyLand.

In a recent poll, 79% of republicans believe Trump is honest. National (US) Poll - September 27, 2017 - Trump Is Not Fit To Be Preside | Quinnipiac University Connecticut

The GOP did not lose its influence over the white middle class voters with their voucher plan for Medicare, passed in the House with almost no republican no votes, that would have almost doubled annual premiums for those forced out of traditional medicare and into the GOP's voucher program (that is, those then under 55 upon their eligibility). This plan, when looked at objectively, was more welfare for the rich and a path toward bankruptcy for the middle class in their golden years. Make America Great Again by giving huge tax breaks to the richest Americans. That's the real plan.

Proposed Changes to Medicare in the “Path to Prosperity”: Overview and Key Questions | The Henry J. Kaiser Family Foundation (click link at the bottom)("Under the proposal, a typical 65-year-old retiring in 2022 would be expected to devote nearly half their monthly Social Security checks toward health care costs, more than double what they would spend under current Medicare law, according to the analysis.")

++++++++++

Will Any High Ranking Trust Appointee Last for One Year?:

Tom Price Resigns as Health and Human Services Secretary - NBC News

Health Secretary Tom Price says he will partly reimburse $400,000 worth of travel on charter planes - LA Times

Price took military jets to Europe, Asia for over $500K - POLITICO; White House approved $500K for Tom Price's military jet travel: Report - CBS News

What about Pruitt, the anti-environmental protection Director of the Environmental Protection Agency?

EPA's Scott Pruitt used private planes for government business - CNN (why was it necessary for the EPA Director to meet with the Vatican?)

EPA’s Pruitt took charter, military flights that cost taxpayers more than $58,000 - The Washington Post

3 Cabinet officials under fire for taking costly flights - CBS News

E.P.A. to Spend Nearly $25,000 on a Soundproof Booth for Pruitt - The New York Times

Scott Pruitt Spent Much of Early Months at E.P.A. Traveling Home, Report Says - The New York Times

Environmental IntegrityEIP Requests EPA Investigation of Administrator Pruitt’s Travel to Oklahoma | Environmental Integrity

Yes, drain that swamp Donald starting with the people you hired.

++++++++++

Trump kids' ski vacation incurs over $300,000 in security costs - CBS News

Congress Allocates $120 Million for Trump Family’s Security Costs - The New York Times

+++++

Portfolio Management:

One important component of my portfolio management is to generate a constant flow of income. The following two snapshots show income received in one taxable account so far today. The CD interest payments are made monthly. The $1K par value taxable bond lots are either 1 or 2 bonds. The municipal bond lots are $5K par value positions, except for the 2027 Montgomery County ($15K par value) and the 2027 Williamson County lot ($15K par value). The larger lots will generally have shorter maturity dates. The Williamson County bonds are rated AAA. I live in that county. The Hercules and First American bonds are vintage purchases. The remainder were bought this year.

Schwab is one day behind in processing this kind of information:

The Vanguard taxable account had far less activity since I own no CDs in that account and fewer bonds. I have a higher cash allocation in that account mostly concentrated in the Vanguard Prime MM fund, which is my highest yielding MM fund, and the settlement fund Vanguard Federal Prime which has a lower current annualized 7 day yield of .98%.

The individual amounts are not viewed as significant. I am concerned about the aggregate amount and the constant flow. So far, I am not having to spend any of my cash flow and consequently can reinvest it into more securities that generate income.

++++++

1. Eliminated TCBIP:

A. Sold 50 TCBIP at $25.45:

Par Value: $25

Coupon: 6.5%

Dividends: Non-Cumulative and Qualified

Last Ex Date: 8/30/17

Optional Call: At par on or after 6/15/18

I will be looking for an opportunity to buy this lot back at below $24, provided that objective is achieved prior to the next ex dividend date. I will not make another purchase above par value.

My consider to repurchase price is less than $24, preferably lower than $23. At a total cost of $23, the yield would be about 7.065% and 6.77% at $24.

An alternative from the same issuer is the junior bond TCBIL which also has a 6.5% coupon. Texas Capital Bancshares Inc. 6.5% Subordinated Notes due 2042

I have bought and sold that security as well. Item # 6 Eliminated TCBIL: Sold 100 at $25.62 at Update For Exchange Traded Bonds And Preferred Stocks Basket Strategy As Of 5/20/16 -South Gent | Seeking Alpha There is an optional redemption at the $25 par value on or after 9/21/17. During the interest rate spike in 2013, I bought TCBIL at $21.3.

2. Eliminated EBAYL:

A. Sold 30 at $26.97:

History:

Profit Snapshot: +$59.28

South Gent's Comment Blog # 6: Bought 30 EBAYL at $24.99

Quote: eBay Inc. 6% Senior Unsecured Notes due 2056

Par Value $25

Makes Quarterly Interest Payments

Coupon: 6%

Optional Call Date: On or After 3/1/21 at Par

Maturity: 2/1/2056

Classification: Baby Bond-Stocks, Bonds & Politics: Exchange Traded Baby Bonds

Prospectus

My consider to purchase price is lower than $24.

3. Eliminated TCFPRC:

A. Sold 50 TCFPRC at $25.66:

Profit Snapshot: $37.53

South Gent's Comment Blog # 7: Bought 50 TCFPRC at $24.91

Quote: TCF Financial Corp. 6.45% Non-Cum. Perp. Pfd. Series B

Par Value: $25

Coupon: 6.45%

Dividends: Quarterly, Qualified and Non-Cumulative

Optional Call Date: 12/19/17

Capital Structure: Senior Only to Common Stock/Junior to All Bonds

Previous Transaction: Item # 1. Sold 50 TCBPRC at $26 at Update For Exchange Traded Bonds And Preferred Stocks Basket Strategy As Of 4/26/16-Item # 1. Bought 50 TCBPRC at $24.68: Update For Exchange Traded Bond And Preferred Stock Basket Strategy As Of 10/22/15

My consider to repurchase price is lower than $24, preferably lower than $23.

4. Intermediate Term Bond/CD Ladder Basket Strategy:

Continued to Pare Intermediate Term Allocation

A. Sold 1 WFC 3.3% SU Bond Maturing on 9/9/24:

Looking to buy back at less than 98.

Profit Snapshot: +$23.68

FINRA Page: Bond Detail (prospectus linked)

ISSUER: Wells Fargo & Co.

WFC Analyst Estimates

Sold at 101.914

YTM Then at 2.994%

Current Yield at 3.238%

Bought at a Total Cost of 99.426

YTM Then at 3.383%

Current Yield at 3.318%

B. Sold 2 Dupont 2.8% SU Bonds Maturing on 2/15/23:

Profit Snapshot: $28.54

FINRA Page: Bond Detail

NEW STOCK SYMBOL: DowDuPont Inc. (DWDP)

DWDP Analyst Estimates - DowDuPont Inc.

Sold at 101.023

YTM Then at 2.596%

Current Yield at 2.77%

Bought at a Total Cost of 99.496

Stocks, Bonds & Politics: Item # 1.C.

YTM Then at 2.894%

Current Yield at 2.814%

C. SOLD 2 CVS 2.75% SU Bonds Maturing on 12/1/22:

Profit Snapshot: $9.08

FINRA Page: Bond Detail

ISSUER: CVS Health Corp. (CVS)

CVS Analyst Estimates

Sold at 100.521

YTM Then at 2.637%

Current Yield at 2.736%

Bought at a Total Cost of 99.967

Stocks, Bonds & Politics: Item # 1.B.

YTM Then at 2.756%

Current Yield at 2.75%

D. Sold 2 W.P. Carey 4.6% SU Bonds Maturing on 4/1/24:

Will consider repurchasing at below 100.

Profit Snapshot: $62.15

FINRA Page: Bond Detail

Issuer: W. P. Carey Inc. (WPC)-A REIT

Sold at 105.382

YTM Then at 3.634%

Current Yield at 4.365%

I discussed buying this bond here: South Gent's Comment Blog # 5

I still own 30 common shares: South Gent's Comment Blog # 7: Bought 30 WPC at $59.45

$7K Outflow from Intermediate Term Bond/CD Ladder Basket

5. Short Term Bond/CD Ladder Basket Strategy:

A. Bought 3 Bank of Baroda 1.1% CDs Maturing on 10/30/17 (1 month CD):

B. Bought 2 Federal Savings Bank 1.35% CDs (monthly interest) Maturing on 3/28/18 (6 month CD):

This bank has a 5 star rating from Bankrate: FEDERAL SAVINGS BANK, THE Review

This is a private bank so I looked at the financial data before buying this FDIC insured CD.

Sourced from: Select Uniform Bank Performance Report Format - FFIEC Central Data Repository's Public Data Distribution

C. Bought 2 Southeast Bank 1.15% CDs Maturing on 12/4/17 (2 month CD):

Southeast Bank is a tiny bank based in Farragut TN. I looked at the financials before buying since I was unfamiliar with this bank:

D. Bought 2 Bank of Baroda 1.1% CDs Maturing on 11/19/17 (2 month CDs):

Bank of Baroda - Wikipedia

E. Bought 2 Compass Bank 1.5% CDs Maturing on 9/28/18 (1 Year CD):

Holding Company: BBVA Compass Bancshares, a wholly owned subsidiary of Banco Bilbao Vizcaya Argentaria S.A. ADR (BBVA)

Uniform Bank Performance Report- FFIEC Central Data Repository's Public Data Distribution

$10K Inflow into Short Term Bond/CD Ladder Basket:

6. Eliminated EBGUF Again:

A. Sold 100 at $25.73-Used Commission Free Trade:

EBGUF is the USD priced Grey Market listing for the ordinary shares of Enbridge Income Fund Holdings Inc. (Canada: Toronto). I trade those shares, using commission free trades, while holding the CAD priced shares traded in Toronto. With EBGUF, I am attempting primarily to trade upswings in the CAD/USD while earning some income.

2007 EBGUF History:

The USD amount of the month dividend will fluctuate up and down with the currency exchange rate. With the CAD rising in value after purchase, the monthly dividend would increase without any change in the penny rate (and vice versa). As to the foreign tax collected by Canada at a 15% rate, I have been able to recover that amount through the foreign tax credit.

Profit Snapshot: +$117.12

ITEM # 2.A. Bought 100 EBGUF at $24.55: Stocks, Bonds & Politics: Observations and Sample of Recent Trades: EBGUF, FFHPRD (8/25/17 POST)

Here are the closing prices for EBGUF and the CAD priced shares traded in Toronto that day:

EBGUF USD$24.61 -0.02 -0.09% : ENBRIDGE INCOME FD

ENF.TO CAD$30.78 -0.10 -0.32% : ENBRIDGE INCOME FUND

The closing prices on 9/21/17 were as follows:

EBGUF USD$25.70 -$0.03 -0.10%

ENF.TO CAD$ 31.66 -C$0.06 -0.19%

Closing Price Percentage Changes

USD Price: +$1.09 or +4.43%

CAD Price: +C$.88 or +2.86%

The differential is due to rise in the Canadian Dollar against the USD. Canadian Dollar to US Dollar Rates

I was slightly concerned that a rise in U.S. interest rates would cause the USD to gain in value. The countervailing force is improved crude prices. So far the CAD/USD is hanging close to .8.

EBGUF is one of several USD priced Canadian stocks where I attempt to play short term movements in the CAD/USD. I don't mind holding the position longer term if the short term trade proves less than prescient. I also own shares priced in CADs where I am holding for the dividend income paid in Canadian dollars.

I have sold the CAD priced shares only once:

Bought: 100 ENF:CA at C$23 (11/6/13 Post)-Item # 1 Sold 100 ENF:CA at C$27.65 (8/2/14 Post) My USD realized gain for that earlier trade was $341.62. The CAD realized gain was C$427.

Dividend History - Enbridge Income Fund

Enbridge Income Fund Holdings Inc. Announces 10% Dividend Increase to Monthly Dividend (1/5/17 Press Release)

The CAD has been retreating some against the USD, probably due to the rise in U.S. interest rates. For this last trade, I only captured a minor blip up in the CAD/USD and sold this lot since I was concerned that this small positive was about to go negative on me.

CAD / USD Currency Chart

My consider to repurchase price is less than $24, preferably lower than $23. At a total cost of $23, the yield would be about 7.065% and 6.77% at $24.

An alternative from the same issuer is the junior bond TCBIL which also has a 6.5% coupon. Texas Capital Bancshares Inc. 6.5% Subordinated Notes due 2042

I have bought and sold that security as well. Item # 6 Eliminated TCBIL: Sold 100 at $25.62 at Update For Exchange Traded Bonds And Preferred Stocks Basket Strategy As Of 5/20/16 -South Gent | Seeking Alpha There is an optional redemption at the $25 par value on or after 9/21/17. During the interest rate spike in 2013, I bought TCBIL at $21.3.

2. Eliminated EBAYL:

A. Sold 30 at $26.97:

History:

Profit Snapshot: +$59.28

South Gent's Comment Blog # 6: Bought 30 EBAYL at $24.99

Quote: eBay Inc. 6% Senior Unsecured Notes due 2056

Par Value $25

Makes Quarterly Interest Payments

Coupon: 6%

Optional Call Date: On or After 3/1/21 at Par

Maturity: 2/1/2056

Classification: Baby Bond-Stocks, Bonds & Politics: Exchange Traded Baby Bonds

Prospectus

My consider to purchase price is lower than $24.

3. Eliminated TCFPRC:

A. Sold 50 TCFPRC at $25.66:

Profit Snapshot: $37.53

South Gent's Comment Blog # 7: Bought 50 TCFPRC at $24.91

Quote: TCF Financial Corp. 6.45% Non-Cum. Perp. Pfd. Series B

Par Value: $25

Coupon: 6.45%

Dividends: Quarterly, Qualified and Non-Cumulative

Optional Call Date: 12/19/17

Capital Structure: Senior Only to Common Stock/Junior to All Bonds

Previous Transaction: Item # 1. Sold 50 TCBPRC at $26 at Update For Exchange Traded Bonds And Preferred Stocks Basket Strategy As Of 4/26/16-Item # 1. Bought 50 TCBPRC at $24.68: Update For Exchange Traded Bond And Preferred Stock Basket Strategy As Of 10/22/15

My consider to repurchase price is lower than $24, preferably lower than $23.

4. Intermediate Term Bond/CD Ladder Basket Strategy:

Continued to Pare Intermediate Term Allocation

A. Sold 1 WFC 3.3% SU Bond Maturing on 9/9/24:

Looking to buy back at less than 98.

Profit Snapshot: +$23.68

FINRA Page: Bond Detail (prospectus linked)

ISSUER: Wells Fargo & Co.

WFC Analyst Estimates

Sold at 101.914

YTM Then at 2.994%

Current Yield at 3.238%

Bought at a Total Cost of 99.426

YTM Then at 3.383%

Current Yield at 3.318%

B. Sold 2 Dupont 2.8% SU Bonds Maturing on 2/15/23:

Profit Snapshot: $28.54

FINRA Page: Bond Detail

NEW STOCK SYMBOL: DowDuPont Inc. (DWDP)

DWDP Analyst Estimates - DowDuPont Inc.

Sold at 101.023

YTM Then at 2.596%

Current Yield at 2.77%

Bought at a Total Cost of 99.496

Stocks, Bonds & Politics: Item # 1.C.

YTM Then at 2.894%

Current Yield at 2.814%

C. SOLD 2 CVS 2.75% SU Bonds Maturing on 12/1/22:

Profit Snapshot: $9.08

FINRA Page: Bond Detail

ISSUER: CVS Health Corp. (CVS)

CVS Analyst Estimates

Sold at 100.521

YTM Then at 2.637%

Current Yield at 2.736%

Bought at a Total Cost of 99.967

Stocks, Bonds & Politics: Item # 1.B.

YTM Then at 2.756%

Current Yield at 2.75%

D. Sold 2 W.P. Carey 4.6% SU Bonds Maturing on 4/1/24:

Will consider repurchasing at below 100.

Profit Snapshot: $62.15

FINRA Page: Bond Detail

Issuer: W. P. Carey Inc. (WPC)-A REIT

Sold at 105.382

YTM Then at 3.634%

Current Yield at 4.365%

I discussed buying this bond here: South Gent's Comment Blog # 5

I still own 30 common shares: South Gent's Comment Blog # 7: Bought 30 WPC at $59.45

$7K Outflow from Intermediate Term Bond/CD Ladder Basket

5. Short Term Bond/CD Ladder Basket Strategy:

A. Bought 3 Bank of Baroda 1.1% CDs Maturing on 10/30/17 (1 month CD):

B. Bought 2 Federal Savings Bank 1.35% CDs (monthly interest) Maturing on 3/28/18 (6 month CD):

This bank has a 5 star rating from Bankrate: FEDERAL SAVINGS BANK, THE Review

This is a private bank so I looked at the financial data before buying this FDIC insured CD.

Sourced from: Select Uniform Bank Performance Report Format - FFIEC Central Data Repository's Public Data Distribution

C. Bought 2 Southeast Bank 1.15% CDs Maturing on 12/4/17 (2 month CD):

Southeast Bank is a tiny bank based in Farragut TN. I looked at the financials before buying since I was unfamiliar with this bank:

D. Bought 2 Bank of Baroda 1.1% CDs Maturing on 11/19/17 (2 month CDs):

Bank of Baroda - Wikipedia

E. Bought 2 Compass Bank 1.5% CDs Maturing on 9/28/18 (1 Year CD):

Holding Company: BBVA Compass Bancshares, a wholly owned subsidiary of Banco Bilbao Vizcaya Argentaria S.A. ADR (BBVA)

Uniform Bank Performance Report- FFIEC Central Data Repository's Public Data Distribution

$10K Inflow into Short Term Bond/CD Ladder Basket:

6. Eliminated EBGUF Again:

A. Sold 100 at $25.73-Used Commission Free Trade:

EBGUF is the USD priced Grey Market listing for the ordinary shares of Enbridge Income Fund Holdings Inc. (Canada: Toronto). I trade those shares, using commission free trades, while holding the CAD priced shares traded in Toronto. With EBGUF, I am attempting primarily to trade upswings in the CAD/USD while earning some income.

2007 EBGUF History:

The USD amount of the month dividend will fluctuate up and down with the currency exchange rate. With the CAD rising in value after purchase, the monthly dividend would increase without any change in the penny rate (and vice versa). As to the foreign tax collected by Canada at a 15% rate, I have been able to recover that amount through the foreign tax credit.

ITEM # 2.A. Bought 100 EBGUF at $24.55: Stocks, Bonds & Politics: Observations and Sample of Recent Trades: EBGUF, FFHPRD (8/25/17 POST)

Here are the closing prices for EBGUF and the CAD priced shares traded in Toronto that day:

EBGUF USD$24.61 -0.02 -0.09% : ENBRIDGE INCOME FD

ENF.TO CAD$30.78 -0.10 -0.32% : ENBRIDGE INCOME FUND

The closing prices on 9/21/17 were as follows:

EBGUF USD$25.70 -$0.03 -0.10%

ENF.TO CAD$ 31.66 -C$0.06 -0.19%

Closing Price Percentage Changes

USD Price: +$1.09 or +4.43%

CAD Price: +C$.88 or +2.86%

The differential is due to rise in the Canadian Dollar against the USD. Canadian Dollar to US Dollar Rates

I was slightly concerned that a rise in U.S. interest rates would cause the USD to gain in value. The countervailing force is improved crude prices. So far the CAD/USD is hanging close to .8.

EBGUF is one of several USD priced Canadian stocks where I attempt to play short term movements in the CAD/USD. I don't mind holding the position longer term if the short term trade proves less than prescient. I also own shares priced in CADs where I am holding for the dividend income paid in Canadian dollars.

I have sold the CAD priced shares only once:

Bought: 100 ENF:CA at C$23 (11/6/13 Post)-Item # 1 Sold 100 ENF:CA at C$27.65 (8/2/14 Post) My USD realized gain for that earlier trade was $341.62. The CAD realized gain was C$427.

Dividend History - Enbridge Income Fund

Enbridge Income Fund Holdings Inc. Announces 10% Dividend Increase to Monthly Dividend (1/5/17 Press Release)

The CAD has been retreating some against the USD, probably due to the rise in U.S. interest rates. For this last trade, I only captured a minor blip up in the CAD/USD and sold this lot since I was concerned that this small positive was about to go negative on me.

CAD / USD Currency Chart

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics: ERROR CREEP and the INVESTING PROCESS Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.

In a prior comment, I noted that RedHill's stock popped based on an announcement last week that it would release tomorrow Phase 2 top line results using BEKINDA 12 mg to treat " diarrhea-predominant irritable bowel syndrome (IBS-D)"

ReplyDeleteToday the company announced something different:

http://globenewswire.com/news-release/2017/10/02/1138640/0/en/RedHill-Biopharma-Accelerates-RHB-104-Phase-III-Study-in-Crohn-s-Disease-with-Top-Line-Results-Expected-Mid-2018.html

RedHill Biopharma Ltd. (RDHL)

$11.010 +$0.200 (+1.851%)

Day's Range $10.520 - $11.250

52 Week Range $8.160 - $14.740

Volume 290,474

Avg. Volume 68,608

Market Cap $184.04M

As of 11:44AM EDT

I have seen data that more than 90% of small businesses have tax rates lower than 25%, but do not recall where I saw that data.

ReplyDeleteWhatever the number may be, no small business in a less than 25% tax bracket would receive a benefit by reducing the tax rate on pass through business income to 25%.

I did find some data from the SBA.

https://www.sba.gov/sites/default/files/rs343tot.pdf

In 2004, more than 50% of small businesses had GROSS Receipts of less than $25k and 88% had Gross Receipts of less than $250,000. Since those numbers are total revenues, the reportable profits would be well below those numbers and 100% or close to that percentage would have taxable net income sufficient to hit the 25% tax bracket. That is just common sense, taking into account the costs of running the business and the myriad of deductions currently allowed to reduce total income to adjusted income (line 37) and then further reductions including itemized deductions or the standard deduction, exemption deductions, etc. allowed in lines 38-42 to arrive at Taxable income, which is line 43.

The purpose is not to help those taxpayers, but to reduce those the taxes paid by those that would otherwise be in the new 35% bracket further to 25%.

This aspect is being sold by Paul Ryan and others as necessary to help small manufacturers compete in a worldwide marketplace. If that is its true purpose, then the provision should be limited to small manufacturing firms and not extended to real developers like Trump, lawyers, accountants, engineers and other high earners that can organize their businesses into pass through entities like an LLC.

+++

The Stocks Jocks are taking the market higher based on future earnings being juiced by a decrease in corporate taxes and what appears to be an ongoing worldwide economic recovery.

S&P 500

2,529.12 +9.76 +0.39%

The ten year treasury ticked up to 2.344% from 2.333% last Friday, continuing its uptrend that started after the 2.05% closing yield on 9/7/17.

The 3 month treasury bill continues to be inappropriately priced in my opinion at a 1.06% yield.

Results from Today's Auction:

https://www.treasurydirect.gov/instit/annceresult/press/preanre/2017/R_20171002_1.pdf

That is of course a negative real yield before taxes and is also below the median point of the FED's FF rate range which is an overnight rate.

The Bond Ghouls currently place a 72.8% probability that the current range of 100-125 basis points will be raised to 125-150 at the December 2017 meeting:

http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html/

It is abnormal to have a negative spread of the 3 month T Bill over the FF rate.

https://fred.stlouisfed.org/graph/?g=8dg

+++

I am probably at or pretty close to another $1K pare in my Vanguard Equity Income Fund-Admiral Class Shares (VEIRX). I did receive in cash a $336.02 quarterly dividend after my last $1K pare on 9/13/17. I received the quarterly dividend on those subsequently sold shares. I will continue to sell $1K when and if the market value exceeds $51K.

+++

I am probably done reducing my intermediate term bond basket.

I noticed in the semi-annual report of T. Rowe Capital Appreciation fund, which is my largest fund position at T. Rowe Price, that the manager had a 20.1% allocation to intermediate term bonds as of 6/30/17.

Pages 30-36

https://individual.troweprice.com/gcFiles/pdf/srcaf.pdf

Maybe he has been selling too. I would be critical if he is holding onto them now. It is find for me to buy them at a $1 per commission per bond but I do not see the logic of buying those low YTM bonds in a fund that charges an expense ratio of .70%.

This fund has a five star rating from Morningstar.

http://www.morningstar.com/funds/xnas/prwcx/quote.html

It is a balanced, relatively conservative fund that is closed to new investors.

I added some material and snapshots in my portfolio management section. I included snapshots of cash flow received on 10/2 in my Schwab and Vanguard taxable accounts. Currently the Vanguard taxable account has more than twice as much cash as my Schwab and Fidelity taxable accounts combined due to much higher MM rates at Vanguard and the narrowing differential in yields between Vanguard MM yields and intermediate term bond yields. Those three accounts would be my 3 largest taxable accounts.

ReplyDelete++

I noticed that Senator Corker (R-TN) stated that he would not vote for a tax bill that increased the deficit.

https://www.nbcnews.com/meet-the-press/video/full-corker-won-t-support-gop-tax-plan-if-it-adds-to-deficit-1059037763567

That is a problem since Corker carries some weight and probably will not accept the notion that the GOP's proposed cuts pay for themselves.

In making that determination, It is true that you can not simply estimate the lost revenue as if the tax cuts have no impact on the economy. For example, the proposed tax cuts for publicly traded corporations will increase the dividends paid by them over time compared to the existing law. Those qualified dividends will increase individual stockholders income that will be taxed at either 15% or 20% depending on the taxpayer's income bracket.

The problem is that even GOP economists who are not shills admit that the cuts will at best recover 20% to 30% of the lost revenue.

http://www.crfb.org/blogs/do-tax-cuts-pay-themselves

And, if tax cuts add trillions to the deficit over time, thereby vastly increasing the need to borrow and then refinance into infinity the additional debt, interest costs will take up larger and larger percentages of federal spending that will likely cause an increase in the interest rates compared to the baseline scenario.

http://www.taxpolicycenter.org/publications/effects-income-tax-changes-economic-growth/full

If the GOP was actually interested in helping the Middle Class taxpayers, which I view as a frivolous proposition, they would keep the state and local tax deduction, raise the exemption amount of the AMT and keep it, limit the 25% business income rate cap to small manufacturers using pass through structures like an LLC, keep all of the exemptions and the extra standard deductions for taxpayers over 65 and the blind, keep the other individual deductions and credits, and raise both the standard deduction and the child tax credit some.

RedHill:

ReplyDeleteRedHill Biopharma Ltd. (RDHL)

$9.44 -$1.44 (-13.24%)

Last Updated: Oct 3, 2017 1:14 p.m. EDT

Easy come, easy go.

Investors did not appreciate the announcement made today. Perhaps, they need to consult a different oracle before pushing the price up based on announcement that an announcement was going to be made.

The actual news release today appears to my untrained eyes to be more of the same regarding RDHL's Bekinda drug.

https://globenewswire.com/news-release/2017/10/03/1140010/0/en/RedHill-Biopharma-Announces-Positive-Top-Line-Results-from-Phase-II-Study-of-BEKINDA-in-Patients-with-Diarrhea-Predominant-Irritable-Bowel-Syndrome-IBS-D.html

Note the difference between the drug and the placebo effect.

https://seekingalpha.com/news/3298940-redhills-bekinda-shows-positive-effect-barely-mid-stage-ibs-d-study-shares-ease-3-percent

http://www.reuters.com/article/us-redhill-boweldrug/redhill-biopharmas-bowel-syndrome-drug-data-fails-to-impress-investors-idUSKCN1C815L

TravelCenters of America LLC (TA)

ReplyDelete$4.50 +$0.35 (+8.43%)

As of 2:52PM EDT.

Day's Range 4.30 - 4.80

52 Week Range 2.95 - 7.75

Volume 1,129,056

Avg. Volume 299,95

Market Cap 178.002M

TA is doing very well today, particularly for it, based on news that Buffett is taking a majority stake in TA's competitor Pilot J.

https://www.reuters.com/article/us-pilotflyingj-m-a-berkshirehathaway/buffett-bets-on-truck-stops-to-buy-majority-of-pilot-flying-j-idUSKCN1C81C0

{As an aside, Pilot J is owned by Tennessee's Haslam family which includes our GOP governor Bill Haslam. I did vote for Haslam twice. Haslam did not vote for Trump. He is contemplating running for Corker's Senate seat. TN is Trump territory and Haslam may have trouble winning the primary against a strong Trump supporter. If Haslam does run for the Senate, I will vote for him in the primary but will reserve judgment on the general election until I see who the Democrats have.}

I am mentioning TA's move today because it is having a positive impact on TA's three exchange traded bonds.

I discussed buying here the 8% senior unsecured (TANNZ) but lacked any conviction. That bond did go ex interest for its quarterly distribution after my purchase.

TravelCenters of America LLC 8% SU Bond (TANNZ)

$23.51 +$0.46 (+2.00%)

As of 3:04PM EDT.

Day's Range 23.30 - 23.76

52 Week Range 17.00 - 26.49

Volume 49,699

Avg. Volume 32,021

My purchase was at $17.25, near the 52 week low, and was made on 8/29/17:

Item # 5

https://tennesseeindependent.blogspot.com/2017/09/observations-and-sample-of-recent_3.html

Perhaps, when investors remember who controls TA's management they will lose some of their enthusiasm.

https://seekingalpha.com/article/4022836-travelcenters-america-q3-update-ongoing-stale-status-quo

I was going to write a comment this morning that the price of KWN, a 7.75% senior unsecured exchange traded bond, was consistent with a call at par value. I noticed this morning, when looking at my Fidelity account, that the symbol had changed to KWNCL. The last two letters stand for "call". The earliest redemption date is 12/1/2017 and that is the call date:

ReplyDeletehttp://www.businesswire.com/news/home/20171003006530/en/

I own 150 share bought at below par value and will simply hold until the issuer redeems at the $25 par value par plus any accrued and unpaid interest through the redemption date.

KWN is a junk rated bond (B2 and BB-).

The Merrill Lynch "High Yield" (i.e. junk) Effective Yield Index currently sits at 5.52%.

https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY

I view that yield as inadequate compensation for the credit risk.

After fully inquiry into what I owned, I found another 50 shares of KWN bringing my total up to 200 shares spread out over 3 accounts.

DeleteTillerson reportedly called Donald a "moron". It does not look like he will last much longer.

ReplyDeletehttps://www.nbcnews.com/politics/white-house/tillerson-s-fury-trump-required-intervention-pence-n806451

http://www.marketwatch.com/story/tillerson-called-trump-a-moron-and-had-to-be-talked-out-of-resigning-nbc-reports-2017-10-04

I would not use the word "moron". Instead I would use this phrase: "an ignorant and dangerous Demagogue suffering from a variety of serious mental problems". I would place the emphasis on ignorant rather than stupid.

A book containing a compilation of articles written by psychiatrists and psychologists that delve into Donald's many mental issues that make him unfit to be President was published yesterday:

https://www.amazon.com/Dangerous-Case-Donald-Trump-Psychiatrists/dp/1250179459

It is not necessary to be a professional IMO to make the same observations about his mental condition. It is only necessary to observe and to listen, and then exercise a modest amount of common sense based on a person's lifetime experiences.

Tillerson felt compelled to respond to the NBC news story. When asked directly whether he called Trump a "moron", Tillerson replied as follows:

Delete"The places I come from, we don't deal with that kind of petty nonsense. I'm just not going to be part of this effort to divide this administration."

I would call that a non-denial denial.

Trump viewed it as a denial however:

Tweet:

"The @NBCNews story has just been totally refuted by Sec. Tillerson and @VP Pence. It is #FakeNews. They should issue an apology to AMERICA!"

https://www.cbsnews.com/news/rex-tillerson-statement-today-leaving-resigning/

A report that the Secretary of State called the President a "moron" is not "petty stuff" as claimed by Tillerson unworthy of a news story.

Northwest Healthcare REIT:

ReplyDeleteI noticed that the shares were down about C$.40 earlier today which frequently indicates a stock public offering by this Canadian REIT.

That is the case today. The company sold 11.42M units (plus the standard greenshoe) at C$10.95.

"NorthWest intends to use the net proceeds of the offering, together with existing resources, to repay the secured operating facility in the amount of approximately $125 million, which was utilized by NorthWest to partially fund the acquisition of Generation Healthcare REIT ("GHC"); and the remainder, if any, for future acquisitions, repayment of additional high cost revolving debt and for general trust purposes."

http://phx.corporate-ir.net/phoenix.zhtml?c=235532&p=irol-newsArticle&ID=2304468

I currently own 400 units and have sold 1100 units so far this year. Of that amount 1000 units were sold at C$10.68 with the proceeds immediately converted into USDs:

Item # 1 A.:

https://tennesseeindependent.blogspot.com/2017/07/observations-and-sample-of-recent_31.html

Money talks:

ReplyDeletehttps://www.propublica.org/article/ivanka-donald-trump-jr-close-to-being-charged-felony-fraud

WBSPRE: This is another security that is currently being priced for a redemption in December.

ReplyDeleteThis equity preferred stock has a 6.4% coupon paid on a $25 par value. The Issuer, a solid regional bank, has the option to call at par on or after 12/15/17.

https://www.sec.gov/Archives/edgar/data/801337/000119312512485095/d442786d424b2.htm

While in my Schwab account, I noticed today that I owned 50 shares that had been bought slightly over par value so I used a commission free trade to sell at $25.32.

I will peck around some tomorrow to see whether I own more. My general rule of thumb is to sell if (1) i I have a cost basis over par value; (2) can realize a profit on the shares; (3) the shares are held at IB or in an account with commission free trades and (4) there is little or no advantage to wait for a redemption at par value.

My first purchase of this security was during the 2013 interest rate spike at $22.29:

Item # 4

https://tennesseeindependent.blogspot.com/2013/09/bought-300-of-artis-reit-at-c1436bought.html

I have published a new post:

ReplyDeletehttps://tennesseeindependent.blogspot.com/2017/10/observations-and-sample-of-recent.html