Basket Net Realized Gain as of 2/13/26: $43,900.77

Start Date 9/2013

The actual reported profit will be higher than shown above, since the snapshots below would not yet include any of the ROC adjustments occurring after the shares were sold and the snapshot taken.

For investors unfamiliar with publicly traded REITs, this NAREIT publication provides a good introduction. REIT-FAQ.pdf

As noted in that publication, publicly-traded REITs are a convenient way for individuals to invest in income-producing real estate.

The REIT structure requires the company to distribute at least 90% of its taxable income to its shareholders each year. Double taxation is avoided for that pass-through income. The REIT structure as a pass-through entity permits a larger dividend distribution than a regular "C" corporation could make after paying taxes on income at the corporate level before making a distribution from income.

However, money is flowing out the door with any pass-through entity like a REIT or BDC. Capital is not being retained to grow the business. Instead, capital is being continually raised through debt and stock sales.

I have been investing in REIT stocks for a long time, which does not make me an expert on this sector by any means.

Instead, as with other sectors where I routinely invest, I have simply become comfortable investing in this sector and have formed opinions over the years about the criteria for determining when and what to buy, and when to sell. I will never have that kind of comfort level when investing in technology that requires technical expertise that I do not have and have no desire to acquire.

My latest foray into REIT common and preferred stocks started in September 2013, soon after those securities were smashed in price. I viewed the price correction to be due primarily to excessive valuations reached after a multi-year up move that was aggravated significantly by a spike in interest rates that started soon after May 1, 2013, when the ten year treasury closed at a 1.66% yield. By year-end, the ten year yield had risen to 3.02% (12/31/13). Daily Treasury Yield Curve Rates

I noted this article published in January 2013: REITs: A word of caution | Vanguard Blog

The spike in interest rates in 2013 was not due to a rise in inflation or inflation expectations. Both CPI and inflation expectations fell during that rate spike period.

Instead, the rate spike was due to the first salvo in the interest rate normalization process.

The normal rate setting process undertaken by the market, which is governed primarily by inflation expectations and credit quality, was supplanted by the FED's manipulation of rates through its asset buying sprees and the maintenance of ZIRP since late 2008. The FED's balance sheet has grown to over $4.171+ trillion as of 10/1/14, the last data available before the publication of this post. System Open Market Account Holdings Federal Reserve Bank of New York Other central bank policies are contributing to the abnormally low rates on treasuries.

Just as an example, one of the foreign central banks heavily in the manipulation game has been the Swiss National Bank's ongoing creation of Swiss Francs and the purchase of Euros for the purpose of suppressing the rise of the CHF against the EUR. SNB Balance Sheet Data August 2014.pdf The newly created money is then invested in sovereign bonds (estimated CHF $471+B) that has been a contributing factor in abnormally low sovereign bond yields prevailing in Europe that makes the treasury yields look good comparatively. Consequently, this causes more demand for those securities at a time when the FED is hogging the supply (more than 50% ownership of most outstanding securities maturing in ten years or more).

A normal historical spread for a nominal 10 year treasury to the anticipated annual inflation rate is about 2%. That is not much of a real rate of return, unless the investor is extremely confident that deflation or very low inflation is more likely than a rate closer to the historical norms. Consumer Price Index, 1913- | The Federal Reserve Bank of Minneapolis As shown by historical data, inflation and periodic episodes of problematic inflation are the norm rather than deflation and/or persistently low inflation numbers (less than 1%). The exception was the period during the Great Depression. Chart 1913 to Date Consumer Price Index for All Urban Consumers

The ten year treasury's real rate of return before the rate spike occurred last year was in negative territory.

Even now, the current yield of the ten year TIP is fluctuating mostly between .25% to .5%. 10-Year Treasury Inflation-Indexed Security, Constant Maturity

{see also: 5-Year Treasury Inflation-Indexed Security, Constant Maturity; 20-Year Treasury Inflation-Indexed Security, Constant Maturity; 30-Year Treasury Inflation-Indexed Security, Constant Maturity-slightly over a 1% current yield}

To understand how REITs may react to a rise in rates, an investor can not simply compare a prior period, where rates were rising due to inflation and/or the FED's response to inflationary pressures, with a rate rise caused by interest rate normalization which is simply the return to the average real rate of returns over inflation expectations. A period when rates are rising due solely to interest rate normalization can have a greater impact on REITs compared to a period where rates are rising due to inflationary pressures. The reason has to do with the ability of the REIT to offset increases in borrowing costs with rent increases.

If CPI inflation remains subdued at less than 2%, and rates rise to normal levels (about 4% to 4.25% for the ten year given current inflation expectations), the REITs will have their borrowing costs potentially rise at a faster rate than their ability to recoup those costs through rent increases tied to the CPI. Most commercial mortgages have relatively short terms and REITs are constantly having to refinance loans and debt obligations.

One potential problem is that REIT prices are currently above the average historical P/FFO. The Lazard firm publishes a monthly report, accessible over the internet, that has charts showing historical P/FFO as well as other valuation metrics. When I click my bookmark to that site, I am taken to the most recent report rather than the one originally bookmarked. USRealEstateIndicatorsReport .pdf

As of August 2014, that report shows REITs were selling a 5% premium to their underlying net asset value and at a P/FFO of approximately 17.8 vs. the historical average of 16. That historical average has been rising due to the recent market prices. When I first started to look at this report, the long term average was around 15.5.

Overall, I would anticipate a high positive correlation between the ten year treasury and REIT prices under current and reasonably anticipated economic conditions. Their yields have fallen with a rebound in prices during 2014 to the publication date of this post.

However, starting in late August 2014 until late September, there was a slight increase in the ten year treasury yield that had a significant negative impact on REIT price. Market price declines were across the board starting in late August. The Vanguard REIT ETF (VNQ) had a total return of -5.78% for the 30 day period ending on 10/3/14.

There are many pundits who have published articles that reach a contrary conclusion, asserting that it is the myth that REIT stocks will be hurt by rising rates. Seeking Alpha-Larry Swedroe July 2014; WSJ Article-Published January 2014 Summarizing a NAREIT Report; Lazard Report March 2014-Misperceptions about Rising Rates and REIT Prices.pdf; The Myth of REIT Interest-Rate Risk-By Brad Thomas published at TheStreet.Pdf

The kind of analysis performed by those investors and the trade organization for REITs do not take the historical record in context by examining all of the relevant criteria impacting REIT operating performance and share price: (1) the valuations when interest rates start to rise; (2) the underlying causes of the interest rate rise (rate normalization, federal reserve tightening cycle, inflation increases); (3) whether short term and intermediate term rates are both rising or whether short term rates are rising (2004-2006) while intermediate and long term rates remain relatively stable (refinancing costs remain about the same); (4) the size of the rate increases across the maturity spectrum in relation the then current REIT yields and investor inflation expectations during such a period; (5) the timing of refinancing in relation to the size and speed of the rate rise; (6) the relative actual and reasonably anticipated potential GDP growth; (7) whether or not there has been above or below normal construction of new buildings prior to the rise in rates; (8) whether the overall stock market is in a bull or bear cycle; and I could on and on.

In other words, when taking historical parallels, a sophisticated investor can not take one variable in isolation from all other material variables that impact price and performance. Each time period can have material differences that will impact the outcome other than merely comparing rising interest rate periods with one another which is nothing more or less than a crutch for a more difficult and accurate analysis.

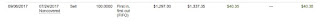

In this post, I will be adding from time to time snapshots of my realized gains and losses from the REIT basket, starting only with the purchases made in September 2013 and thereafter, until I abandon this sector basket altogether with a liquidation.

This basket strategy does not include MREITs.

The profits/losses from Canadian REITs will be impacted for tax reporting purposes by the currency conversion rates in existence at the time of purchase and sale. I am buying those securities with CADs and receiving the sale proceeds in CADs. The reportable profit will depend, however, on the conversion values at the time of purchase and disposition. In cases so far, my reportable taxable profit is significantly less than my actual CAD profit.

The Canadian REITs do have currency risks for a U.S. investor. All pay monthly distributions and generally have higher yields based on CAD payments than the U.S. REITs. Given the decline in the CAD since hitting a high back in 2011, the value of the distribution is less since the CAD dividend buys fewer USDs, in effect resulting in a dividend cut after the conversion. For me, this results only in a lower reportable taxable distribution since I am being paid in CADs.

A U.S. investor who buys these securities on the U.S. pink sheet exchange or the Grey Market (a dark market), using USDs, will receive the distribution payment after the conversion from CADs into USDs and the withholding tax.

Since dividends/distributions are an important component of total return in this basket, I will compute the amounts annually. The totals for the Canadian securities will consist of the reportable taxable amounts in USDs which will be lower than what I received in CADs whenever the CAD is worth less than 1 USD.

Profit snapshots will be divided into common and preferred share classes.

Some USD tax profits realized from Canadian REIT sales are estimated.

Equity REIT Common Shares:

Trades made after 5/3/15 will not have blog links and will be discussed generally in a periodic update published at my SA Instablog site noted above:

Fidelity converts CADs into USDs immediately after the sell transaction. For Canadian and Australian REITs bought in their local currencies in my Interactive Brokers Account, the profit or loss is expressed in CADs or AUDs and then an approximate profit/loss in USDs is calculated for purposes of my running total here only.

The equity REIT preferred stock snapshots appear after the common share snapshots. Over the last several years, most of the trades have utilized commission-free trades.

Gains at over $500:

U.S. REITs only:

6. Bluerock Residential Growth REIT = $1,620.86. Acquired

11. New Senior Investment Group = $879.17. Acquired.

*HR acquired HTA in a reverse merger where HTA was the surviving entity. The name was then change to Healthcare Realty with the HR symbol.

** Healthpeak acquired Physicians Realty and then changed its symbol to DOC and kept its name as Healthpeak.

Profits greater than $200 are highlighted in green.

(WPC realized gain at $484.03 as of 2/5/26)

All losses are highlighted in red.

RI = Roth IRA Account

REIT Common Stocks/Funds:

2026

|

| 2026 PINE 5 Shares +$23.33 |

|

| 2026 PINE 17+ Shares +$78.16 |

|

| 2026 UDR 24+ Shares +$100.07 |

|

| 2026 UDR 16 Shares +$60.32 |

|

| 2026 BNL 5 Shares +$21.29 |

|

| 2026 IGR 50 Shares +$35.49 |

|

| 2026 GTY 5 Shares +$13.83 |

|

| 2026 GTY 5 Shares $14.53 |

|

| 2026 GTY 5 Shares +$5.27 RI |

|

| 2026 PINE 7 Shares +$24.08 |

|

| 2026 NTST 5 Shares +$21.71 |

|

| 2026 WPC 10+ Shares +$62.94 |

|

| 2026 GTY 5 Shares +$8.18 |

|

| 2026 CTO 3 Shares +$2.55 |

|

| 2026 STAG 5 Shares +$92.61 |

|

| 2026 OLP 5 Shares +$9 |

|

| 2026 PINE 10 Shares +$6.95 |

|

| 2026 INVH 10 Shares +$9.62 |

|

| 2026 PLYM 20+ Shares +$142.84 |

|

| 2026 PLYM 20 Shares +$144.65 |

|

| 2026 PLYM 5 Shares +$33.38 RI |

2025

|

| 2025 AX.UN:CA 200 Shares +C$20 |

|

| 2025 IRM 2 Shares +$161.38 |

|

| 2024 HR 20+ Shares +$27.11 |

|

| 2025 HPP 100+ Shares -$680.31 (price before 1 for 7 reverse split) |

|

| 2025 NTST 5 Shares +$17.34 |

|

| 2025 LXP 5 Shares +$6.3 |

|

| 2025 LXP 30 Shares +$13.42 |

|

| 2025 ILPT 30 Shares +$80.24 |

|

| 2025 HIW 3 Shares +$32.52 |

|

| 2025 WPC 10 Shares Net +$28.81 RI |

|

| 2025 NTST 16 Shares +$41.6 |

|

| 2025 BNL 15 Shares +$54.62 |

|

| 2025 PLYM 10 Shares $53.3 |

|

| 2025 PLYM 10 Shares +$46.65 |

|

| 2025 PLYM 5 Shares +$21.62 RI |

|

| 2025 PLYM 5 Shares $38.56 RI |

|

| 2025 SBRA 5 Shares +$30.53 |

|

| 2025 PDM 33+ Shares -$60.8 |

|

| 2025 HIW 11+ Shares +$96.1 |

|

| 2025 CHCT 3 Shares +$5.86 RI |

|

| 2025 CHCT 5 Shares +$3.14 |

|

| 2025 WPC 30 Shares +$229.73 |

|

| 2025 WPC 10 Shares +$93.34 |

|

| 2025 HR 9+ Shares +$10.32 |

|

| 2025 ARE 2 Shares +$18.64 RI |

|

| 2025 ILPT 20 Shares -$274.95 |

|

| 2025 PDM 82+ Shares +$56.65 |

|

| 2025 STAG 5 Shares $79.82 |

|

| 2025 IGR 50 Shares +$44.57 |

|

| 2025 GNL 9 Shares $5.99 |

|

| 2025 GMRE 10 Shares +$3.68 |

|

| 2025 HR.UN:CA +C$304 |

|

| 2025 NTST 10 Shares +$10.3 |

|

| 2025 STWD 10 Shares +$49.09 |

|

| 2025 SBRA 5 Shares +$27.51 |

|

| 2025 MPW 20 shares -$289.59 |

|

| 2025 NTST 10 Shares +$3.95 |

|

| 2025 SBRA 10 Shares $50.29 |

|

| 2025 SBRA 22 Shares +98.46 |

|

| 2025 STAG 10 Shares +$149.57 |

|

| 2025 PDM 50 Shares -$208.63 |

|

| 2025 BNL 5 Shares +$5.7 |

|

| 2025 GOOD 10 Shares +$54.53 |

|

| 2025 STAG 10 Shares +$165.13 |

|

| 2025 HIW 5 Shares +$29.77 |

|

| 2025 LXP 20 Shares +$20.62 |

|

| 2025 O 5 Shares +$34.36 |

|

| 2025 MAA 5 Shares $220.26 |

|

| 2025 HIW 11 Shares +$87.9 RI |

|

2025 SBRA 10 Shares +$34.43

|

|

| 2025 NSA 5 Shares +$7.24 RI |

|

| 2025 GOOD 1 Share +$4.42 RI |

|

| 2025 WPC 5 Shares +$7.45 |

|

| 2025 LXP 5 Shares +$2.51 RI |

|

| 2025 LXP 40 Shares +$6.65 |

|

| 2025 NSA 10 Shares +$24.05 |

|

| 2025 NSA 5 Shares +$6.18 |

|

| 2025 NSA 2 Shares +$1.46 RI |

|

| 2025 EPRT 1+ Shares +$13.35 RI |

|

| 2025 APLE 3 Shares +$3.6 RI |

|

| 2024 WPC 15 Shares Net of $12.66 |

|

| 2025 WPC 4+ Shares +$7.44 |

|

| 2025 CTO 4 Shares +$10.17 |

|

| 2025 CTO 2 Shares +$5.71 |

|

| 2025 WPC 4 Shares +$15.76 |

2024

|

| 2024 OPI 50+ Shares -$507.46 |

|

| 2024 HR 14+ Shares +$56.05 |

|

| 2024 ILPT 10 Shares -$155.88 |

|

| 2024 CTO 13 Shares +$12.89 |

|

| 2024 CUBE 1 Share +$28.48 |

|

| 2024 GOOD 3 Shares +$14.74 |

|

| 2024 PDM 15 Shares -$32.92 |

|

| 2024 SBRA 5 Shares +$31.47 |

|

| 2024 STWD 5 Shares +$4.13 |

|

| 2024 EPRT 5 Shares +$48.81 |

|

| 2024 CTO 10 Shares -$13.48 |

|

| 2024 SBRA 10 Shares +$46.4 |

|

| 2024 SBRA 7 Shares +$32.77 |

|

| 2024 HIW 2 Shares $22.8 |

|

| 2024 CTO 5 Shares +$6.11 |

|

| 2024 SBRA 2 Shares +$7.77 |

|

| 2024 DEI 30 Shares +$32.56 |

|

| 2024 HIW 5 Shares +$45.89 |

|

| 2024 HIW 10 Shares +$4.71 |

|

| 2024 PDM 10 Shares -$18.36 |

|

| 2024 CLPR 17+ Shares +$27.89 RI |

|

| 2024 CLPR 35 Shares +$12.63 RI |

|

| 2024 KRG 25 Shares +$112.08 |

|

| 2024 CLPR 294+ Shares +$154.52 |

|

| 2024 CLPR 20 Shares +$36.24 |

|

| 2024 BXP 3 Shares +$29.14 RI |

|

| 2024 PDM 5 Shares -$22.53 |

|

| 2024 BNL 5 Shares +$15.86 |

|

| 2024 GOOD 2 Shares +$7.28 |

|

| 2024 SBRA 5+ Shares +$21.73 |

|

| 2024 BDN 20 Shares -$55.13 |

|

| 2024 BDN 10 Shares -$50.75 |

|

| 2024 NSA 5 Shares +$52.95 |

|

| 2024 KRG 5 Shares +$21.8 |

|

| 2024 GNL 5 Shares +$1.04 |

|

| 2024 O 5 Shares +$46.52 |

|

| 2024 EPRT 5 Shares +$24.84 |

|

| 2024 SBRA 20 Shares -$28.11 |

|

| 2024 OLP 5 Shares +$28.48 |

|

| 2024 STAG 10 Shares +$199.74 |

|

| 2024 SBRA 15+ Shares +$19.23 |

|

| 2024 PINE 15 Shares +$3.35 |

|

| 2024 EPRT 4 Shares +$14.62 |

|

| 2024 EPRT 3+ Shares +$8.3 RI |

|

| 2024 STWD 4+ Shares +$27.88 |

|

| 2024 KRG 3 Shares +$5.97 |

|

| 2024 NSA 10+ Shares $69.74 RI |

|

| 2024 NSA 5 Shares +$23.15 |

|

| 2024 O 3 Shares +$4.44 RI |

|

| 2024 NNN 4 Shares +$24.64 RI |

|

| 2024 OLP 5 Shares +$16.38 |

|

| 2024 NSA 7 Shares +$44.76 |

|

| 2024 NSA 7 Shares +$37.45 RI |

|

| 2024 EQR 2 Shares +$18.29 |

|

| 2024 O 5 Shares +$13.74 |

|

| 2024 IRM 5 Shares +$407.72 |

|

| 2024 PDM 31 Shares +$45.52 |

|

| 2024 NNN 1+ Share +$7.74 |

|

| 2024 O 2 Shares +$1.04 |

|

| 2024 CTO 25 Shares +$12.04 |

|

| 2024 GOOD 5 Shares +$14.2 |

|

| 2024 LXP 20 Shares +$23.61 |

|

| 2024 ALEX 10 Shares +$34.6 RI |

|

| 2024 ALEX 11 Shares +$37.5 |

|

| 2024 BNL 10 Shares +$16.38 |

|

| 2024 BNL 6 Shares +$5.61 RI |

|

| 2024 NNN 3 Shares $13.22 RI |

|

| 2024 CTO 10 Shares +$2.91 |

|

| 2024 EPRT 8+ Shares +$26.47 |

|

| 2024 EPRT 2 Shares +$4.63 RI |

|

| 2024 PINE 11 Shares +$21.07 |

|

| 2024 LXP 20 Shares +$32.25 |

|

| 2024 STAG 10 Shares +$189.88 |

|

| 2024 OLP 5 Shares +$18.5 RI |

|

| 2024 IIPR 2 Shares +$71.84 |

|

| 2024 MAA 2 Shares +$9.07 |

|

| 2024 BRT 25 Shares +$64.17 |

|

| 2024 SBRA 14+ Shares +$25.41 |

|

| 2024 OLP 5 Shares +$2.4 |

|

| 2024 STAG 10 Shares +$249.22 |

|

| 2024 PEAK 7 Shares +$26.66 RI |

|

| 2024 NLOP 2 Shares +$12.92 |

|

| 2024 DOC 61+ Shares Net of +$39.05 |

|

| 2024 O 5 Shares +$4.48 |

|

| 2024 HIW 5 Shares +$12.75 RI |

|

| 2024 NNN 1 Share +$3.79 RI |

2023:

|

| 2023 IGR 180 Shares +$253.41 |

|

| 2023 IGR 10 Shares +$8.17 |

|

| 2023 SLG 36+ Shares +$35.68 |

|

| 2023 DOC 18 Shares +$8.36 RI |

|

| 2023 GOOD 16 Shares +$65.88 |

|

| 2023 DOC 3+ Shares +$3.4 RI |

|

| 2023 PEAK 15 Shares +5.6 |

|

| 2023 PLYM 5 Shares +$47.83 RI |

|

| 2023 SBRA 25 Shares +$26.59 |

|

| 2023 WPC 5 Shares +$59.5 |

|

| 2023 STAG 50 Shares +$1,074.13 |

|

| 2021 PLYM 20 Shares +$212.59 |

|

| 2023 SLG 20+ Shares +$68.26 |

|

| 2023 STAG 1 Share +$14.25 RI |

|

| 2023 WPC 1 Share +$2.65 RI |

|

| 2023 GMRE 15 Shares +$31.42 |

|

| 2023 EPRT 13+ Shares +$32.9 |

|

| 2023 VNO 34+ Shares +$19.43 |

|

| 2023 GOOD 26+ Shares Net of $128.61 |

RTL Elimination: 3 Taxable Accounts = $220.55

|

| 2023 PCH 5 Shares +$7.5 |

|

| 2023 GNL 19+ Shares +$40.41 RI |

|

| 2023 RTL 26+ Shares +30.05 RI |

|

| 2023 OHI 17+ Shares +$43.55 |

|

| 2023 HR 5 Shares +$3.2 |

|

| 2023 GNL 20+ Shares +$72.33 |

|

| 2023 GNL 28 Shares +$148.11 |

|

| 2023 GMRE 20 Shares +$33.87 |

|

| 2023 IRM 3 Shares +$98.68 |

|

| 2023 LXP 20+ Shares +$33.97 |

|

| 2023 LXP 7 Shares +$9.43 RI |

|

| 2023 DIR.UN:CA +C$653 |

|

| 2023 GMRE 15 Shares +$3.39 |

|

| 2023 REET 24+ shares +$71.38 |

|

| 2023 STWD 13 Shares +$87.37 |

2022:

|

| 2022 GTY 30 Shares + $191.46 |

|

| 2022 GTY 5 Shares +$43.82 |

|

| 2022 MAC 10 Shares +$42.01 |

|

| 2022 OHI 4+ Shares +$13.02 RI |

|

| 2022 OHI 6 Shares Net of +3.46 RI |

|

| 2022 OHI 3 Shares +$9.55 |

|

| 2022 GTY 1 Share +$5.79 |

|

| 2022 IRM 1 Share +$29.61 |

|

| 2022 CLPR 4+ Shares +$8.38 RI |

|

| 2022 LTC 3+ Shares +$17.44 RI |

|

| 2022 CTT 15+ shares +$10.33 |

|

| 2022 OHI 6 Shares +$2.72 |

|

| 2022 IRM 19+ Shares +$631.54 |

|

| 2022 HTA 20 Shares +$198.37 |

|

| 2022 HIW 5 Sharess +$6.79 RI |

|

| 2022 AX.UN:CA 200 units +C$165.5 |

|

| 2022 HIW 7 Shares +$15.31 |

|

| 2022 BRG 20+ Shares +$454.86 |

|

| 2022 BRG 2+ Share +$34.54 RI |

|

| 2022 HR 4 Shares +$8.58 RI |

|

| 2022 LTC 2 Shares + $21.86 RI |

2021:

|

| 2021 DEA 22+ shares +$18.32 |

|

| 2021 PDM 34+ shares +$210.28 |

|

| 2021 PDM 10+ Shares +$63.22 |

|

| 2021 PDM 10 Shares +$65.73 |

|

| 2021 BDN 15+ Shares +$58.12 |

|

| 2021 BDN 21+ shares +$98.17 |

|

| 2021 OPI 10+ Shares +$54.13 |

|

| 2021 CLPR 20 Shares +$35.84 |

|

| 2021 BRG 3 Shares +$14.19 RI |

|

| 2021 CXP 57+ Shares +$304.86 |

|

| 2021 PDM 5 Shares +$25.6 |

|

| 2021 RIOCF 20 Shares +$139.02 |

|

| 2021 IRM 25+ shares +$327.08 |

|

| 2021 HTA 10 shares +$96.87 |

|

| 2021 HTA 2 Shares +$19.22 RI |

|

| 2021 CXP 10 Shares +$85.4 |

|

| 2021 CXP 10 Shares +$30.75 |

|

| 2021 CXP 3 Shares +$25.02 RI |

|

| 2021 CXP 4+ Shares +$30.48 RI |

|

| 2021 CUBE 4 Shares +$108.54 |

|

| 2021 IGR 162+ Shares +$173.59 |

|

| 2021 NWHUF 50 Shares +$193.76 |

|

| 2021 MAC 10 Shares +$38.47 |

|

| 2021 PLYM 10 Shares +$108.09 |

|

| 2021 PLYM 10 Shares +$108.89 |

|

| 2021 NWHUF (Canadian REIT/USD Priced) 350 Units +$965.98 |

|

| 2021 VNQ 1 Share +$18.71 RI |

|

| 2021 IRM 1 Share +$24.34 |

|

| 2021 GNL 50+ shares +$96.81 |

|

| 2021 GOOD 5+ Shares +$20.77 |

|

| 2021 PLYM .818 Share +$3.57 |

|

| 2021 GNL 9 Shares +$8.56 RI |

|

| 2021 MAC 5 Shares +$10.91 |

|

| 2021 VNO 5+ shares +$69.4 |

|

| 2021 PDM 1 Share +$2.27 |

|

| 2021 IRM 6 Shares +$72.42 |

|

| 2021 BRT 4 Shares +$34.69 |

|

| 2021 IRM 5 Shares +$48.12 |

|

| 2021 STAG 4 Shares +$32.49 |

|

| 2021 BXP 2 Shares +$19.52 |

|

| 2020 CIO 20 Shares +$92.42 |

|

| 2021 BDN 50 Shares +$7.72 |

|

| 2021 APLE 90+ shares +$29.49 |

|

| 2021 PEAK 15 Shares +$38.01 |

|

| 2021 SKT 50 SHARES +$185.84 |

|

| 2021 SLG 6+ Shares +$128.97 |

|

| 2021 SLG 2+ Shares +$49.44 |

|

| 2021 DEA 4 Shares + $5.47 |

|

| 2021 PEAK 3 Shares +$6.8 |

|

| 2021 VNO 2 Shares +$14.88 |

2020

|

| 2020 IGR 9 Shares $4.99 |

|

| 2020 SKT 124+ Shares -$207.35 |

|

| 2020 PDM 10 Shares +$1.46 |

|

| 2020 HT 86+ shares -$294.59 |

|

2020 CXP 20 Shares +$17.84

|

|

2020 ARESF 280 Shares +$77.08

|

|

2020 AIV 11 Shares +$18.19

|

|

2020 JCAP 93+ Shares +$127.02

|

|

2020 JCAP 124+ Shares +$148.18

|

|

| 2020 MNR 10 Shares +$37.44 |

|

| 2020 MNR 10 Shares +$24.63 |

|

| 2020 HTA 62 Shares +$351.78 |

|

| 2020 HT 10 Shares +$10.27 |

|

| 2020 67+ VTR Shares +$126.99 |

|

| 2020 BPYU 10 Shares +$9.39 |

|

| 2020 CLDT 72+ Shares -540.21 |

|

| 2020 SLG 8 Shares +$38.48 |

|

| 2020 RLJ 55+ Shares -$194.03 |

|

| 2020 STWD 10 Shares+$47.74 |

2019:

|

| 2019 IGR 100 Shares +$42.98 |

|

| 2019 HTA 10 Shares +$39.2 |

|

| 2019 GNL 50 Shares +$1.42 |

|

| 2019 SBRA 134+ Shares +$6.27 |

|

| 2019 SBRA .6365 Share +$1.48 |

|

| 2019 AHT 102+ Shares +$11.35 |

|

| 2019 SNR 398+ Shares +$256.55 |

|

| 2019 DEA 10 Shares (11/6 sell) +$47.24 |

|

| 2019 HT 35 Shares +$34.98 |

|

| 2019 BDN 100 Shares +$100.4 |

|

| 2019 JCAP 50 shares +$25.87 |

|

| 2019 VICI 50 Shares +$40.02 |

|

| 2019 SKT 50 Shares +$38.48 |

|

| 2019 IRM 50 Shares +$17.46 |

|

| 2019 DEA 62+ Shares +$62.75 |

|

| 2019 DEA 10 Shares +$11.63 |

|

| 2019 IRT 150 Shares +$799.79 |

|

| 2019 LXP 155+ Shares +$6.37 |

|

| 2019 IRT 121+ Shares +$427.88 |

|

| 2019 IRT 127 Shares +$362.17 |

|

| 2019 DIR.UN:CA 100 Shares +C$215 |

|

| 2019 GOOD 30 Shares +$71.74 |

|

| 2019 GOOD 50+ Shares +$93.49 |

|

| 2019 VNQ 10 Shares +$98.73 |

|

| 2019 LXP 108+ Shares +$79.9 |

2018:

2017:

|

| 2017 MPW 50 Shares +$60.37 |

|

| 2017 DEA 50 Shares +$97.85 |

|

| 2017 APLE 50 Shares +$70.52 |

|

| 2017 SIR 50 Shares +$126.48 |

|

| 2017 XRE:CA 150 Shares +C$47 |

|

| 2017 BRG 50 SHARES +$150.85 |

|

| 2017 SGP:AU 500 Shares +A$63 |

|

| 2017 ZRE:CA 100 Shares +C$45 |

|

| 2017 APLE 50 Shares +$32.47 |

|

| 2017 LXP 50 Shares +$50.54 |

|

| 2017 ARESF 100 Shares +$109.48 |

|

| 2017 LXP 50 Shares +$38.52 |

|

| 2017 D.UN -$1,641.3 |

|

| 2017 OHI 39 Shares +$63.24 |

|

| 2017 Roth IRA 100 Shares MPW +$40.35 |

|

| 2017 NWHUF 100 Shares +$106.98 |

|

| 2017 SNR 100 Shares +$50.77 |

|

| 2017 NWH.UN:CA 1000 Shares +USD$606.31 |

|

| 2017 100 DRG.UN:CA +C$121 |

|

| 2017 ARESF 100 Shares +$22.37 |

|

| 2017 DUNDF 500 Shares USD +$127.43 |

|

| 2017 XHR 50+ Shares +$171.95 |

|

| 2017 OHI 107 Shares +$211.51 |

|

| 2017 LXP 100 Shares +$20.08 |

|

| 2017 APLE 100 Shares +$24.85 |

|

| 2017 GMRE 50 Shares +$82.54 |

|

| 2017 Roth IRA MPW 50 Shares +69.99 |

|

| 2017 Roth IRA OHI 52+ Shares +$66.63 |

Three Australian REITs: USD Profit About USD$196

|

| 2017 GHC.AU and SGP.AU +A$192.36 |

|

| 2017 GPT.AU 500 Shares +A$65.5 |

|

| 2017 Roth IRA 52+ Shares OHI +$66.23 |

|

| 2017 AX.UN-CA 200 Unites +C$96.5 (about $73.34 USD reportable) |

|

| 2017 Roth IRA 100 LXP +$271.9 |

|

| 2017 ROTH IRA APLE 50+ SHARES +$24.46 |

2016:

|

| 2016 ACRVF 100 Shares $100.76 (CAD Profit C$252) |

|

| 2016 GMRE 100 Shares +$77.77 |

|

| 2016 GMRE 50 Shares $43.98 |

|

| 2016 Roth IRA LXP 500 Shares +$301.81 |

|

| 2016 Roth IRA 100+ APLE +$81.18 |

|

| 2016 CBL 50 Shares $74.64 |

|

| 2016 RIOCF 100 Shares +$71.74 |

|

| 2016 IRET 100 Shares +$8.93 |

|

| 2016 LXP 100 SHARES +$99.23 |

|

| 2016 BRG 100 Shares +$192.85 |

|

| 2016 HT 50 Shares +$95.47 |

|

| 2016 HT 100 Shares +$53.81 |

|

| 2016 XHR 50 Shares +$90.48 |

|

| 2016 Roth IRA XHR 50 Shares +$58.03 |

|

| 2016 XHR 50 Shares +$45.41 |

|

| 2016 MPW 200 Shares +$272.73 |

|

| 2016 MPW 107+ Shares +$136.74 |

|

| 2016 WIR.U 100 Shares +$80.27 |

|

| 2016 GPT 396+ Shares +$773.09 |

|

| 2016 ROTH IRA CCP 30 SHARES +$162.08 |

|

| 2016 BRG 101+ Shares +$145.12 |

|

| 2016 OHI 101+ Shares +$887.91 |

|

| 2016 SNR 100 Shares +$210.47 |

|

| 2016 ROTH SNR 50 Shares +$103.49 |

|

| 2016 ROTH IRA IRT 50 Shares +$100.99 |

|

| 2016 Roth IRA BRG 100 Shares +$38.47 |

|

| 2016 Roth IRA CBL 50 Shares +$14.03 |

|

| 2016 OHI 50 Shares +$117.6 |

|

| 2016 Roth IRA 50 Shares OHI +$73.05 |

|

| 2016 BRG 220+ Shares +$245.32 |

|

| 2016 STAG 42 Shares +$271.31 |

|

| 2016 CIO 100 Shares +$207.97 |

|

| 2016 SNR 100 Shares +$23.07 |

|

| 2016 SNR 108+ Shares +$38.79 |

|

| 2016 Roth IRA 50 IRT Shares +$31.2 |

|

| 2016 Roth IRA 50 IRT Shares +$23.07 |

|

| 2016 Roth IRA IRT 200 Shares +$86.28 |

|

| 2016 HCP 52+ Shares -$34.67 |

|

| 2016 HCP 50 Shares -$36.22 |

|

| 2016 IRT 200 Shares +80.46 |

|

| 2016 BRG 100 Shares +$38.59 |

|

| 2016 STAG 54 Shares +$318.54 |

|

| 2016 Roth IRA 50 RNP $91.03 |

|

| 2016 MPW 52 Shares +$112.02 |

|

| 2016 Roth IRA 100 LXP +$80.19 |

|

| 2016 STAG 50 Shares $48.31 |

|

| 2016 FREL 75 Shares +$144.26 |

|

| 2016 Roth IRA STAG 52 Shares +$31.06 |

|

| 2016 Roth IRA 50 MPW $84.99 |

|

| 2016 MPW 101+ SHARES +$261.97 |

|

| 2016 MPW 100 Shares +$49.68 |

|

| 2016 MPW 100 Shares +$17.36 |

|

| 2016 NPRUF 200 Shares +$173.76 |

|

| 2016 BDN 100 Shares +$55.5 |

|

| 2016 GPT 112+ Roth IRA +$25.09 |

|

| 2016 RNP 50 Shares +$88.48 |

|

| 2016 IRM 50 shares +$398.06 |

|

| 2016 LXP 100 Shares +$90.68 |

|

| 2016 LXP 150 Shares +$133.97 |

|

| 2016 SRC 154+ Shares +$66.92 |

|

| 2016 VNQ 10 Shares +$72.63 |

|

| 2016 STAG 133 Shares +$125.27 |

|

| 2016 GPT 313+ Shares +$133.52 |

|

| 2016 Roth IRA HT 50 Shares +$22.54 |

|

| 2016 GPT 386 Shares +$52.98 |

|

| 2016 CIO 50 SHARES +$61.04 |

|

| 2016 RIOCF 50 Shares +$12.32 |

|

| 2016 Realty Income (O) 100 Shares +$1,579.5 |

|

| 2016 IRC 204+ Shares +$191.11 |

2015:

+++++++++++++

Equity REIT Preferred Shares:

BRGPRA snapshots from the later part of 2020 were the result of two separate issuer partial redemptions occurring in multiple accounts. The full call occurred in 2021.

PLYMPRA: Called at $25 Par Value on 9/6/23 (owned in 3 accounts with purchases at a $25 per share Total Cost)

|

| 2025 VNOPRM 5 Shares +$12.05 |

|

| 2025 VNORPM 5 Shares - $10.57 |

|

| 2025 CODIPPRA - $142.26 |

|

| 2025 CTOPRA 8 Shares +$15.62 RI |

|

| 2025 EPRPRC 20 Shares +$87.13 |

|

| 2025 NSAPRA 10 Shares +$9.03 |

|

| 2025 NSAPRA 10 Shares +$4.8 |

|

| 2025 EPRPRC 10 Shares +$40.2 |

|

| 2025 EPRPRC 5 Shares +$18.35 RI |

|

| 2025 VNOPRM 10 Shares +$19.51 |

|

| 2025 SLGPRI 5 Shares +$.7 RI |

|

| 2025 UMBPRD 5 Shares +$6.25 RI |

|

| 2025 ERPPRC 10 Shares $19.94 RI |

|

| 2025 EPRPRC 5 Shares +$14.18 |

|

| 2024 ADCPRA 10 Shares +$9.68 |

|

| 2025 UMHPRD 10 Shares +$18.66 |

|

| 2025 REXRPRB 15 Shares +$30.64 |

|

| 2025 REXRPRC 30 Shares $37.23 |

|

| 2024 HPPPRC 15 Shares +$25.1 |

|

| 2024 HPPPRC 125 Shares $174.34 |

|

| 2024 VNOPRM 5 Shares -$25.3 |

|

| 2024 HPPPRC 15 Shares -$21.4 |

|

| 2024 VNOPRM 5 Shares +$7.45 |

|

| 2024 CIOPRA 35 Shares +$75.32 |

|

| 2024 HPPPRC 25 Shares +$36.06 |

|

| 2024 HPPPRC 40+ Shares +$119.81 |

|

| 2024 EPRPRC 21 Shares Net of +$26.54 |

|

| 2024 SLGPRI 15 Shares +$62.49 |

|

| 2024 HPPPRC 10 Shares +$2 |

|

| 2024 HTIA 20 Shares +$45.87 |

|

| 2023 GNLPRD 25 Shares +$114.31 |

|

| 2023 GOODN 10 Shares +$5.5 RI |

|

| 2023 HPPPRC 10 Shares +$6.92 RI |

|

| 2023 CIOPRA 10 Shares +$42.5 |

|

| 2023 HTIA 10 Shares +$2.92 RI |

|

| 2023 CIOPRA 3 Shares +$2.47 RI |

|

| 2022 MNRPRC 80 Shares +$301.52 (issuer redemption at $25 par value) |

|

| 2021 GOODM 20 shares +$115 |

|

| 2021 BRGPRA 15 Shares +$130.64 |

|

| 2021 BRPRA 20 Shares +$80.34 |

|

| 2021 BRGPRA 4 Shares +$41.64 |

|

| 2021 BRGPRA 1 Share +$9.86 |

|

| 2021 HTPRD 50 Shares +$21.65 |

|

| 2021 AHTPRI 50 Shares +$22.62 |

|

| 2020 BRGPRA 17 Shares +$50.51 |

|

| 2020 BRGPRA 3 Shares +$34.5 |

|

| 2020 BRGPRA 1 Share +$9.09 |

|

| 2020 BRGPRA 75 Shares +$150.25 |

|

| 2020 VNOPRM 11 Shares +$72.21 |

|

2020 BRGPRA 2 Shares +$23

|

|

2020 BRGPRA 13 Shares +$38.29

|

|

| 2020 BPYUP 10 Shares +$46.29 |

|

2020 SLGPRI 20 Shares +$122

|

|

2020 CIOPRA 30 Shares +$78.16

|

|

2020 HTPRD 50 Shares +$85.89

|

|

2020 JCAPPRB 5 Shares +$37.05

|

|

2020 JCAPPRB 10 Shares +$77.59

|

|

2020 JCAPPRB 30 Shares +$155.07

|

|

| 2020 GNLPRB 105 Shares +$63.54 |

|

| 2020 EPRPRC 25 Shares +$91.49 |

|

| 2020 VNOPRM 5 Shares +$29.94 |

|

| 2020 AHTPRI 50 Shares -$587.54 |

|

| 2020 JCAPPRB 10 Shares +$6.99 |

|

| 2020 AHTPRI 50 Shares +$3.22 |

|

| 2020 ROTH IRA HTPRD 50 shares +$271.47 |

|

| 2019 HTPRD 50 Shares +$161.46 |

|

| 2019 MNRPRC 100 SHARES +$76.24 |

|

| 2019 BHRPRD 50 Shares +$251.44 |

|

| 2019 HTPRD 50 Shares +$64.02 |

|

| 2019 EPRPRG 50 Shares +$149.68 |

|

| 2019 GMREPRA 70 Shares +$208.36 |

|

| 2019 DLRPRJ 60 Shares +$171.78 |

|

| 2019 CIOPRA 50 Shares +$155.22 |

|

| 2019 AHTPRI 50 Shares +$15.7 |

|

| 2019 PSAPRE 50 Shares +$178.48 |

|

| 2019 VNOPRM 50 Shares +$56.68 |

|

| 2019 CIOPRA 50 Shares +$20.86 |

|

| 2019 Roth IRA 50 HTPRD +$38.49 |

|

| 2019 MNRPRC 50 Shares +$23.75 |

|

| 2019 GMREPRA 30 Shares +$9.79 |

|

| 2018 REXRPRB 30 Shares +$49.82 |

EPRPRC 150 shares +$402.73