Economy:

The government reported that real GDP increased at a 5.2% annual rate in the third quarter, up from 4.9% in its first estimate. Gross Domestic Product (Second Estimate) Corporate Profits (Preliminary Estimate) Third Quarter 2023 | U.S. Bureau of Economic Analysis (BEA)

PCE up 3.6%:Personal Income and Outlays, October 2023 | U.S. Bureau of Economic Analysis (BEA)

Annual PCE Price Index = 3%, down from 3.4% through September

Annual Core Price Index: 3.5%, down from 3.7% through September

Month-to-Month PCE Price Index: Zero

Discussed at PCE inflation report October 2023

Mortgage demand from homebuyers gets boost as interest rates fall

There was some interesting date in this article: Corporate America Has Dodged the Damage of High Rates. For Now -The New York Times The average rate on existing home mortgages is only 3.6%. That highlights a point that I have been making for several years about benign support for discretionary consumer spending resulting from lower debt service payments.

And, net interest payments on corporate debt has plunged to 40 year lows.

In the 2008 third quarter, companies paid $628.63B in interest payments. That number has declined to $136.81B in the 2023 second quarter.

In other words, companies with access to the bond market refinanced debt during the extended period when rates were abnormally low. If interest rates continue to decline, then coupons for new debt next year may only be slightly higher than the coupons on the maturing debt for many companies.

Many cash rich companies can invest excess cash in treasury bills that pay more than the weighted average coupons of existing debt.

Small businesses, on the other hand, who borrow short term at the prime rate, or higher, have seen significant increases in their financing costs.

China consumption shows no sign of strong V-shaped recovery: McKinsey; China consumption: Start of a new era | McKinsey

Pending Home Sales Fell 1.5% in October

The Fed - Beige Book - November 29, 2023 ("On balance, economic activity slowed since the previous report, with four Districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity.")

October New Home Sales:

Ten Year 2023 Treasury Yields: U.S. Department of the Treasury

1/3/23: 3.79%

10/19/23: 4.98%

12/1/23: 4.22%, down from 4.37% on 11/30

Current FF range 5.25-5.5%

98.8% probability of no change in the FF rate after this month's meeting

Probabilities as of the December 2024 meeting:

++++

Allocation Shifts Discussed in this Post:

Treasury Bills Purchased at Auction: $6,000 in principal amount

Corporate Bonds: $4,000 in principal amount

Individual Common Stocks (no sales): $861.18 in purchases

Stock CEF (IGR): +$224 (yield at 16%)

Inflow Stocks/Stock Funds: +$1,085.18

Bond ETF (FALN): $255.30

Equity Preferred Stock: $104.25 (yield at 8.54%)

Exchange Traded Baby Bond: $109.85 (yield at 7.4%)

2023 Net Outflow Stocks/Stock Funds: -$29,343.54

+++++

Trump and His Party:

RealClearPolitics - Election 2024 - 2024 Republican Presidential Nomination

RealClearPolitics - Election 2024 - General Election: Trump vs. Biden

Trump doesn’t have presidential immunity from civil lawsuits over January 6, appeals court rules; Appeals Court Decision.pdf (one judge on the 3 judge panel was appointed by Trump).

The gist of the decision is that the President has an absolute immunity in non-criminal cases for actions that are undertaken as part of the job.

However, the Court rejected Trump claim that all speech made by President about a matter of public concern is an official act.

"When a first-term president opts to seek a second term, his campaign to win re-election is not an official presidential act, The office of the presidency as an institution is agnostic about who will occupy it next. And campaigning to gain that office is not an official act of the office."

The court could not decide based on the record whether Trump's speech at issue in this case was immune. The case was remanded for further proof about whether the actions and speech were part of Trump's official duties or unrelated to duties as President. Based on what is known now, the ultimate outcome IMO will be, more probable than not, that his speech was not part of his job as President.

In a related ruling, the federal court judge in the election subversion criminal case refused to grant Trump's motion to dismiss the charges based on the First Amendment and his claim of immunity from prosecution. Federal judge says Trump does not have absolute immunity, denying bid to dismiss election subversion case:

Excerpt from Decision: Judge Chutkan's Opinion at page 6.pdf

Trump's argument is that a President can never be charged with a crime committed while President.

And the judge correctly noted that "it is well established that the First Amendment does not protect speech that is used as an instrument of a crime."

The Executive Immunity doctrine will be applied differently depending on whether the case is based in criminal or civil law.

Game over': Expert says Trump attorney just landed a 'bullseye for prosecutors'-Raw Story The Trump attorney, Jennifer Little, reportedly testified before the Grand Jury that she advised Trump that he had to turn over the documents marked as classified and she is confident that Trump fully understood that the failure to do so would be a crime. After the FBI raid in August, documents marked as classified were found in Trump's office at Mar-a-Largo.

New York appeals court reinstates gag order against Donald Trump in civil fraud trial A limited gag order is normal for any litigant whose words incite threats of violence and violence against witnesses and court staff and/or are designed to intimidate witnesses. Hundreds of threats have been made against the court's staff who have been targets of Trump's venom which he spews daily.

Marjorie Taylor Greene (R-GA) has demanded that every member of the Jan 6th committee, Nancy Pelosi, unnamed employees of the FBI and the Jan 6 witnesses need to be prosecuted criminally under a Trump DOJ. Rep. Marjorie Taylor Greene🇺🇸 on X A Russian flag is more appropriate for Ms. Greene IMO.

Scott Perry’s texts reveal details about efforts to overturn Trump’s loss in 2020 Perry is a republican congressman from Pennsylvania.

As Advertisers Flee, Elon Musk Doubles Down On ... Pizzagate

Ryan Fournier, students for Trump co-founder, arrested on assault charges - CBS News He allegedly struck his girlfriend with a pistol.

Rep. George Santos (R-NY) expelled from Congress for corruption, cutting GOP majority More than 1/2 of the republicans, including Speaker Johnson, voted against the expulsion motion. The NY Governor, a Democrat, will appoint someone to fill his seat until there is a special election next February.

++++

Putin and His Orwellian Empire of Misery:

Russian weapons manufacturing plant goes up in flames after massive explosion-Express.co.uk

Russia's Main Link to China 'Paralyzed' After Tunnel 'Sabotage'—Reports; Ukraine Blows Tunnel between Russia and China, Delegates Snub Lavrov-YouTube The explosion hit a train loaded with fuel while it was moving through the tunnel. Russia claims that an explosive device was placed under one car. It looks like this explosion will render the tunnel unusable for several weeks at a minimum.

Soon thereafter, another train carrying fuel exploded as it moved across a 115 foot bridge across a deep gorge. This rail line is the only other one linking China/North Korea with Russia. Ukrainian spy agency stages train explosions on a Russian railroad in Siberia-ABC News; Ukraine blows up 2 railway connections between Russia and China – POLITICO

The key point is that Ukraine can strike Russian rail lines in Siberia that are used to carry military supplies from China and North Korea.

EU belittles Russia's Lavrov on way to Skopje talks The EU's top diplomat does not have the time to meet with Putin's lap dog.

Killers of Russian Women Go Free - The Atlantic This article provides details on the killers that Putin is letting out of prison to fight in Ukraine and who are given their freedom after a period of service. "One murderer whom Putin recently pardoned, 27-year-old Vladislav Kanyus, spent more than three hours killing his former girlfriend, Vera Pekhteleva. Forensic records describe 111 stab wounds, including several on the woman’s face. Then Kanyus choked his 23-year-old victim with the electrical cord of an iron."

The Russian parliament decriminalized spousal abuse in 2017 that does not cause "substantial bodily harm" that requires hospitalization and does not happen more than 1 time each year. For those who cause substantial bodily harm, the sentence was reduced from up to 2 years "in prison to just 15 days or, in many instances, a fine," which averages only $88 (see link below). The law implements what I call traditional Russian values. 380 out of 450 members of the Russian "parliament" voted for this law change.

Putin’s Other War: Domestic Violence-Harvard International Review Another example of how Russians tolerate spousal abuse is the case of Margarita Gracheva, a mother of two, whose husband dragged her into the woods and threatened her with a knife. The police were notified and did nothing which is normal. Three months later, her husband cut her hands off. One and five women in Russia face abuse every year

Putin's 'pride' leads to huge casualties at Avdiivka | Major General Tim Cross - YouTube

Russia presses criminal case against award-winning journalist Masha Gessen - The Washington Post Russia will criminally charge journalists who provide accurate information about war crimes committed by Russian soldiers. Russia is a 100% pure Orwellian state and that will continue indefinitely. If someone living in Russia does not want to live and die in an Orwellian state controlled by violent psychopaths, the only solution is to leave and never go back.

The only question is whether Russia will remain forever a 100% pure Orwellian state or will experience periods when the percentage is reduced for very brief periods to somewhere between 80% to 100%.

Finland to close entire Russian border

Kremlin warns of tensions if Poland sends troops to Finnish-Russian border | Reuters

Putin’s Major-General Vladimir Zavadsky killed by his own mine - YouTube

The Russian economy is currently benefiting from borrowing large sums that are then used to fund its war of aggression against Ukraine. Buying military equipment and supplies that are destroyed in Ukraine, using borrowed money, is going to add to Russia's already serious economic problems longer term.

Next time Russia faces a financial crisis, and it will soon enough, China, Iran, North Korea and Syria will need to bail it out. Russian financial crisis (2014–2016)-Wikipedia; 1998 Russian financial crisis - Wikipedia; The Russian economy in health, oil, and economic crisis - Atlantic Council Putin made the decision to sever economic and financial ties with the West by invading Ukraine for the sole purpose of destroying that nation's democracy and absorbing its territory into the Russian federation.

Losses ∙ Russia ∙ WarSpotting — documented material losses in Russo-Ukrainian war

Russia is willing to enter a peace agreement whereby Ukraine accepts Russia's annexation of about 1/5th of its internationally recognized territory, agrees to never join the EU or NATO and to demilitarize in exchange for Putin's promise to respect Ukraine's territorial integrity of whatever remains which is as worthless as Russia's promise in the Budapest Memorandum. Actually, Russia's promises are worse than worthless when a nation gives up something meaningful in reliance.

++++

1. Small Ball Buys:

Zions, Comerica, First Horizon: Regional bank takeover risk Of the banks mentioned in the article, I own First Horizon Corp (FHN) and Webster Financial (WBS). U.S. regulators prevented Toronto Dominion from buying FHN as previously discussed here. The offer was for $25 in cash plus an additional amount for any delay in closing the acquisition after a specific data. The parties agreed to mutually terminate the merger with FHN receiving $200M in cash + another $25M in reimbursements for costs incurred by FHN. TD Bank and First Horizon Mutually Agree to Terminate Merger Agreement - May 4, 2023 I eliminated my position before than announcement and restarted it after it. Item # 1. Eliminated FHN - Sold 5 at $24.38; 20+ at $24.47; and 47+ at $24.38 (11/15/22 Post)(profit snapshot = $1,071.04; Item # 1. Pared FHN in Fidelity Account - Sold 450 at $24.33 (11/1/22 Post)(profit snapshot = $1,261.77)

The current FHN price is hovering mostly in the $10 to $12.5 range starting in May 2023. FHN Advanced Charts | MarketWatch

I suspect that new regulators may be necessary for another bank to make an offer unless the bank has no operations in the south. Two potential acquirers would be the super regionals HBAN and KEY who operate primarily in the midwest with some operations in the northeast.

I am now willing to accept less than a 5% dividend yield on a starter position given the decline in interest rates and my huge reinvestment problem for securities that mature in 2024.

A. Bought 10 FALN at $25.53:

Quote: iShares Fallen Angels USD Bond ETF Overview

Cost: $255.3

This is my first purchase.

"The iShares Fallen Angels USD Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds that were previously rated investment grade." Examples include bonds issued by Vodafone, Seagate, Ford Motor Credit, Las Vegas Sands, and FirstEnergy.

Some Holdings as of 11/22/23

More than 1 bond from a single issuer may be owned by the fund.

Two examples are bonds issued by Ford Motor Credit and Seagate:

This is a junk bond fund, but most of the holdings will be rated BB or BB+.

If both S&P and Moody's have ratings, this chart will use the lowest rating which results in some investment grade bonds being included that have a Baa3 or BBB- rating from one rating agency and a Ba1/BB+ from the other but the investment grade is probably wobbly with a negative outlook (E.G. the BDN bonds)

Sponsor's website: iShares Fallen Angels USD Bond ETF

Expense Ratio: .25%

Number of Holdings: 208 as of 11/22/23

Weighted Average Maturity: 7.25 years

Effective Duration: 4.78 years

I have owned in the past a similar ETF which has a .1% higher expense ratio. VanEck Vectors Fallen Angel High Yield Bond ETF Overview; Item #1.K. Eliminated ANGL - Sold 25 at $29.12 (7/3/20 Post)(profit snapshot = $58.44)

Purchase Restriction: Up to 100 shares, with each subsequent purchase required to be at the lowest price in the chain.

This kind of purchase is based on a concern that treasury bill yields may start declining next year.

My current forecast is that the FED will cut the FF rate rate .25% in the 2024 second half, but more cuts would likely occur with a recession, real GDP slumping close to below 1% with inflation no longer being problematic, or inflation plunging below 2% sufficiently to raise the spectre of deflation.

Dividends: Monthly at a variable rate.

Last 12 Dividends: $1.27 per share, rounded up.

Yield Using TTM $1.27 annual and $25.53 TC per share: 4.97%

B. Restarted OGE - Bought 5 at $34.84 - Schwab Account:

Recent History this Account:

Quote: OGE Energy Corp

Cost: $174.2

OGE is the parent company for Oklahoma Gas and Electric Service Company that generates, transmits, and delivers electricity to customers in Oklahoma and western Arkansas.

I restarted a position based on a concern that treasury bill rates will start to trend down more next year. Small yield declines in the 3 month to 1 year T Bills occurred during November.

Owned Generation as of 12/31/22: 10-K at pages 22-23

OGE Analyst Estimates | MarketWatch

OGE had a substantial ownership interest in Enable Midstream that was acquired by Energy Transfer LP (ET) in 2021. OGE Energy Corp. announces the successful close of the merger between Energy Transfer and Enable Midstream Partners ("110,982,805 common units of Enable owned by OGE Energy were exchanged for 95,389,720 common units of Energy Transfer.") OGE liquidated the Energy Transfer (ET) units in 2022.

Last Elimination: Item # 2.D. Eliminated OGE - Sold 2 at $38.29; 5 at $38.87; and 8 at $38.52 (4/14/22 Post)(profit snapshots = $75.3)

Dividend: Quarterly at $.4182 per share ($1.6728 annually)

The dividend was $.20875 in 2013, so a doubling in 10 years.

Dividend History | OGE Energy Corp.

Yield at $34.84 = 4.8%

Last Ex Dividend: 10/9/23

Last Earnings Report (Q/E 9/30/23): SEC Filed Press Release and 10-Q

Revenue = $945.4M

Net Income: $241.9M

E.P.S. = $1.2

Consensus at $1.16 per Schwab

Analyst Reports (available to Schwab customers):

Morningstar (11/20/23): 4 stars with a fair value of $38, noting that management has a 5% to 7% annual E.P.S. growth target by 2027.

Argus (11/3/2023): Buy with a $45 price target. The analyst likes "the company's visible forward earnings stream, strong cost controls, well-run generation facilities, and growing dividend".

Other Sell Discussion: Item # 3.E. Eliminated OGE-Sold 15 at $34.62 (6/4/21 Post)(profit snapshot = $57.36)

C. Added to NMFC - Bought 5 at $12.85 - Schwab Account:

Quote: New Mountain Finance Corp. (NMFC) - Externally Managed BDC

Cost: $64.25

2022 SEC Filed Annual Report (Risk factor summary starts at page 11 and ends at page 55)

Last Buy Discussion: Item # 1.E. Bought 25 NMFC at $12.85; 5 at $12.79 - Schwab Account (9/2/23 Post)

Elimination of Duplicate Positions: I previously eliminated my duplicate positions Item # 2.D. Eliminated Duplicate NMFC Positions (Fidelity and Vanguard Accounts)- Sold 30 Shares at $12.86 (9/2/2023)(profit snapshots = $160.55)

Net Asset Value per share history:

9/30/23: $13.06

6/30/23: $13.14

12/31/22: $13.02

IPO May 2011-Prospectus: Public Offering Price at $13.75 (all expenses including the sales load paid by the management company)

Dividend: Quarterly at $.32 per share ($1.28 annually)

NMFC Dividend History | Seeking Alpha

Two special dividends totalling $.07 per share were paid earlier in 2023. A 4 cent per share special dividend will go ex on 12/14.

I am not reinvesting the dividend.

Yield at AC = 10.79% (regular dividend only)

Next Ex Dividend: 12/14/23 (regular dividend of $.32 per share and the $.04 special dividend

Last Earnings Report (Q/E 9/30/23):

SEC Filed Earnings Press Release

Net Investment Income per share: $.40

NMFC credit risk ratings of investments:

Portfolio Composition:

10-Q for the Q/E 9/30/23 The summary of investments starts at page 7. A name with a (35) beside it indicates that the loan is on nonaccrual.

The $953K in first lien loans to Education Management (p.17) have been written down to zero.

A long term problem has been investments in UniTek Global Services, Inc. that were placed on nonaccrual in the 2020 first quarter. The "Company's junior preferred shares in UniTek had an aggregate cost basis of $

A major writedown has already occurred in first lien loans made to Ansira that went on non-accrual in the 2022 third quarter. The original cost was at $41.152M and has been written down to $1.993M.

Other problems are discussed at pages 68-69. Most of the hits to net asset value per share have already been taken with write-downs in prior quarters.

Other Sell Discussions: Item # 2.G. Pared NMFC in Fidelity Account - Sold 3 at $13.39 (8/6/21 Post); Item # 2.H. Sold All Fractional NMFC Shares Bought with Dividends in Fidelity Account at $13.69 (6/25/21 Post); Item # 3.G. Pared NMFC in Fidelity Taxable-Sold 20 at $12.27 (1/1/21 Post); Item # 2 Eliminated NMFC-Sold 102+ at $14.2 (1/25/20 Post); Item # 2.A. Sold 50 NMFC at $13.95 (1/15/20 Post); Item # 1.B. Eliminated NMFC-Sold 60 at $13.96 and 50 at $13.94 (2/9/19 Post); Item # 1 A. Sold 50 NMFC at $14.06 (8/19/18 Post); Item # 1 Sold Remaining 50 Shares of NMFC at $14.63 (11/1/14 Post); Sold 100 of 150 NMFC at $14.4773 (10/23/14 Post); Item # 8 Sold Highest Cost NMFC Lot at $15.37 (9/14/2014 Post)

Exchange Traded Baby Bond: NMFC recently sold a $25 par value SU bond that matures in 2028. New Mountain Finance Corp. 8.25% Notes due 2028 (NMFCZ); Prospectus I view this offering as raising funds to replace those recently incinerated by the bad loans discussed above.

10 Year Average Annual Total Return (dividends reinvested) Through 12/1/23: +8.78%. The start price was $14.78 and the end price was at $12.83.

Sourced: DRIP Returns Calculator | Dividend Channel

Goal: Same as with all BDC investments. Sell the shares at any profit before any ROC adjustment to the tax cost basis plus the dividends.

D. Restarted IGR - Bought 50 at $4.5 - Schwab Account:

History this Account:

In my Schwab account I owned this stock CEF for a few days in May 2020, buying 100 shares at $5.32+ and selling 11 days later at $5.95+.

Quote: CBRE Clarion Global Real Estate Income Fund Overview

Cost: $225

Most recent elimination: Item # 3.B. Eliminated IGR - Sold 180 at $6.54 (3/11/23 Post)(profit snapshot = $253.51)

SEC Filing - Holdings as of 9/30/23 Cost at $1.381+B with the value at $1.04+B. REITs have performed poorly over the past year in response to higher interest rates. Using leverage rising in cost to buy stocks going down in price will add to the unrealized loss total. Maybe this is about to turn more favorable.

Leveraged at 31% as of 10/31/23

CBRE Global Real Estate Income Fund-This is a link to the SEC Filed Shareholder Report for the semiannual period ending 6/30/23. In this report at page 30, it is stated that the fund has a $400M secured line of credit and had borrowed $368.712M as of 6/30. The fund pays interest at a .75% spread to the federal funds rate. The average interest cost was 5.5% during the six month period.

Sponsor's website: CBRE Global Real Estate Income Fund

To 10 Holdings as of 10/31/23:

Of those stocks, I have a small ball position only in CubeSmart (CUBE).

Dividend: Monthly at $.06 per share ($.72 annually)

There has been some ROC support. While IGR has a net unrealized capital loss, there are stocks that have unrealized gains. Since there is no loss carryforward, as of 12/31/22, there is at least a possibility that the dividend can be supported with capital gains.

Yield at $4.5: 16%

Next Ex Dividend: 12/19/23

Data Date of 11/27/23 Trade:

Closing Net Asset Value per share: $5.26

Closing Market Price: $4.5

Discount: -14.45%

Average 3 year discount: -8.31%

Sourced: IGR-CEF Connect

CBRE Global Real Estate Income (IGR) Portfolio | Morningstar (lists top 25 holdings)

Other Sell Discussions: Item # 2.G. Pared IGR in Fidelity Account - Sold 10 at $6.69 (2/5/23 Post)(profit snapshot = $8.17): Item # 2.H. Pared IGR - Sold 2 at $9.09 (8/27/21 Post)(profit snapshot = $6.29); Item #3.H. Sold All IGR Shares Purchased with Dividend (6/12/21 Post)(profit snapshot = $49.1); Item # 1.R. Sold 42+ IGR at $8.1 (4/17/21 Post)(profit snapshot = $43.23); Item # 1.A. Pared IGR-Sold 100 at $7.64 (4/9/21 Post)(profit snapshot = $63.6); Item # 1. I. Eliminated IGR Vanguard Account-Sold 100 at $5.95 and Eliminated IGR in Schwab Account-Sold 100 at $5.96 (6/13/20 Post) (profit snapshots = $113.32); Item # 1.C. Sold 9 IGR at $8.33 (2/19/20 Post)(profit snapshot = $4.99); Item # 2.A. Sold 100 IGR at $8.01 (12/28/19 Post)(profit snapshot = $42.98); Item # 1 Sold 283 IGR at $7.89+ (8/24/13 Post)(profit snapshot on all 2013 sales = $77.62)

Goal: Any profit before ROC adjustments to the tax cost basis in excess of the dividends.

E. Added to HIW - Bought 1 $18.13; 1 at $17.93; 3 at $17.74 :

Quote: Highwoods Properties Inc. (HIW) - Office REIT

Management: Internal

Cost: $89.28

The office properties are primarily located in "the best business districts of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa."

10-Q at page 29

2022 Annual Report (Debt listed at page 84)

Website: Highwoods

Investment Category: Equity REIT Common and Preferred Stock Basket Strategy

Last Debt Offering (11/23): Prospectus $350M of 7.65% SU notes maturing in 2034, using the proceeds to repay outstanding debt including the balances in its unsecured credit facility and a bank term loan. Priced at 98.672 with proceeds to HIW at 98.022.

Last Discussed: Item # 1.J. Added to HIW - Bought 1 at $20.2; 1 at $19.85; 1 at $19.31; 1 at $18.87 (10/7/23 Post)

Average cost per share: $23.81 (53+ shares)

Dividend: Quarterly at $.50 per share, last raised from $.48 effective for the 2021 second quarter payment.

I do not anticipate another dividend increase until interest rates start to move back down, reducing the downside pressure on FFO, and the work-from-home trend returns to something close to a pre-pandemic level.

Most Office REITs have cut their dividends (e.g. OPI, BDN) or eliminated them (e.g. VNO, HPP). Highwoods has, so far, maintained its quarterly dividend after the last raise to $.50 per share.

I am reinvesting the dividend.

Yield at New AC = 8.4%

Last Ex Dividend: 11/17/23 (owned 48+ shares as of)

Last Earnings Report (Q/E 9/30/23): 10-Q for the Q/E 9/30/23 and HIW Announces Third-Quarter 2023 Results.pdf

FFO per share = $.93, down from $1.04 in the 2022 third quarter

Net Income to FFO:

Revenues: $207.095M, up from $206.977M

Highwoods does not present a cash available for distribution ("CAD") number and provides insufficient information for me to confidently calculate CAD. I can reasonably assume, however, that quarterly CAD per share is in excess of the $.50 per share dividend.

In service Occupancy: 88.7%

2023 Guidance: FFO per share of $3.73-$3.77

Last Elimination: Item # 1.I. Eliminated HIW - Sold 7 at $47.22 (2/3/22 Post)

I do not have access to any analyst reports.

Earlier this month, BofA downgraded its rating to neutral from buy and Truist kept its buy rating but lowered the PT to $28 from $35.

Office REITs Feel the Pressure as Vacancies Creep Up. Blame the Work at Home Crowd. - Barrons This article summarizes the opinion of a Morgan Stanley analyst, who is bullish on HIW, noting it has less exposure to the work-from-home trend given the southern geographic areas where it operates.

When I drive around Nashville, for example, the office parking lots seem to have the same number of cars in parking lots as prior to the pandemic.

F. Added to TRST - Bought 5 at $27.13 - Fidelity Account:

Quote: Trustco Bank Corp. (TRST)

Cost: $134.65

Investment Category: Regional Bank Basket Strategy

Last Discussed: Item # 1.I. Added to TRST - Bought 5 at $27.75 (6/3/23 Post)

Elimination of Duplicate Positions: I previously eliminated my duplicate positions: Item # 2.C. Eliminated TRST in 2 Taxable Accounts - Sold 5 at $36.84; 5 at $37.02 (3/11/23 Post)(profit snapshot = $41.28); Item # 3.A. Eliminated TRST in Schwab Taxable Account - Sold 20 at $38 (12/13/22 Post)(profit snapshot = $129.8)

New Average cost per share: $29.55 (41 shares)

Dividend: Quarterly at $.36 per share ($1.44 annually)

TRST Stock Dividend History & Date

Yield at $29.55 = 4.87%

Last Ex Dividend: 11/30/23 (owned all as of)

Last Earnings Report (Q/E 9/30/23): SEC Filed Press Release

Comparisons are to the 2022 third quarter.

E.P.S. $.77, down from $1.1

NIM: 2.85%, down from 3.16%

Efficiency ratio: 58.33%, up from 49.87% (up is bad)

NPL Ratio: .36%, down from .4%

NPA Ratio: .31%, down from .32%

Charge offs: "have been in a net recovery position for the past seven quarters."

Coverage ratio: 260%

ROE: 9.32%, down from 12.78%

Of those numbers, the only positive ones are the non-performing assets, loans, coverage and charge off ratios.

I would expect NIM to improve gradually as more owned securities mature with the proceeds reinvested in higher yielding ones. The favorable impact will, however, be muted by the decline in yields from recent highs which may continue. Deposit costs are probably starting to trend down from recent highs based on what I am seeing in brokered CD offerings, but it takes time for high yielding CDs to mature.

Investment Securities (page 14, 10-Q):

The decline in yields this quarter will reduce the unrealized loss. $60+M will mature within 1 year of 9/30/23. There may also be a slight increase in paydowns from mortgage backed securities that can be reinvested at higher yields. Most of the unrealized loss is concentrated in mortgage backed securities. It would not be irrational to forecast that NIM will trend higher over the next several quarters.

TRST Realized Gains to Date: $1,408.67

Other Sell Discussions: There was a 1 for 5 reverse stock split in 2021 that explains the lower prices. TRST Split History The prices referenced in the following links are not adjusted for that reverse split.

Item # 3.G. Eliminated TRST-Sold 15+ in Schwab Taxable at $7.45 and 40+ in Fidelity Taxable at $7.44 (5/14/21 Post)(profit snapshots = $111); Item # 1.D. Pared TRST-Sold 10 at $6.72 (1/9/21 Post); Item # 3.A. Eliminated TRST Sold 56+ at $8.8 (11/27/19 Post)(profit snapshot = $68.51); Item # 2.B. Sold 125 TRST at $8.6 (11/2/19 Post); Item # 2 Sold 100 TRST at $6.69 Update For Regional Bank Basket Strategy As Of 7/26/16-South Gent | Seeking Alpha; Item # 1 Sold 315+ TRST at $6.92 (1/11/15 Post)(largest gain to date = $549.47); Sold 50 TRST at $7.29 (11/25/13 Post); Sold 308 TRST at $6.64 (10/28/13 Post)(profit snapshot = $238.38)(on a reverse split adjusted basis, the sales price was $33.2)

G. Started SAMG - Bought 10 at $15.65:

Quote: Silvercrest Asset Management Group Inc. Cl A

Cost $156.5

Silvercrest Asset Management Group, Inc., through its operating subsidiary, Silvercrest L.P. and its subsidiaries "provides investment management and family office services to individuals and families and their trusts, and to endowments, foundations and other institutional investors primarily located in the United States of America."

SAMG Analyst Estimates | MarketWatch (3 analysts, average 2024 E.P.S. currently at $1.77, up from an estimated $1.44 in 2023)

Dividend: Quarterly at $.19 per share, last raised from $.18 effective for the 2023 third quarter payment.

SAMG Stock Dividend History & Date

Yield at $15.65 = 4.86%

Next Ex Dividend: 12/7/23

Last Earnings Report (Q/E 9/30/23): SEC Filing

Diluted E.P.S. = $.34, down from $.35

Adjusted Diluted E.P.S. $.36, up from .34

Revenue: $29.704M, up from $29.042M

Average Assets Under Management (AUM): $31.6B, up from $28.1B

AUM at Quarter's End: $31.2B, up from $27.4B

"The increase was attributable to market appreciation of $2.9 billion and net client inflows of $0.9 billion." Fee income is dependent on AUM and the value of those assets. Hopefully, the value has been rising this quarter.

H. Started WBA - Bought 5 at $20.14; 5 at $19.75:

Quote: Walgreens Boots Alliance Inc. (WBA)

Cost: $199.45

WBA Analyst Estimates | MarketWatch

Annual Report for the F/Y Ending 8/31/23

As of 8/31/23, Walgreens had 8,600 retail stores in the U.S. and 4,297 internationally. There were also 529 healthcare locations in the U.S. that were not located in the retail stores.

|

| Page 35 |

"The Company filled 801 million prescriptions (including vaccinations) in the segment in fiscal 2023. Adjusted to 30-day equivalents, prescriptions filled were 1.2 billion in fiscal 2023." (page 4)

Created at the beginning of fiscal 2022, the "U.S. Healthcare segment currently consists of a majority position in VillageMD, a national provider of value-based care with primary, multi-specialty, and urgent care providers serving patients in traditional clinic settings, in patients’ homes and online appointments; Shields, a specialty pharmacy integrator and accelerator for hospitals; CareCentrix, a participant in the post-acute and home care management sectors, and the Walgreens Health organic business that contracts with payors and providers to deliver clinical healthcare services to their members and members’ caregivers through both digital and physical channels." (page 6)

I took a snapshot of a five year chart intraday on 11/29/23.

|

| 75.19% decline in price |

This is not a total return chart. The total return with dividends reinvested was -70.42% or an average annual total return of -21.62%.

I have not owned WBA during that 5 year period. The stock's destruction shown in this chart has some appeal to me for a first purchase. For it not to have some appeal, I would need a brain transplant.

Looking for a High-Yield Dividend Stock? Avoid Buying Walgreens Boots Alliance. | The Motley Fool

Average cost per share: $19.94 (10 shares)

Dividend: Quarterly at $.48 per share ($1.92 annually)

The dividend is nowhere near safe. It is not possible to look at the stock price chart and have any comfort in anything other than the knowledge that the stock was not owned during that decline. The yield implies a consensus opinion that the dividend will be slashed soon. That is not as certain IMO as the current price suggests.

Yield at Average Cost per share: 9.63%

Last Ex Dividend: 11/13/23

Last Earnings Report (F/Q ending 8/31/23): This report added to the angst.

SEC Filed Earnings Press Release

This report is for the 4th fiscal quarter.

GAAP E.P.S. (-.21)

Adjusted E.P.S. +$.67, down 18% "on a constant currency basis, reflecting a 23.5 percent headwind from significantly lower COVID-19 vaccine and testing volumes."

Average non-GAAP E.P.S. estimate: $.69

2023 F/Y results had a number of unusual items:

"Net loss in fiscal 2023 was $3.1 billion, compared with net earnings of $4.3 billion in the year-ago period. This decrease is driven by a $5.5 billion after-tax charge for opioid-related claims and litigation in the period and lapping of a $2.5 billion after-tax gain on the Company’s investments in VillageMD and Shields Health Solutions in the year-ago period, partly offset by a $1.7 billion after-tax gain from the partial sale of the Company’s investments in Cencora and the complete sale of the Company’s investment in Option Care Health. Adjusted net earnings were $3.4 billion, a decrease of 20.5 percent on a constant currency basis, primarily driven by lower adjusted operating income." (emphasis added)

Pharmacies that filled prescriptions for Opioid prescriptions were a primary target for lawsuits along with the manufacturers in lawsuits filed by states including my own. Teva, Allergan, CVS, and Walgreens Finalize Opioid Settlement Agreements (Tennessee's share will be about $419M paid over 15 years).

Fiscal 2024 Guidance: Adjusted E.P.S. $3.2 to $3.5

SU Bond Trades:

Item # 1.C. Sold 2 WBA 3.45% SU Bonds at 100.727 (7/12/17 Post)(profit snapshot = $34.04)

Item # 4.B. Sold 2 WBA 3.3% SU Maturing on 11/18/21 at 102.127 (9/14/19 Post)(profit snapshot = $62.54)

I currently own 2 Walgreens 3.8% SU bonds maturing on 11/18/24. Bond Page | FINRA.org

Based on my credit risk concerns, which are not currently acute, I will own no more than 2 WBA SU bonds at any given point in time. So I will need to receive the proceeds from the 2 bonds that mature next November before buying 2 more.

I. Added to HTBK - Bought 5 at $8.57 - Vanguard Account:

Quote: Heritage Commerce Corp.

Cost $42.85

Locations-Heritage Bank of Commerce

Investment Category: Regional Bank Basket Strategy

Last Discussed: Item # 3.B. Added 5 HTBK at $6.9 (5/13/23 Post); Item # 2.A. Added 5 HTBK at $7.92 (4/22/23 Post)

The lower cost shares were bought after the Silicon Valley Bank failure that would be followed by two more regional bank collapses caused by deposit runs. The entire regional bank stock sector tanked in response. Heritage has some operations in the same geographic area served by Silicon Valley Bank but has not experienced, since that bank failure, any of the same problems at a level that concerns me.

The main problem has been net interest margin contraction that is commonplace among banks. The contraction is caused by the shift in Federal Reserve monetary policies starting in March 2022 that resulted in the cost of bank funds (deposits and borrowings) to rise faster than interest income. The cost of deposits includes more than higher savings account and CD rates and includes a massive shift out of interest free deposits into interest bearing ones. Many customers did not care about having excess funds in interest free deposits when interest bearing deposits paid almost nothing. The sharp rise in short term interest rates resulted in more customers moving deposits into accounts that paid interest.

New Average cost per share this account: $9.2 (70 shares)

Dividend: Quarterly at $.13 per share ($.52 annually), last raised from $.12 effective for the 2020 first quarter payment

HTBK Stock Dividend History & Date

Yield at New AC = 5.65%

Last Ex Dividend: 11/16/23 (owned 65 as of)

Last Earnings Report (Q/E 9/30/23): SEC Filed Press Release

Comparisons are to the 2022 third quarter

E.P.S. $.26, down from $.30

NIM: 3.57%, down from 3.73%

Efficiency ratio: 52.89%, up from 47.02%

Tangible Book value per share: $7.94, up from $7.09

NPA Ratio: .1%, up from .02%

NPL Ratio: .17%, up from .03%

Coverage Ratio: 869.84% (allowance for credit losses to non-performing loans)

ROTE: 13.6%, down from 16.6%

10-Q:

|

| Owned Securities, page 61 |

Weighted average life of investment portfolio: 4.72 years

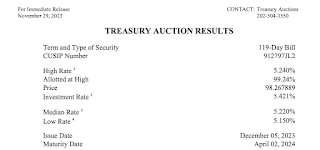

2. Treasury Bill Auction Purchases:

A. Bought 1 Treasury Bill at the 11/28/23 Auction:

1 Year T Bill

Matures on 11/29/24

Interest: $50.04

Investment Rate: 5.214%

3. Corporate Bonds:

A. Bought 2 Brixmor Operating LP 3.85% SU Maturing on 2/1/25 at a Total Cost of $97.31:

Issuer: Operating entity for Brixmor Property Group Inc. Stock Quote (BRX) who does not guarantee the notes. A guarantee is better than no guarantee but is not material to the overall credit risk since the properties are owned by the partnership, see page 6, 10-Q)

SEC Filed Earnings Press Release for the Q/E 9/30/23 and Supplemental

(revenues at $307+M; properties 364; FFO of $151.184M)

10-Q for the Q/E 9/30/23 (debt discussed starting at page 18)

New Finra Page: Bond Page | FINRA.org

Credit Ratings: Baa3/BBB

YTM at Total Cost: 6.248%

Current Yield at TC = 3.96%

B. Bought 2 Affiliated Managers 3.5% SU Maturing on 8/1/25 at a Total Cost of 95.843:

Issuer: Affiliated Managers Group Inc. (AMG)

AMG Analyst Estimates | MarketWatch

AMG SEC Filed Earnings Press Release for the Q/E 9/30/23

New Finra Page: Bond Page | FINRA.org

Credit Ratings: A3/BBB+

YTM at Total Cost: 6.15%

Current Yield at TC = 3.65%

I own 4 AMG 4.25% SU bonds that mature on 2/15/24. In effect, I am extending the maturity by about 18 months for 2 of the 4 bonds that mature on 2/15/24.

4. U.S. Equity Preferred Stocks:

A. Bought 5 DBRGPRJ at $20.85:

Quote: DBRG-PJ

Cost: $104.25

Issuer: DigitalBridge Group Inc. (DBRG) The company was originally called Colony Northstar. The name was changed to DigitalBridge in June 2021.

DBRG "is a leading global digital infrastructure investment manager. The Company deploys and manages capital on behalf of its investors and shareholders across the digital infrastructure ecosystem, including data centers, cell towers, fiber networks, small cells, and edge infrastructure."

I have never owned the common stock. This is my first purchase of a DBRG preferred stock.

Website: DigitalBridge

SEC Filed Third Quarter Investor Presentation

SEC Filed Supplemental Financial Report for the Q/E 9/30/23

Coupon: 7.125% paid on a $25 par value

Dividends: Paid quarterly and cumulative.

Yield at $20.85: 8.54%

Last Ex Dividend: 10/6/23

The call protection expired in September 2022.

5. Exchange Traded Baby Bond:

A. Added 5 ARGD at $21.97:

Quote: Argo Group International Holdings Ltd. 6.5% Senior Notes Due 2042 (ARGD)

Both ARGD and ARGD.PRA traded yesterday under their existing symbols, but there was some indication that both will soon be subject to a name, symbol and/or CUSIP change. I will know more next week.

Investment category: Exchange Traded Baby Bonds

Argo was just acquired by Brookfield Reinsurance Ltd. (BNRE) and is currently a wholly owned subsidiary of BNRE. Brookfield Reinsurance Completes $1.1 Billion Acquisition of Argo Group (11/16/23) In this press release, it is stated that "Argo and its insurance subsidiaries are rated ‛A-’ by Standard and Poor’s." I am not sure whether that is a financial strength rating which may be different from a SU bond credit rating. Prior to the acquisition, this bond was rated by BBB- by S&P and I did not see any change in that rating at the relevant S&P webpage. As a practical matter, Brookfield, having paid about $1.1B in cash to acquire Argo, is not going to allow a bond default if it can do something to prevent it.

Average cost per share: $22.64 (115 shares)

Yield at New AC = 7.18%

(.065% coupon x. $25 par value = $1.625 annual interest payment per share ÷ $22.64 average total cost per share = 7.1776%)

Last Quarterly Ex Interest Date: 11/30/23 (owned all as of)

Previous Sell Discussions (includes trades under former symbol AGIIL): Item # 6.H. Sold 5 ARGD at $20.8 - Schwab Taxable Account (11/8/22 Post); Item # 5.A. Pared ARGD in Schwab Account- Sold 25 at $25.4-Part of Highest Cost Lot (5/23/20 Post); Item # 3 Sold 50 AGRD at $25.87 (9/25/19 Post); Item # 4 Sold 100 AGIIL at $25.11 (9/25/17 Post); Item # 4 Sold 50 AGIIL at $26.89 - Update For Exchange Traded Bonds And Preferred Stocks Basket Strategy As 6/3/16 - South Gent | Seeking Alpha; Item # 2 Sold 50 AGIIL at $24.21-Roth IRA (6/28/14 Post); Item # 2 Sold: 50 AGIIL at $24.48 (6/7/14 Post)

ARGD-AGIIL Realized Gains to Date: $653.79

6. Cash Flow into my Fidelity Account 11/20 and 12/1 (1 of 5 taxable accounts):

The following snapshots reflect one aspect of my investment approach that places a strong emphasis on a constant flow of interest and dividend payments and proceeds received from maturing fixed coupon investments. Sourcing will be from a highly diversified and large number of holdings. The primary emphasis will be on interest payments generated by bonds (corporate and municipal), treasury notes,treasury bills, and CDs.

Corporate Bond Treasury Redemptions: $9,000 (The treasury notes were bought at a discount to par value in the secondary market)

Tennessee Municipal Bond - Tax Free Interest: $703.13 (all five bond lots except for the 10 Sumner County GO Maturing on 12/1/34, rated at AA+)

$1,000 Par Value Corporate Bond Interest Payments: $343.88 (1 or 2 bond lots, except for a 3 bond lot in the Welltower 2025 SU and a 3 bond lot of the Entergy Mississippi first mortgage bond maturing in 2027, of which $113 originates from electric utility first mortgage bonds)

Treasury Note Interest Payments: $80.63

CD Interest Payments (all monthly): $33.61

Exchange Traded Bonds Interest Payments (Quarterly): $39.22 (of which $36.56 comes from the first mortgage bonds EAI and ELC that are owned in 3 taxable accounts and both RI accounts).

CEF Monthly Dividend Payments: $105.12 (AIO, AOD, AVK, BHK, BWG, ERC, FAX, GDO, GLQ, JQC, KIO, MMT, NCZ, PPT, THQ, WIW)

Common Stock Dividends: $69.96

Preferred Stock Dividends: $7.9 ($3.45 monthly-GOODN)

Other Dividend Payments: $21.95

Total Dividends and Interest Payments 11/30 and 12/1 - Fidelity Account = $1,335.44 (Tennessee municipal bond interest payments are made on the first and will be larger than the corporate bond payments made that day. The corporate bond interest payments will occur throughout the month and will generally be larger than the municipal total for each month.)

Total Cash Flow with $9,000 in Redemptions: $10,335.44

%20.png)

%20.png)

.png)

The US looks strong. Maybe time to buy in especially with longer term money.

ReplyDeleteYet international including is China is weak. It's usually that the US effects the world. Not the other way around?

I'm enjoying seeing my total portfolio go up as the market rallies even with only 1/4 in stocks. Be better if I had more in.

I see worries about the macro economy and recession next year. But the majority of pundits are looking at goldilocks and soft landing. Doesn't seem to be any real worries on the horizon outside of black swans.

Land: The U.S. economy has several strong tailwinds. The longest term one and possibly the most important is the refinancing of the main debt obligation, the home mortgage, at abnormally low 30 year rates. This refinancing tsunami created more disposable income, measured in tens of billions, that can be spent, saved and/or invested.

DeleteSourcing consumer spending from greater disposable income after mortgage service payments is beneficial as opposed to sourcing the spending from more debt, particularly too much credit card debt.

Other current secular forces include wage growth exceeding annual CPI, a continued strong job market, and more disposable income from risk free savings.

The Fed's 15 year Jihad Against Savers deprived savers an estimated $400B to $500B per year of disposable income before taxes, a rough estimate which assumes that the risk free rate of return would have been 4% to 5% rather than close to zero.

The fact that these tailwinds exist do not necessarily mean that the stock will continue skyward since more of the conceivable long term good news is already baked into many large cap stocks that have led the market higher. But, a continued decline in interest rates and inflation may very well keep the animal spirits alive for awhile notwithstanding valuations of specific stocks and sectors.

Regional bank stocks and REITs were my best gainers last Friday.

The main negative headwind has been inflation. The market is reacting now, much as it did starting in the summer of 1982, to a consensus forming that problematic inflation is in the rear view mirror.

Much of the inflation still being reported comes from owners equivalent rent, an expense that is not paid by homeowners. For me and tens of millions of households, that "inflation" component is not an expense that I pay, but is instead a source of increased profit when and if I sell my home. I built my home in 1982 at a cost less than $80,000 which includes the land purchase of 1.25 acres for about $17,000, and have not yet paid rent to myself. The home could be sold now for $800+K.

Prices for "durable goods" is actually in deflation now. Prices have fallen year-over-year for 5 straight months. In October, durable good prices were down 2.6% compared to September 2022.

Crude oil and other commodity prices are down. A persistent decline started in September and can be seen in the DJIA commodity index or ETFs that attempt to track prices through futures like GSG whose peak price over the past 3 years was hit in the summer of 2022:

https://www.marketwatch.com/investing/fund/gsg/charts?mod=mw_quote_tab

And, the price inflation caused by supply chain problems resulting from the pandemic is in the past as well.

So it's essentially a benefit now pulled forward from the savings jihad, that cost then but is helping the economy now by previously providing lower cost loans.

DeleteThere's a steady observation that when the FED starts lowing rates, that's when the market goes down. But that may merely coincide with the Fed lowering when a recession response to their tightening. This time the economy is showing a soft landing, not recession.

So there's one worry left. Usually when there's no worries left, it's nearer the top and time to worry. :). But there isn't exuberance except in those few stocks (and indices holding them).

The exchange traded baby bond (ARGD) and equity preferred stock (ARGOPRA) issued by Argo International have kept the same symbols after Argo was acquired by Brookfield Reinsurance, but the CUSIP numbers were changed. I mentioned in this post, when discussing an add to ARGD, that something was going on that involved a symbol, CUSIP number and/or name change. Both securities have $25 par values.

ReplyDeleteArgo Group International Holdings Ltd. 6.5% Senior Notes Due 2042 (ARGD)

$23.49 +$0.08 +0.34%

Last Updated: Dec 6, 2023 at 10:04 a.m. EST

https://www.marketwatch.com/investing/stock/argd?mod=search_symbol

Argo Group International Holdings Inc. Dep. Pfd.

$24.14 -$0.11 -0.45%

https://www.marketwatch.com/investing/stock/argo.pra?mod=search_symbol

A purchase of ARGO.PRA was last discussed here:

Item #2.C Added to ARGO.PRA - Bought 5 at $19.05

https://tennesseeindependent.blogspot.com/2023/01/argopra-eai-fcntx-feny-fhb-fnb-fsptx.html

The ARGO.PRA dividends are non-cumulative. The coupon is currently 7%, but will transition to a floater, if not called, on 9/15/25 at a 6.712% spread to the 5 year treasury note. The coupon resets every 5 years unless called. (see prospectus at pages S7-8)

Today Bloomberg chatting about the new diet drugs, said that they're being tried off label so to speak, by alcoholics to cure alcoholism. They're labeling the diet drugs and upcoming trend.

ReplyDeleteMeanwhile mining asteroids is not developed enough to be realistic, for them to label it a trend. That certainly didn't surprise me.

Land: Pfizer discontinued the trial for its weight loss drug. Roche acquired a clinical stage company. Those two events caused renewed interest in Viking Therapeutics Inc.(VKTX) which I previously eliminated.

DeleteITEM # 1.A. Eliminated VKTX - Sold 30 at $22.84:

https://tennesseeindependent.blogspot.com/2023/05/bbdc-botz-brkl-cfg-fhb-fhnpre-hbnc-jqc.html

The Europeans Medicines Agency is asking for more information about the safety.

https://www.biopharmadive.com/news/ema-glp1-safety-diabetes-weight-loss-questions/701272/

Mining asteroids is a theme in the Apple series For All Mankind where humans are already living on the moon and are planning for a Mars landing. A recent episode involved capturing an asteroid for that purpose, which was unsuccessful and resulted in 2 deaths. The idea is futuristic, as in way into the distant future, and uneconomic, assuming it can be done in the distant future, unless the minerals are absolutely necessary and can not be found on earth in sufficient quantities to meet demand.

Interesting - Bloomberg chatted for a while without any mention of the drugs not doing well in trials. So a lesson learned about how incomplete the discussions can be.

DeleteThe Pfizer weight loss drug failed but the ones from Lilly and Novo Nordisk have been approved by the FDA.

Deletehttps://www.fda.gov/news-events/press-announcements/fda-approves-new-drug-treatment-chronic-weight-management-first-2014

https://investor.lilly.com/news-releases/news-release-details/fda-approves-lillys-zepboundtm-tirzepatide-chronic-weight

https://www.fda.gov/news-events/press-announcements/fda-approves-novel-dual-targeted-treatment-type-2-diabetes

Thanks!

DeleteCRISPR Therapeutics AG (CRSP)

ReplyDelete$64.66 -$5.55 -7.90%

Last Updated: Dec 8, 2023 at 2:27 p.m. EST

https://www.marketwatch.com/investing/stock/crsp?mod=search_symbol

I just added 1 share since the stock is slightly less risky today after the FDA provisionally approved the gene editing therapy for sickle cell anemia.

"Vertex and CRISPR Therapeutics Announce US FDA Approval of CASGEVY™ (exagamglogene autotemcel) for the Treatment of Sickle Cell Disease"

https://ir.crisprtx.com/news-releases/news-release-details/vertex-and-crispr-therapeutics-announce-us-fda-approval

CRSP sold a 60% interest to VRTX for this indication. In addition to the amount previously paid, VRTX will make another milestone payment of $200M in connection with this FDA approval.

The FDA action date for the gene editing treatment for β-thalassemia is 3/30/24.

The price has been jumping around a lot since this news was released earlier today.

As previously discussed, the CRSP stock price will require at least 1 other FDA approval, hopefully for 1 of the cancer therapies, before I would expect a return to a $100+ price.

CRISPR Therapeutics Provides Business Update and Reports Third Quarter 2023 Financial Results

https://ir.crisprtx.com/news-releases/news-release-details/crispr-therapeutics-provides-business-update-and-reports-third-4

Seems strange to go down with that approval. But maybe some selling on the news.

DeleteI bought another CRSP share today after it dropped another $7+ dollars or so. The FDA approval of its gene editing therapy for sickle cell anemia is more of a proof of concept as opposed to a future money maker. It is a one and done therapy which will cost over $2M. So it is not like a $100 pill taken once a day for life that costs 3 cents to make. Profits, if any, will be shared with Vertex with CRSP receiving 40%. By selling a 60% interest to VRTX, the initial payment being $900M and an additional $200M milestone payment was connected with the FDA approval, CRSP may have received most of the money that it will receive for the sickle cell indication.

Deletehttps://investors.vrtx.com/news-releases/news-release-details/vertex-pharmaceuticals-and-crispr-therapeutics-amend

The FDA is currently considering whether to approve a gene editing therapy for transfusion-dependent beta-thalassemia, with the action date no later than 3/30/24. If approved, the revenues and profits will be shares using the 60/40 split.

CRSP is still speculative IMO. There needs to be at least 1 approval of a 100% owned therapy, preferably one of the cancer ones that are currently in trial.

There was a setback about two years ago when one cancer therapy improved the outcomes over several months, compared to existing therapy, but the better result did not last long. The FDA is not going to approve a gene editing therapy that does not work better than an existing CART-T unless there is a significant cure percentage with the overall results dragged down by limited or no effect for some patients. I have discussed that therapy in both posts and comments. CRSP is still pursuing that trial and several others in the cancer area.

Another problem is that CRSP is not getting much love from analysts.

These speculative clinical stage drug stocks that I nibble on work out sometimes but some will crash and burn.

I had one today that rose 25.25% which just brought me close to breakeven after multiple small ball average downs.

MorphoSys AG ADR (MOR)

$8.83 +$1.78 +25.25%

https://www.marketwatch.com/investing/stock/mor?mod=search_symbol

This was the news on that one:

https://www.morphosys.com/en/news/morphosys-pelabresib-improves-all-four-hallmarks-myelofibrosis-phase-3-manifest-2-study#:~:text=Myelofibrosis%20is%20characterized%20by%20four,standard%20of%20care%20in%20myelofibrosis.

Thanks! I'm figuring this is a long term wait. There's 2 parts to drug pipelines. One is drug success but the other's monetizing it. May point to not coming through on stock price, since they've sold off value already. It's why I bought 2 shares and watched, not 100k's worth. Still may come through.

DeleteLand: CRSP monetized 60% the gene editing therapies for sickle cell and Beta Thalassemia in 2021 when it looked like both would work. What is left has not been proven yet to work but some of the therapies in trial may prove to work. I will generally give more credit than analysts to a proof of concept for a novel approach to curing diseases, which in this case involves genetically caused disorders. So I am sticking with CRSP. The next main data point is whether the FDA will approve the therapy for Beta Thalassemia which is a genetic disorder which results in anemia caused by the body being unable to make beta globin, one of the two building blocks for the production of hemoglobin.

Deletehttps://ir.crisprtx.com/news-releases/news-release-details/positive-results-pivotal-trials-exa-cel-transfusion-dependent

The cancer therapies are probably the most important for the stock price.

https://ir.crisprtx.com/news-releases/news-release-details/crispr-therapeutics-announces-updates-immuno-oncology-pipeline

I have published a new post:

ReplyDeletehttps://tennesseeindependent.blogspot.com/2023/12/bbdc-dirunca-emp-fcvsx-fsphx-glq-jpc.html